Here we go… money printing.

This is a big one.

Learning about this single concept completely changed how I think about investing my money.

It led me to:

Pull all my money out of a bank-managed mutual fund

Open a self-directed investing account and take control of my finances

Buy Bitcoin

Grow my wealth to multiple 6-figures before 30

In short, this was my Matrix “Red Pill” moment. The beginning of my wealth-building journey, and the spark that eventually became Wealth Potion.

“Remember… all I am offering is the truth, nothing more.”

Now, “money printing” is a term that gets tossed around a lot. And as we’ve mentioned before, it usually doesn’t mean the literal printing of paper cash.

So what is “money printing” exactly? And why is it so important?

Here’s the tl;dr:

Money printing is a set of financial engineering techniques that the central bank uses to manage the economy… but ultimately makes the rich richer, and keeps the poor poorer.

If you’re like me, you want to be on the right side of that equation.

In today’s issue, we’ll break down:

Why you should care about money printing

What money printing really means in practice

How to take advantage of money printing via your investments

As always, you can watch along on YouTube (including some bonus The Matrix references)

Let’s dive in.

Why You Should Care About Money Printing

Let’s rewind to 2020.

The world was shut down. Businesses were closed. Millions lost their jobs.

And yet, the stock market… soared?

The S&P 500 doubled from its pandemic lows in just over a year. Real estate prices exploded. Bitcoin (and crypto) went parabolic.

But we all remember 2020, don’t we? The lockdowns, the layoffs, the uncertainty…

So how could asset prices skyrocket while the real economy was frozen?

Or to phrase that question slightly differently:

Where did all that money come from?

The answer is that governments around the world unleashed trillions of dollars in “stimulus,” “liquidity programs,” and “quantitative easing.”

Different names with the same effect.

In other words, the government printed money.

As Morpheus told Neo, let’s go a bit further down the rabbit hole 🐰

Bank Boldly. Climb Higher.

Peak Bank offers an all-digital banking experience, providing all the tools and tips you need to make your way to the top. Take advantage of competitive rates on our high-yield savings account and get access to a suite of smart money management tools. Apply online and start your journey today.

Member FDIC

What Does “Money Printing” Actually Mean

Technically speaking, paper bills were not “printed”. But new money was created.

Side note: the central bank does in fact have the power and jurisdiction to physically print new bills, but in the modern era, this method is rarely used.

Here are some of the actual “money printing” methods that central banks use:

Quantitative Easing (QE): The central bank buys government bonds or other financial assets, pumping liquidity into the financial system and driving asset prices up.

Lowering Interest Rates: By cutting rates, borrowing becomes cheaper. Businesses and consumers take out more loans, which expands the money supply through new credit creation. We covered this recently.

Bank Reserves & Lending Expansion: Central banks lower reserve requirements or flood banks with excess reserves. This allows banks to lend more, effectively multiplying the amount of money circulating in the economy.

Government Stimulus & Deficit Spending: When governments run large deficits funded by central bank bond purchases, it’s a backdoor form of money printing i.e. spending money that didn’t exist before.

QE Infinity, Yield Curve Control, Negative Interest Rates: These are some more niche, extreme measures in the central bank’s toolkit that the U.S. hasn’t used yet. (I’ll do a future article on these, because things could get pretty wild…)

The central bank doing everything they can to avoid calling it “money printing” (2025, colorized)

Simply put, central banks around the world injected money into the financial system, buying bonds and other assets to “support the economy.”

Let’s take a look at Quantitative Easing, as an example:

Quantitative Easing is when the central bank purchases bonds from banks to stabilize the financial system during times of crisis. When the central bank makes such a purchase, it gets added to the central bank’s balance sheet. And we can see this data clear as day.

$3,000,000,000,000 in quantitative easing.

The y-axis is in millions of dollars. And basically overnight, the Fed balance sheet expanded by $3 trillion.

But importantly, that newly created money didn’t go evenly to everyone.

What you’re seeing in that graph is completely separate from the stimulus check you received in the mail.

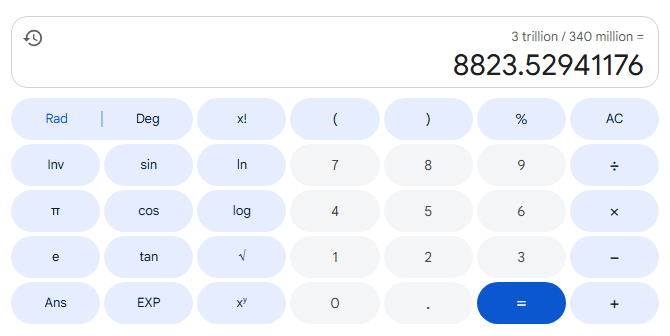

And if that $3 trillion were divided equally among all Americans…

It would’ve been like received $8,800 in the mail.

But it wasn’t distributed equally. Instead, that money went to financial institutions.

Banks, corporations, and investor class received a lot more than $1,000.

And this brings us to the moral of the story.

How to Profit from Government Money Printing

In short, own risk assets.

Let’s continue the example of quantitative easing in 2020.

Where did that money go?

Let’s break it down:

The central bank “creates” money to buy assets (e.g. bonds) from the banks.

The bank receives that new money as cash reserves.

Banks then lend or invest that newly received money.

Bond yields fall, which pushes more investors into riskier assets, like stocks.

Risk assets (stocks, real estate, Bitcoin) surge in price.

Or, to put it another way:

When money is “printed”, it flows first into the hands of banks, corporations, and investors. From there, it gets poured into stocks, real estate, and financial assets, driving their prices higher.

This is what economists call the Cantillon Effect.

When new money enters the economy, those closest to the source of money creation (Wall Street, governments, and asset owners) benefit first. Prices rise before wages can catch up, leaving everyone else scrambling as the cost of living increases.

This is why the massive stimulus in 2020 led to inevitable inflation in 2021 and 2022.

Inflation peaked at 9% in June 2022

So while most people were getting stimulus checks, the wealthy were watching their portfolios skyrocket. And then inflation steals your purchasing power 12 months later.

The best course of action in 2020 would’ve been to own risk assets.

Yes, it is risky. It is literally in the name. Investors watched as their stock portfolios plummeted almost 50% in a matter of days when the pandemic broke out.

But if they just held on… they doubled their money within 18 months.

And when inflation hit, they were protected. Because their assets had grown their wealth along the way.

So the moral of the story is to own risk assets. Do what the wealthy do, and protect yourself from inflation by investing your money, instead of saving it.

Personally, I use Bitcoin (not crypto) to protect and build my wealth. I have a high risk appetite, and so I am comfortable with stomach-churning drops and massive volatility. It’s a meagre price to pay for the asymmetric upside.

If you liked this week’s article, I’d love to hear from you. I read every single reply and try to get back to each of you in a timely manner. Don’t be a stranger.

To your prosperity,

Brandon @ Wealth Potion