Huge (yuge, some might say) economic news dropped last week.

The Fed just cut interest rates by 0.25%. This is the first rate cut since Trump took office.

But there’s another story that a lot of you may have missed…

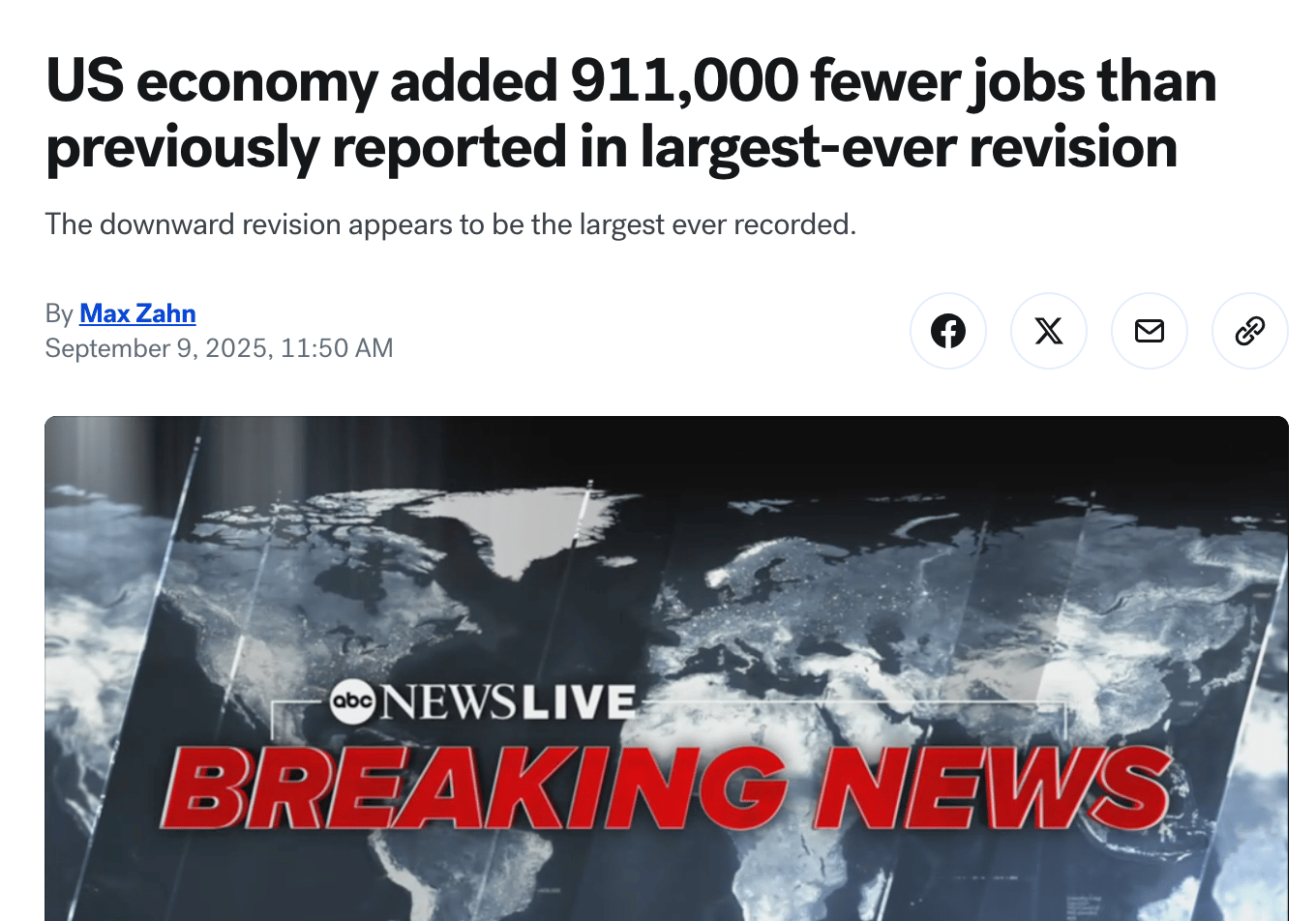

The week prior, the BLS revised last year’s jobs number down by 911,000… the biggest revision in history.

What does this all mean?

Today, we’re going to cover a few critical financial concepts:

A recap of the Federal Reserve and why it exists

The importance of interest rates and their effect on the economy

A quick timeline of Trump’s recent feud with Jerome Powell

The Bureau of Labor Statistics and the jobs report revision

What this all means for us as investors

And since Wealth Potion is all about simplifying these concepts to help you protect and build your wealth, I’m going to give you the rundown in 1000 words (approximately).

And in this week’s YouTube video, I’ll share how I wrote this article and recorded this video 3 days before the Fed’s rate cut was announced 🔮

tl;dr - Rate cuts usually mean that asset prices will go up. Plan accordingly.

The Federal Reserve and It’s Mandate

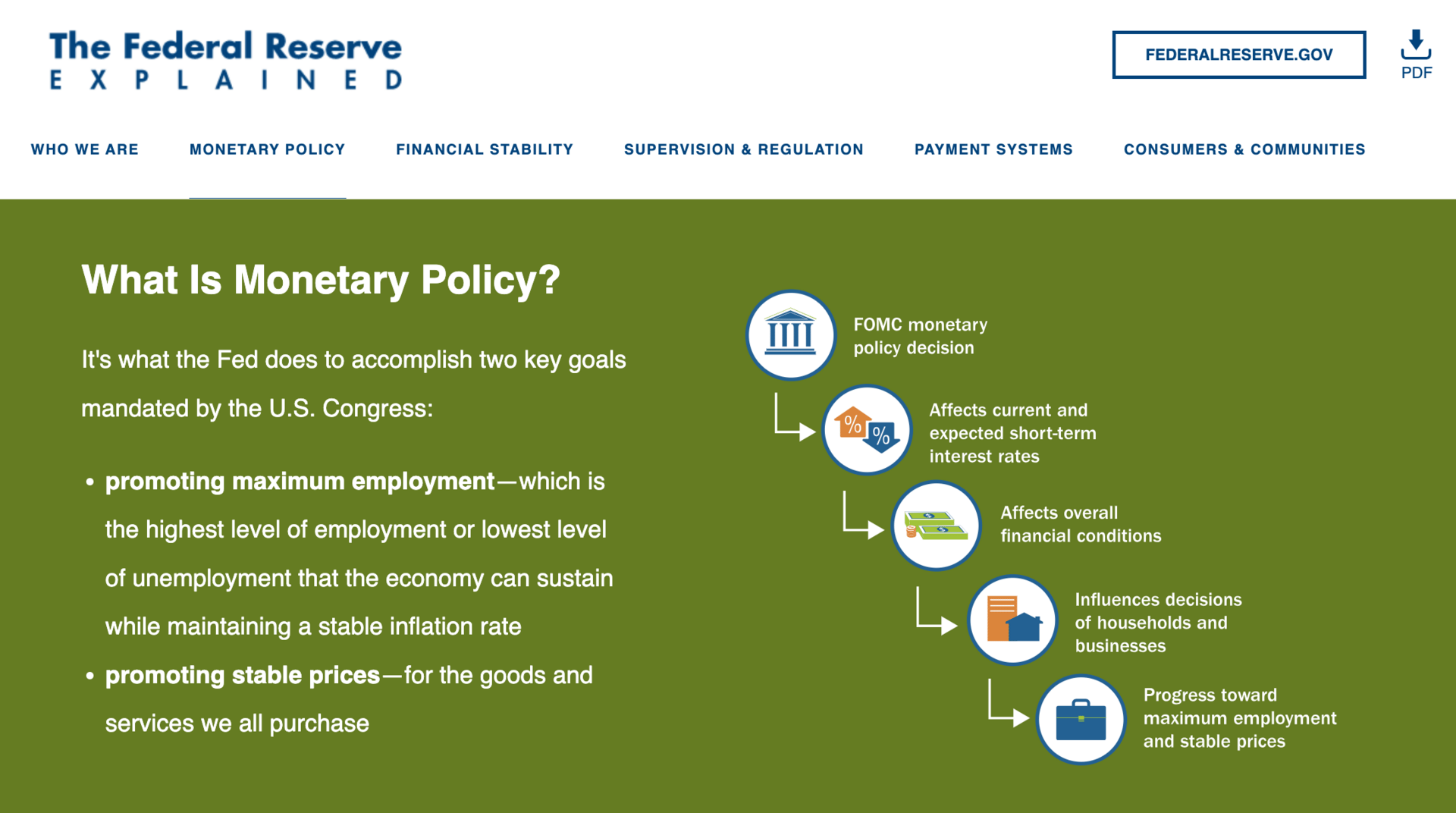

The Federal Reserve (AKA the Fed) is the Central Bank of the United States. It’s the bank for the banks.

And despite what most people assume, the Federal Reserve is a privately-owned institution independent from the US. government.

We’re going to come back to this later…

The Eccles Building of the Federal Reserve

The Fed has two stated goals: low inflation, and low unemployment.

One of it’s most powerful tools for hitting those goals is by controlling interest rates.

It doesn’t directly control the interest rate on your mortgage, or your car loan, or your credit card… but it controls the interest rate that the banks use when they lend to one another.

A brief overview from federalreserve.gov

When your bank’s interest rate goes up, other interest rates usually go up as well. And vice versa.

And those interest rates have massive ripple effects on the entire global economy.

Before we break this down, a quick word from today’s sponsor:

Your daily edge in private markets

Wondering what’s the latest with crypto treasury companies, Pre-IPO venture secondaries, private credit deals and real estate moves? Join 100,000+ private market investors who get smarter every day with Alternative Investing Report, the industry's leading source for investing in alternative assets.

In your inbox by 9 AM ET, AIR is chock full of the latest insights, analysis and trends that are driving alts. Readers get a weekly investment pick to consider from a notable investor, plus special offers to join top private market platforms and managers.

And the best part? It’s totally free forever.

Interest Rates and the Economy

Here’s how it works:

High interest rates → borrowing money costs more, people and businesses spend less, economy slows down. Inflation usually decreases.

Low interest rates → borrowing money gets cheaper, people spend more, asset prices go up, economy heats up. Inflation usually increases.

It’s a crude tool, but it’s very powerful. Think of it like a thermostat for the economy.

If you’ve been following closely so far, you may have noticed something troublesome...

The Fed’s two goals are opposed to one another.

If inflation is too high, and the Fed hikes rates, this slows down the economy and can increase unemployment.

If unemployment is too high, and the Fed cuts rates, this could overheat the economy and create inflation.

This is ultimately the Fed’s catch-22.

Like a thermostat, if they leave the AC on for too long, the economy freezes up. If they leave the heater on for too long, the economy overheats.

And since 2022, the Fed has been cranking the thermostat way down to fight inflation. In other words, they hiked interest rates way up to chill the economy.

After years of zero rates (aka “easy money”), suddenly borrowing was expensive again.

You probably noticed. Mortgage rates jumped, credit card debts spiked, companies tightened hiring or even did layoffs.

Enter the BLS jobs report…

The Bureau of Labor Statistics and the Jobs Report

The BLS (Bureau of Labor Statistics) is like the scorekeeper for the economy. Every month, they publish the “jobs report,” which basically says:

How many jobs were added or lost

What the unemployment numbers look like

How much wages are growing or shrinking

Politicians, investors, and the Fed all watch this number like hawks (no pun intended).

Strong job growth = economy still healthy, inflation risk still alive.

Weak job growth = economy slowing, maybe by too much.

But here’s the thing: the BLS doesn’t just publish numbers once and move on.

They revise them as more data comes in. And last week, they announced the biggest downward revision in history: 911,000 fewer jobs than we thought.

Put simply: The U.S. economy wasn’t as strong last year as everyone believed.

And so if you’ve seen any of the headlines (or memes) about Trump’s feud with Jerome Powell, perhaps they’re making more sense now.

Recent Timeline of Trump vs. Powell

Remember how I mentioned that the Federal Reserve is independent from the U.S. Government?

This is why there’s a feud going on.

So what’s been happening lately?

First half of 2025: Powell holds interest rates steady. Inflation has cooled off, but the Fed keeps insisting on “higher (rates) for longer.”

July 2025: In speeches and pressers, Powell hints that rate cuts could arrive in September if inflation keeps trending down and the economy shows more signs of slowing. Markets cheer.

Now (September 2025): The BLS drops a bombshell. Last year’s job growth was overstated by 911,000. The labor market wasn’t nearly as strong as everyone thought.

Jerome Powell has pie on his face.

Putting it All Together + What’s Next

The Fed’s next meeting was last week: September 16th and 17th.

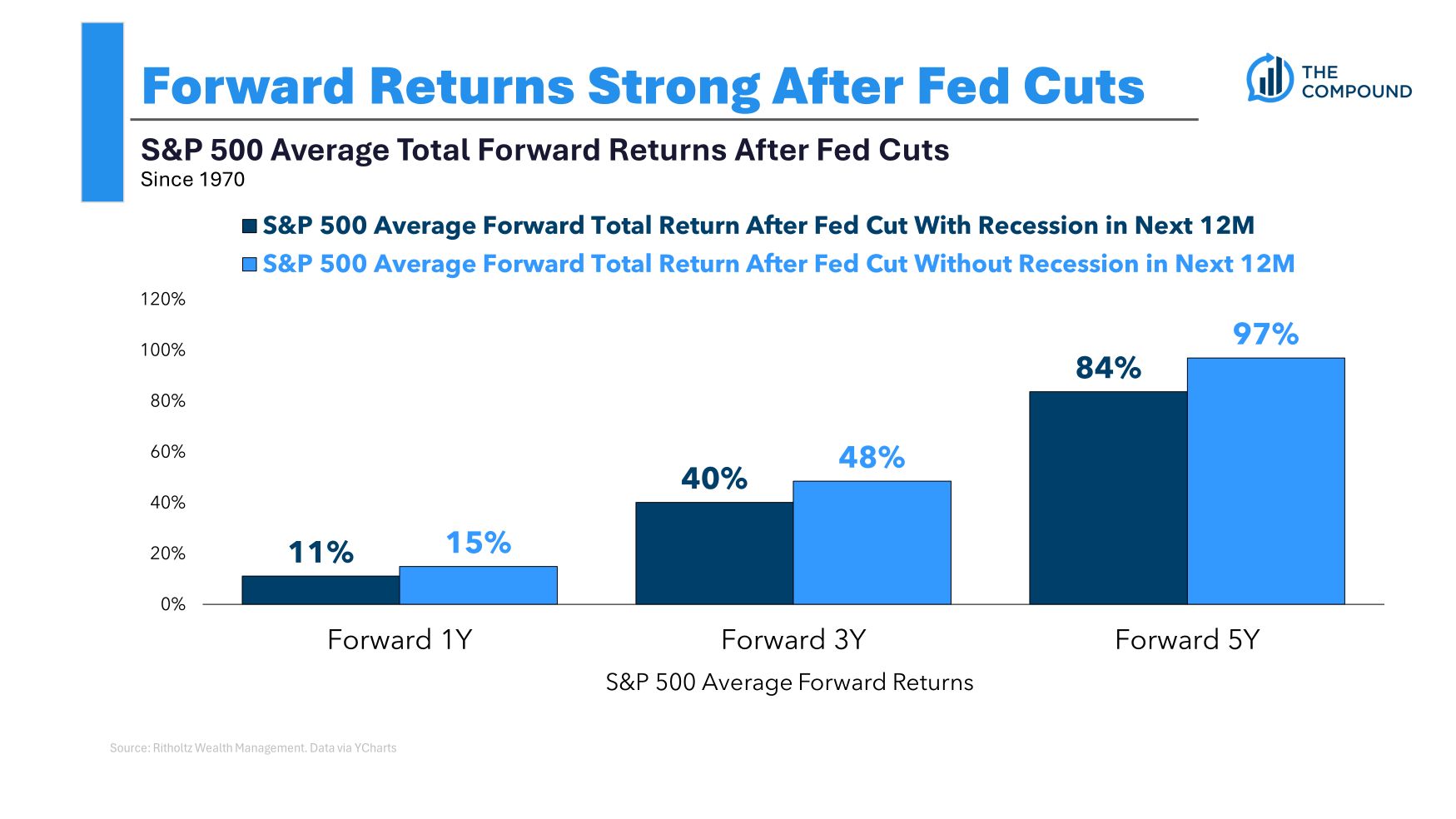

And when rates go up, assets usually rise:

Stocks go up because future earnings are worth more when discounted at lower rates.

Bonds go up because existing bonds with higher yields look more attractive.

Real estate gets a boost because mortgages get cheaper.

Bitcoin and gold tend to rip higher as “hard assets” when money gets looser.

But this is NOT financial advice. Because there are two important caveats:

With a rate cut practically guaranteed at this point, investors have already “priced in” the rate cut. More on this topic here, as well as in this week’s video.

A Fed rate cut doesn’t necessarily mean that other interest rates go down.

This 2nd caveat is a deeper topic that we’ll cover in a future edition of Wealth Potion. Subscribe to the newsletter + YouTube if you’re interested in that, and forward this to a friend if you’ve learned something so far. Thanks for your support.

All that said, I am still bullish. I am a buy-and-hold investor and am still long Bitcoin and other risk assets.

Here’s a quick recap of what we’ve covered:

The Federal Reserve has a huge impact on the U.S. economy and asset prices.

The Fed acts (or doesn’t act) based on data that is often wrong

The BLS report reveals that the U.S. economy was not as strong as everyone thought in 2024

This puts pressure on the Fed to lower interest rates and add liquidity to the financial system, which is usually good news for asset prices

We, as investors, need to look for these signals all the time. And that’s my goal at Wealth Potion: to provide you with the signal without any of the noise.

To your prosperity,

Brandon @ Wealth Potion