I may have a ruffled a few feathers.

My recent article Debunking 3 Myths About Inflation received a lot of responses.

Some replied with genuine questions, some with nuanced disagreement, and some… more colorful replies. But I’m standing my ground.

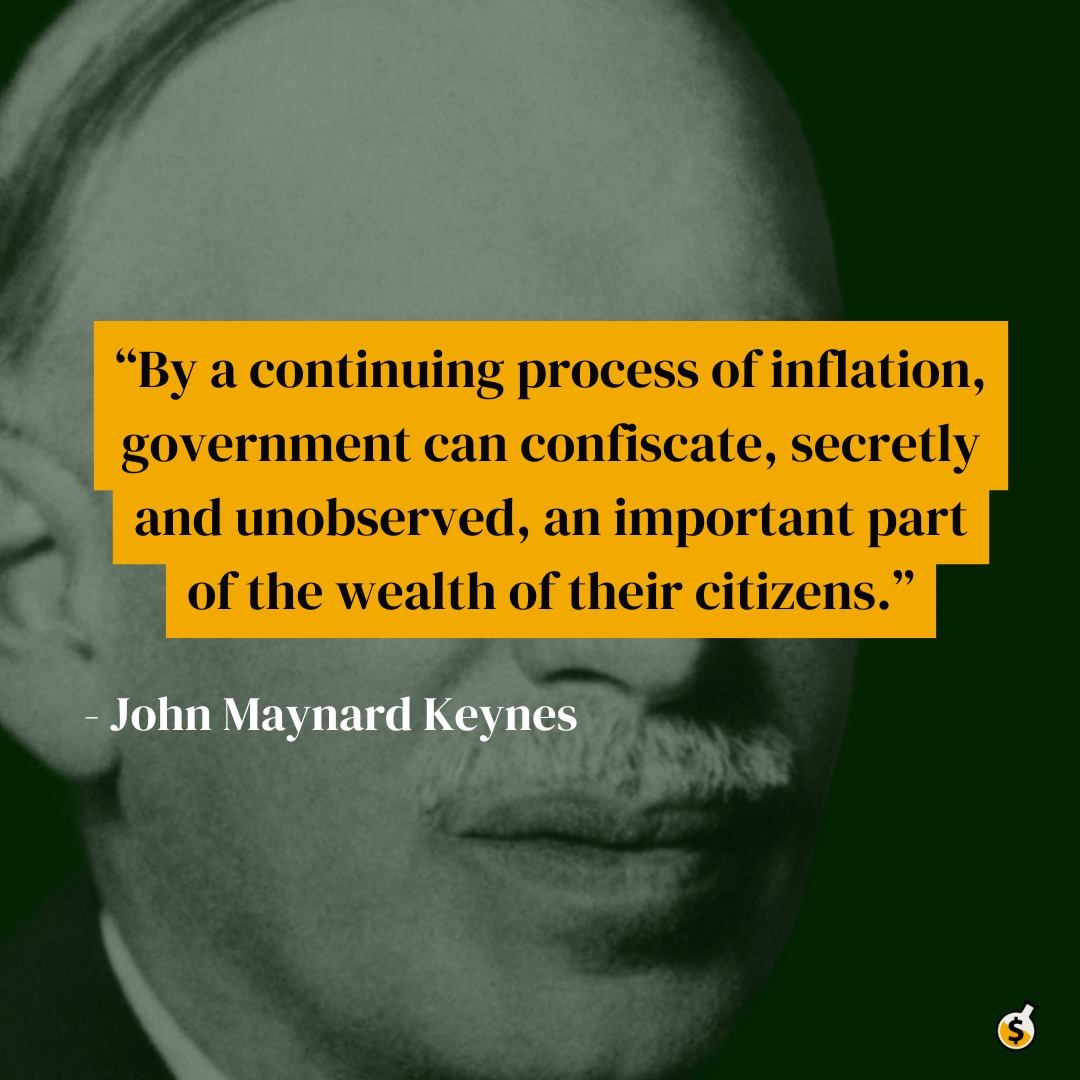

A famous economist once said this about inflation.

In fact, I’m doubling down.

Today, I’ll respond directly to some of those rebuttals, and then I’ll elaborate on what I mean when I say “Inflation is Theft”.

Specifically, this article will cover:

Why “money hoarding” isn’t necessarily a bad thing

A real life example where we experience deflation

How inflation disproportionately affects the poor

How inflation benefits borrowers at the expense of lenders

John Maynard Keynes’ thoughts on inflation (don’t miss this!)

Let’s dive in.

“But Deflation Leads to Money Hoarding!”

This is by far the most common response I received across X (Twitter), YouTube comments, and email replies.

"(Inflation) penalizes people saving money without investing it" one commenter on YouTube writes.

“If money is deflationary, you would just hold it and buy only necessary stuff” someone replies on X.

There were many more examples, but you get the point.

The argument that they are making is essentially this:

Low-to-moderate (2%) inflation debases our money by a small amount, which encourages people to spend and invest their money as opposed to “hoard” it. Spending and investing produces economic activity whereas money hoarding does not. Therefore, some inflation is good for the economy.

Firstly, this position is based on the Keynesian premise that a healthy economy is one with strong overall spending, with people buying lots of goods and services.

After all, we measure economies by GDP, which is a measure of consumption.

Austrian economists would challenge this premise. They would define a healthy economy as one with sustainable investment, but also savings, and efficient resource allocation, rather than relying on strong spending alone.

This is a very deep and nuanced philosophical topic that could be an entire article and video on its own…

So let’s just accept the Keynesian premise for now.

Instead, I want to focus specifically on the phrase “money hoarding”.

Deflation would mean that instead of money losing value over time (as it does with inflation), money would gain value over time.

Imagine in 2030 that your dollar were able to purchase more things.

(That doesn’t sound so bad does it?)

The Keynesian fear is that this would result in people hoarding their money.

Inflation disincentives "putting (money) under the mattress” someone on YouTube replies.

But wait, isn’t that just… saving?

That is correct. What Keynesians refer to as hoarding is really just saving.

This is why the universally acceptable financial advice of the 21st century is not to save, but to buy assets AKA invest your money (I wrote about this at length here).

Because in an inflationary system, cash is a melting ice cube. So the prudent thing to do is to buy assets that will increase in dollar value over time.

Stocks, bonds, real estate, Bitcoin, fine art, Pokemon cards… you name it.

Just buy something.

Consider the fact that home ownership is becoming further and further out of reach for most young people today, and you can see the concern that Austrians largely have with Keynesian economics prioritizing spending over everything else. An inflationary system “financializes” housing. In other words, it has turned housing into a financial asset… and is that a good thing?

A Real Life Example of Deflation

A good friend of mine from back in Canada sent a very thoughtful reply to my newsletter.

In it, he detailed why the example I used of ground beef isn’t ideal for explaining inflation and deflation. This is because groceries are an example of a good with inelastic demand.

And he’s absolutely correct.

Put simply, the price of ground beef doesn’t have as big of an impact on whether or not you buy it.

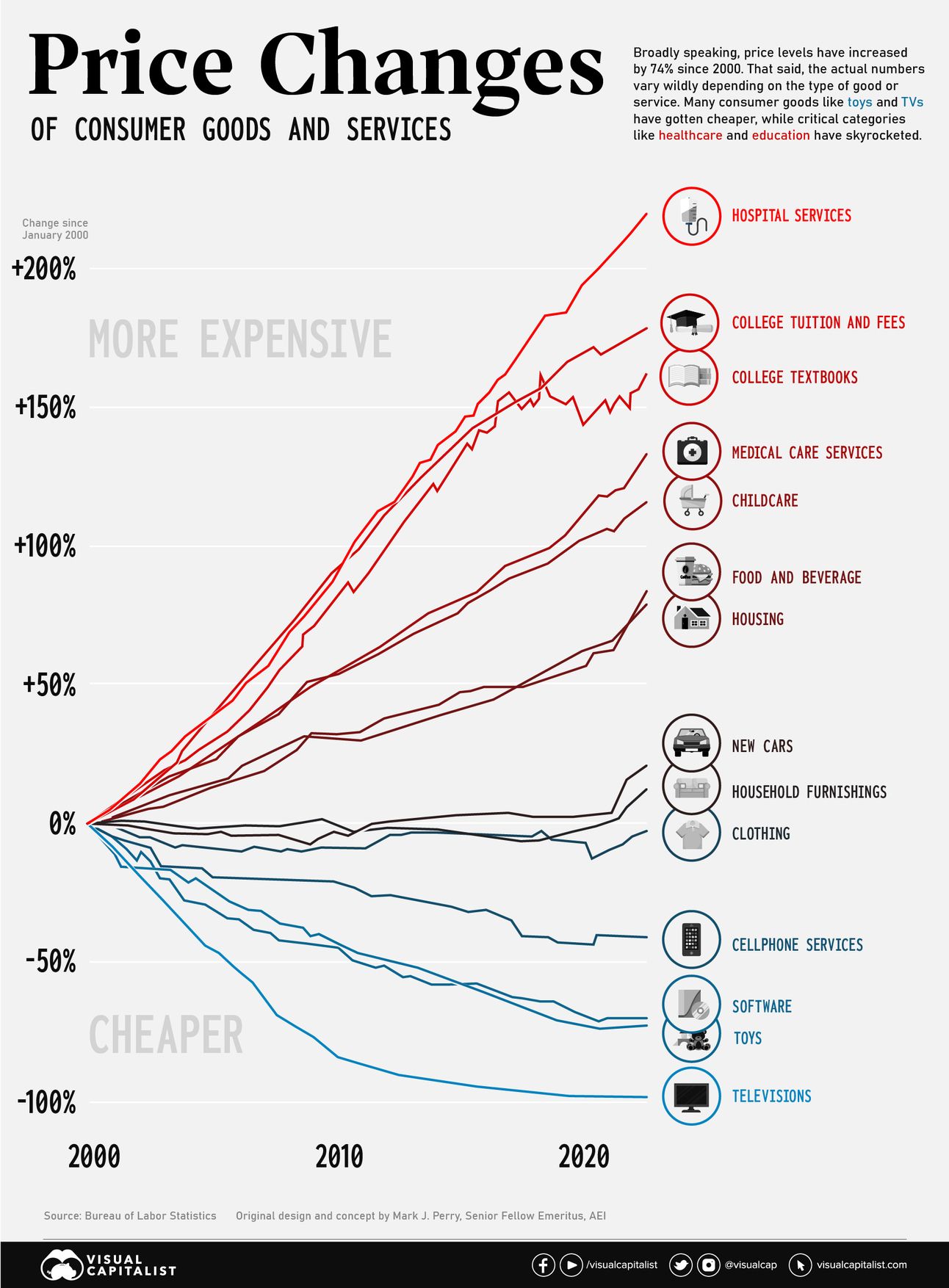

Instead, he suggests using the example of TVs (electronics) to understand the effects of inflation and deflation.

And I agree with him once more. Electronics is a much better example.

Firstly, electronics have elastic demand. Because it is largely discretionary spending (it’s more of a nice-to-have) our willingness to buy new electronics is much more likely to be influenced by the price.

But here’s where I disagree.

Secondly (and more importantly), electronics is an industry where we have actually experienced deflation, and we have not seen money hoarding occur.

Over the past 2.5 decades, electronics have experienced deflation while most other industries have experienced inflation.

Let’s make this super relatable:

Perhaps you, or someone you know, is the kind of person that always buys the new iPhone.

It doesn’t matter if they just bought the iPhone 15 and the battery is still going strong… they’re going to buy the iPhone 16.

But wait… this flies in the face of the anti-deflation rhetoric!

In an industry where there is rapid deflation, we should see people deferring their spending and hoarding their money, right?

Wrong. Consumer desires win the day. People want the newer, faster, prettier phone. Why? Because they want it!

And yes, of course some people might choose defer their spending by a year or two (i.e. skipping the iPhone 16 and waiting for the 17, or just buying a 15), but this does not lead to less economic activity.

In fact, TVs, phones, software, and electronics in general have seen more innovation, development and growth than most other industries.

Because people want electronics.

Still not buying it (pun intended)? Let’s use the opposite example.

Perhaps you, or someone you know, never upgrades their phone.

They still have the iPhone 8, or a Blackberry… or a Motorola Razr (remember those?).

I got a nice hit of nostalgia looking up this photo and I hope you did too.

Now, let’s imagine a world where electronics are inflating in price. So imagine when the iPhone 16 is released, the price of the iPhone 15 increases as well.

In this alternate reality, would that person be upgrading their phone?

I’d argue no. That person’s preference is for an older phone. They don’t value upgrading their phone.

Btw, this is a perfect example of Austrian economics vs Keynesian economics. Where Keynesians believe that the economy is largely dictated by aggregate demand (more people wanting more stuff), Austrian economists believe that the economy is ultimately dictated by individual human action based on subjective preferences. I dive into this more in my video.

In case it’s not clear, this is a philosophical discussion and there is no “right or wrong” answer.

But I hope this provides you with some food for thought that pushes back on the reflexive “deflation is bad” narrative.

If you disagree, or if you have questions, I’d love to hear from you:

Now, it’s time to double down 😈

Why Inflation is Theft

I want to make something very clear:

If you want to grow your wealth in the financial system we live in today, you should absolutely be buying assets.

I am not arguing against that.

I am simply suggesting the following thought experiment: What if we didn’t have to?

Maybe you own assets, and you think that this system is working just fine. And you’re right! If you own assets, you’re probably doing great, financially speaking.

Here are two things I’d ask you to consider:

1. Inflation Disproportionately Hurts the Poor

You know who doesn’t have access to financial assets?

The poorest people in our society.

Most lower-to-middle class people are working paycheque-to-paycheque. Whatever little bits of money they save, they are likely saving it in the form of cash.

In the bottom 20% of income-earners in the US, only 5.5% directly own stocks.

And as you move up and up the wealth ladder, you get access to more diverse forms of asset ownership.

Owning your own home is a very topical example right now for millennials and Gen Z.

Private credit, private equity, fine art, wine, are some more extreme examples.

In the US, stock ownership is highly concentrated at the top.

The stats are already dismal for the United States, so you can imagine what access to financial assets looks like globally.

And it gets even worse when we introduce debt…

2. Inflation Benefits the Borrower at Expense of the Lender

At first glance, this goes against conventional wisdom.

Isn’t the person in debt at a disadvantage? And the person lending money at an advantage?

Sometimes. This depends wholly on the interest rate.

Let’s take a look at the interest rates that lower-to-middle class people have access to (or are reliant upon):

Credit cards: 20% to 30%

Student loans: 5% to 15%

Car loans: 6% to 9%

And now, let’s look at the forms of debt accessible to the wealthy:

Mortgage rates: 7.5%

Securities-Backed loans: 5.5% to 7%

Private banking loans: 2% to 5%

Yet again, the wealthier you are, the more access you have to financial instruments to protect and grow your wealth.

But we haven’t even introduced inflation yet!

The government strategically uses inflation to reduce their debt load (a topic for another day).

Let’s use an example:

Let’s say I borrow $10,000 from you at 2% interest.

So in 1 year, I will pay you back $10,200.

Now, let’s say that inflation was 3% that year.

A year from now, I will pay you back $10,200… but that $10,200 will have lost purchasing power. In fact, it’ll buy fewer goods than the $10,000 that I borrowed from you 1 year ago!

You just lost “money”. Not dollars per se, but purchasing power.

This is a mindf*ck of a concept that I will definitely be writing about more.

Because this is one of the more sinister aspects of inflation.

To our human brain, we see number go up, and we are happy. But in reality, we could be losing purchasing power.

To put it simply:

If you borrow money at an interest rate that is lower than inflation, you are stealing purchasing power from the lender.

As a reminder, inflation was ~9% in 2022.

So if you borrowed money at an interest rate of less than <9% in 2022, then congratulations! You gained purchasing power on that debt.

Side-note: the US government is very aware of this. And with the US federal debt climbing to unprecedented levels, it is very likely that we will see more inflation in the years to come. Once again, a topic for another day.

Bonus: Keynes’ Thoughts on Inflation

As discussed, our current financial system is built upon the Keynesian principle of the management of aggregate demand for a stable economy.

So what did Keynes think about inflation?

Well, I have a surprise for you.

Remember that quote at the top of this article?

That was a quote from John Maynard Keynes himself.

You see, Keynes himself was acutely aware of the risks of government intervention, despite his advocating for it.

He (and his school of economics) believed that government intervention of the economy works when it’s done responsibly.

In particular, the risk of inflation lies in a government that is too eager to stimulate a slow economy, but too hesitant to tighten an overheated economy.

And so I bring back my meme from my prior issue.

Jerome Powell has effectively declared victory over inflation… despite inflation hovering at 2.5% (still higher than the Fed’s 2% target).

This eagerness to stimulate the economy again has sent risk assets soaring…

And the bond market is already pricing in higher inflation in the years to come.

If the tweet above still seems like a foreign language to you, don’t worry. That’s what I’m here for.

We’ll be discussing this more in future issues of Wealth Potion. So if this topic is interesting to you, subscribe and follow along. I won’t let you down.

This week’s issue is brought to you by Webstreet:

Where Diversification Meets 11.4% Cash Returns 📈

Our friends at Webstreet are launching their eighth fund. WebStreet buys and operates cash-flowing websites and SaaS businesses for accredited investors to invest in. So far WebsStreet has delivered 11.4% cash returns and is on track for 20%+ IRR.

Build in Public Update

New dashboard layout, what do you think? Clearer, or more confusing?

Pretty steady growth this week.

I’ve also found a way to re-purpose my long-form YouTube videos for short-form across Shorts, TikTok, and Instragram.

I was struggling to film original shorts content for the other platforms, so this method allows me to focus on my long-form content and scale to the other social media platforms.

I’m also finding value in diving deeper and deeper into specific topics.

This week’s article is a perfect example.

In the beginning, I was just trying to put videos out. Build the muscle. I was much less concerned with keeping things within a theme or niche.

But I seem to be getting some great responses around these macroeconomics concepts, especially inflation.

That said, this is all just me trying to get a read of what my audience wants. So I’d love to hear from you.

What content do you want to see more of on Wealth Potion?

To your prosperity,

Brandon @ Wealth Potion