We recently discussed how passive investing outperforms the vast majority of active investing strategies… even on Wall Street.

However, passive investing is not just about choosing index ETFs instead of stocks.

So what does it mean to be truly passive?

A passive investor removes their emotions from their investments. It means investing in a fully automated, hands-off way.

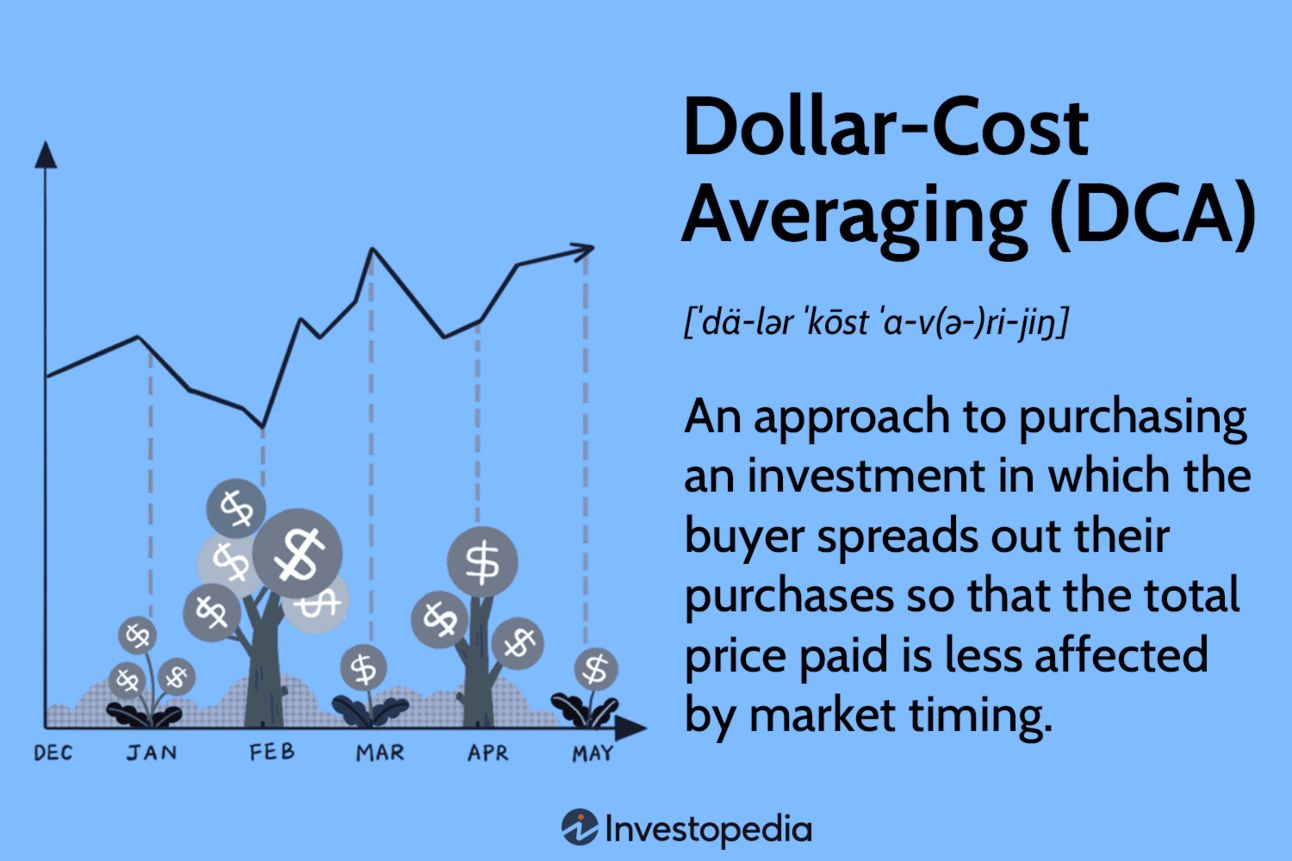

And one of the most powerful ways to achieve this is through Dollar-Cost Averaging.

Today, we discuss:

What is Dollar-Cost Averaging (DCA)?

Why DCA Works so Well

How to Setup DCA in Your Portfolio

And in this week’s video, I emphasize what I think is the most underrated aspect of dollar-cost averaging:

Let’s dive in.

What is Dollar-Cost Averaging (DCA)?

Dollar-Cost Averaging (DCA) is the strategy of investing a fixed amount of money on a regular schedule, regardless of what the market is doing.

Let’s say you decide to invest $500 every month into an index ETF like $VOO.

Some months the market will be up, and you’ll buy fewer shares.

Other months, the market will be down, and you’ll buy more shares for the same amount of money.

Most importantly, you have removed your emotions from the equation.

Over time, this smooths out the impact of volatility and avoids the risk of dumping a huge lump sum right before a downturn.

What matters is that you buy the same amount, at the same interval of time, no matter what.

To put it simply:

Yes, the ETF could go down in price.

You will buy shares regardless.

Yes, the ETF could go up in price.

You will buy shares regardless.

You don’t try to time the market. You set rules for your investing strategy, and you don’t break those rules. If you’re truly able to do this, it has an important implication.

Gold hitting record highs

The price of gold keeps heating up. If the record-breaking year of 2024 wasn't enough, gold hit a major historic 2025 milestone by crossing the $3,000/ounce threshold!

Here are 3 Key Reasons:

Looming economic & political uncertainty

Increasing central bank demand

Rising National Debt - over $36 Trillion

So, could gold surge even higher?

According to a recent statement from Jeffrey Gundlach, famed American business man and investor… “Gold continues its bull market that we’ve been talking about for a couple of years, ever since it was down to $1,800.” He expects gold to reach $4,000/oz.

Is it time you learn more about precious metals?

Get all the answers in your free 2025 Gold & Silver Kit. Plus, if you request your free kit today, you could qualify for up to 10% Instant Match in Bonus Silver*.

*Offer valid on qualified orders of Goldco premium products only. Receive up to 10% in free silver based on purchase amount; cannot be combined with other offers. Additional terms apply—see your customer agreement or contact your representative for details.

DCA Requires a High Quality Asset

There is an important implication of Dollar-Cost Averaging.

You need to be investing in an asset that you have high confidence in.

So much confidence, that if the stock market were to tank tomorrow, you’d still be comfortable with buying it at the same interval.

In fact, you would be excited because that means you get to buy your favorite asset at a discount.

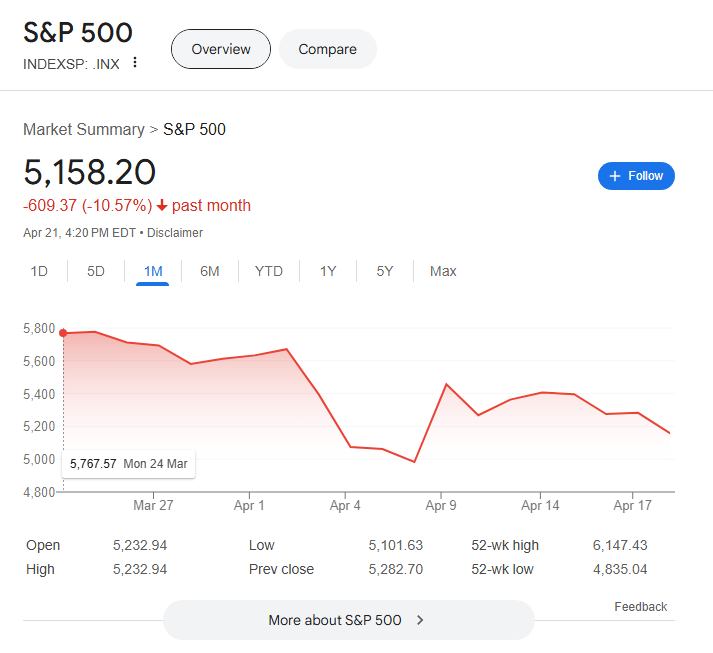

Many S&P 500 investors have had their confidence tested this past month.

In this example (as well as last week), we used the S&P 500 via the index ETF $VOO as our investment vehicle of choice. Many investors choose the S&P 500 because it’s a simple, diversified way to bet on the long-term growth of the U.S. economy.

But you could DCA into any asset, stock, or ETF that you have sufficient confidence in.

Ask yourself:

“Would I be happy to buy more of this… even if it drops 20% tomorrow?”

If the answer is yes, then you’re on the right track.

In Level 5 of the 5 Levels of Investing Series, we’ll discuss one such asset which has outperformed the S&P500 massively, so stay tuned.

If you don’t have rock-solid confidence, you might be tempted to break the rules of your system. And that defeats the point of dollar-cost averaging (DCA).

Why Dollar-Cost Averaging Works So Well

Markets go up and down all the time.

If you try to guess the best time to invest, you’ll almost always be wrong.

Time in the market beats timing the market.

DCA flips the script. Instead of trying to guess when to invest, you just commit to investing regularly, and let the math and automation handle the rest.

Here’s why it works:

1. You Buy the Dip (Without Even Trying)

When prices are low, your fixed dollar amount buys more shares. You’re essentially buying assets on sale.

2. You Avoid Emotional Investing

It’s extremely difficult to stay calm when markets crash (or when they skyrocket). Most people panic-buy at the top and panic-sell at the bottom.

3. It Turns Investing into a Habit

Because you’re doing it regularly (weekly, biweekly, or monthly), it becomes part of your routine. No stress, but with all the benefits.

“The best way to own common stocks is through an index fund... and just keep buying it through thick and thin.”

That’s DCA in a nutshell.

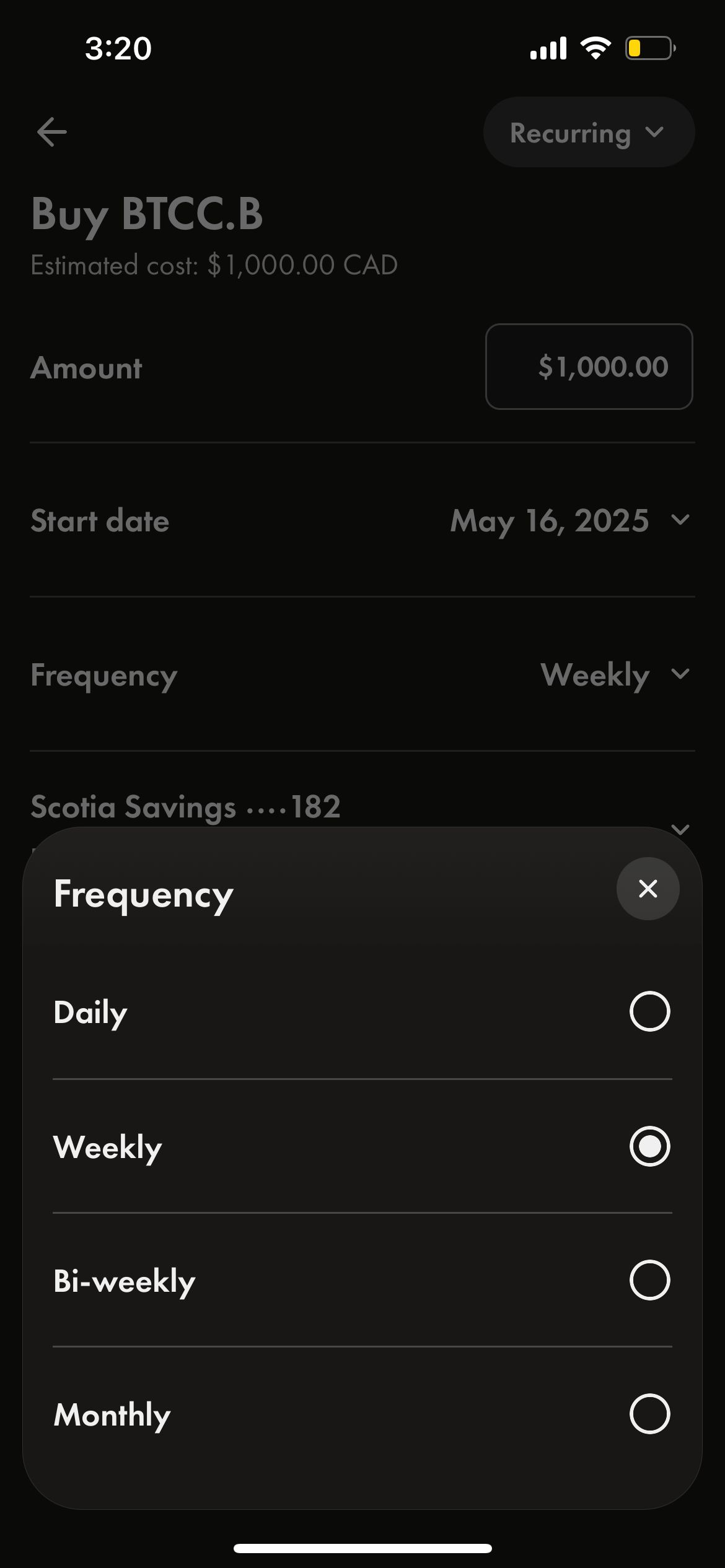

How to Setup Dollar-Cost Averaging

Getting started with Dollar-Cost Averaging is incredibly simple.

If you’ve already opened your brokerage account and chosen your index ETF (covered in Level 4: Passive Investing), you’re 90% of the way there.

An example of setting up DCA in Wealthsimple (sometimes listed as “Recurring” buys)

Now it’s just about automating the process:

Step 1: Decide How Much and How Often

Pick a dollar figure you can commit to consistently, based on your income and your lifestyle. It could be $100 per week, $500 per month, or whatever fits your budget. Consistency is more important than the amount.

Step 2: Choose the Date(s)

Some people set their investments to align with payday. Others pick the 1st and 15th of the month. Some like to invest on a certain day of the week. There’s no perfect date. Just pick one you’ll stick with.

Step 3: Automate It

Many brokerages (like Wealthsimple, Vanguard, or Fidelity) let you automate recurring deposits and even automate the purchases. If not, you can set a recurring calendar reminder to log in and make the trade manually.

Pro Tip: If you automate both the deposit and the ETF purchase, you’ll never have to think about it again. That’s real passive investing.

And voila, you’re done.

The 3 easy steps above assume that you’ve already chosen an asset to invest in. You could use an index ETF (as we discussed here), or you can select an individual asset or stock. If you choose a single asset (instead of an index ETF), know that your portfolio is at greater risk due to lack of diversification.

Final Thoughts & Action Items

Dollar-Cost Averaging takes the guesswork out of investing. It’s like putting your portfolio on autopilot, and then watching it grow over time.

Let’s recap the action steps:

✅ Select the asset you’ll invest in

✅ Pick your DCA amount and schedule

✅ Automate deposits into your brokerage

✅ Automate your ETF purchases, if possible

✅ Stay consistent - resist the urge to tweak things constantly

In the coming weeks, we’ll cover some more topics related to passive investing and DCA, including:

The importance (and downsides) of diversification

Budgeting and how to avoid Lifestyle Creep

The asset that I DCA in my personal portfolio (it’s not an index ETF!)

And as always, if you have any questions, reply to this email — my goal with Wealth Potion is to answer all of your questions about personal finance, wealth building, and starting a business, so the more the merrier.

To your prosperity,

Brandon @ Wealth Potion