Index investing is supposed to be simple.

Buy the whole market. Set it and forget it. Then, let compounding do the work.

But if you've ever searched for Index ETFs on Google or in your brokerage app, you’ve probably been hit with a tidal wave of options.

Uhh… excuse me?!

$VOO. $SPY. $IVV. $VTI. $QQQ. $SCHD. $VEA. $VT… They all kind of sound the same. They’re all index ETFs… right?

So why are there so many? And how do you choose?

Today, we will cover:

What an Index ETF is

How to navigate the many Index ETF options

The importance of expense ratios

How to construct an investment portfolio of ETFs

As always, you can watch this article on YouTube as well:

Let’s dive in.

What Is An Index ETF?

An Index ETF (Exchange-Traded Fund) is a basket of stocks designed to mimic the performance of a market index.

If you buy a share of an ETF that tracks the S&P 500, you’re getting tiny pieces of the 500 largest U.S. companies, weighted by their market size. You own Apple, Microsoft, Amazon, and hundreds of others… all at once.

If individual stocks are fruits, think of an Index ETF as a fruit smoothie.

Instead of having to buy a ton of fruits and trying to equally portion a bunch of blueberries, tiny slices of watermelon, and 498 other fruits… you can just have a smoothie.

One of the major benefits of investing in Index ETFs is the built-in diversification.

Diversification is important because it spreads your risk across a large number of companies. If one company’s stock plummets, your money is still relatively safe, because you’re invested in 499 other companies.

Why Are There Multiple S&P 500 ETFs?

I often use the example of the S&P 500 (and the S&P 500 Index ETF) as an example, for a few reasons:

The S&P 500 is one of the most well-known indices in the world

It is one of the best performing indices in the world (10% annual return for 100+ years)

The 500 makes it super easy to understand — you’re investing in the 500 largest publicly-traded US companies

However, there are multiple S&P 500 Index ETFs!

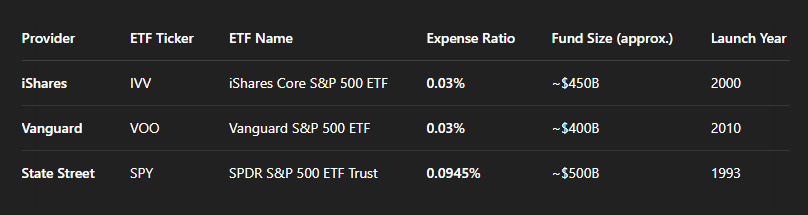

Let’s look at the three most common S&P 500 ETFs:

$SPY – The OG. Launched in 1993. Huge daily volume.

$VOO – Vanguard’s low-cost version.

$IVV – iShares’ alternative with similar fees.

All three track the same index. So most importantly, all three hold the same 500 companies, and all three will give you nearly identical performance.

But they’re managed by different companies, and this is where some of the differences matter.

This is like getting a fruit smoothie from Booster Juice, Jamba Juice, or Erewhon… but the fruit smoothies are identical. You are getting the exact same fruits, at the exact same proportions.

All three smoothies have the same fruit, in the same proportions. Erewhon is just more expensive.

The most important difference is the expense ratios (how much you pay annually).

$SPY ( ▲ 0.73% ) has a 0.0945% fee

$VOO ( ▲ 0.73% ) and $IVV ( ▲ 0.73% ) have a 0.03% fee

So in this example, $SPY ( ▲ 0.73% ) is the Erewhon smoothie — the exact same ingredients, but you pay higher fees because Erewhon employees are paid more.

Low fees are critical when selecting an index ETF. In fact, this is what makes index ETFs so much more effective at building your wealth compared to your typical mutual fund at a bank.

Remember in Level 2 of the 5 Levels of Investing Series where we talked about the 1% fee that financial advisors take, and how it compounds over time?

Mutual funds often have a fee of about 0.5%, whereas index ETFs fees are closer to 0.05% — a 10x difference.

So although the additional fee for $SPY ( ▲ 0.73% ) compared to $VOO ( ▲ 0.73% ) and $IVV ( ▲ 0.73% ) is fairly small, you definitely want to avoid actively managed mutual funds where fees can be much, much higher.

Popular Index ETFs by Market Exposure

Thus far, we’ve been using the S&P 500 as our example for an index ETF.

But there are many more indices, and they all have index ETFs!

Here are a few categories and examples you’ll commonly see:

ETF | Index | What it Tracks |

|---|---|---|

$VOO | S&P 500 | 500 large U.S. companies |

$VTI | CRSP US Total Market | The entire U.S. market (large, mid, small-cap) |

$QQQ | Nasdaq-100 | Tech-heavy giants like Apple, Nvidia, Tesla |

$SCHD | Dow Jones Dividend 100 | High-quality dividend stocks |

$VEA | FTSE Developed Markets | International developed stocks |

$VT | FTSE Global All Cap | The whole world—U.S. and international |

$IBIT | Bitcoin Spot Rate | Direct exposure to spot Bitcoin |

You don’t need to own all of these.

But you should understand what each ETF gives you exposure to, and how it might fit your investment strategy.

Think tech is the future? You could buy $QQQ ( ▲ 1.07% )

Want to optimize for dividends? You could buy $SCHD ( ▲ 0.35% )

Bullish on Bitcoin? You could buy $IBIT ( ▼ 0.06% )

As a YouTube commenter replied to one of my videos, many investors opt for an active “selection”, but a passive “holding” strategy.

These various index ETFs allow you to express your values and your perspective through your investments, while still being passive in the long run.

Now be careful… if you are frequently entering and exiting positions in various index ETFs, you might end up actively managing your portfolio.

Index ETFs benefit your investment portfolio by being easy-to-use and inherently diversified. But you still need to remain a passive investor in order for compounding to work its magic.

How Do You Choose an Index ETF(s)?

Start by asking: What part of the market do I want exposure to?

If you want just the U.S. large caps, go with an S&P 500 ETF like $VOO ( ▲ 0.73% ) .

If you want the entire U.S. market, including small-caps, $VTI ( ▲ 0.82% ) gives you the full spread.

If you want tech-focused growth, $QQQ ( ▲ 1.07% ) has been a high-flyer.

If you want dividends, $SCHD ( ▲ 0.35% ) is a fan favorite.

If you want global exposure, look at $VT ( ▲ 0.72% ) or combine $VOO ( ▲ 0.73% ) + $VEA ( ▲ 0.41% ) .

Yes, you could keep it simple and choose one index ETF to invest in.

But these various options exist so that you can mix-and-match and configure your portfolio so that you have confidence in it.

In a future Wealth Potion article, we discuss why it is critical to have confidence in your investments. When the market has a downturn, you want to be so confident that you want to buy more of your favorite investments, and not be tempted to sell them.

And this is where many ETF investors opt to have a portfolio of index ETFs, as opposed to buying just one.

/r/bogleheads is a community on Reddit dedicated to passive, index ETF investing

Maybe you’re bullish on Bitcoin, but you’re not so bullish that you’d stake your entire portfolio on it. And you broadly think the US is going to continue to be the economic leader of the world… and you think tech is the future.

So you could invest 50% in $VOO ( ▲ 0.73% ) , 40% in $QQQ ( ▲ 1.07% ) , and 10% in $IBIT ( ▼ 0.06% ), as an example.

Index ETF Investing Has a Learning Curve

Topics like this one are exactly why I started Wealth Potion. Shout-out to one of my long-time subscribers for replying to last week’s newsletter on Passive Investing and asking for a follow-up all about Index ETFs.

Although Index ETF Investing is often touted as simple, it can still be very overwhelming at first. It’s amazing that retail investors have access to these investment vehicles. But the downside is that there are so many options.

Hopefully, this week’s article made Index ETFs a bit easier to digest.

And as always, if you have any questions, feel free to reply. I read all replies and try to get back to each and every one of you ❤️

To your prosperity,

Brandon @ Wealth Potion