You’ve made it.

You’ve conquered your debt, escaped the cash trap, avoided shady financial advisors, and you’ve set up your tax-free accounts.

Now it’s time to fill those accounts with investments.

It’s time to put our money to work.

However, it’s at this step that many investors are tempted to pick and choose their favorite stocks…

But there’s a better way.

A way that is easier, simpler, less stressful, and will build your wealth faster.

Today, we’ll cover:

🧠 The Temptation of Active Investing

🏆 Why Passive Investing Wins

⚙️ How to Start Passive Investing

As always, you can watch this article on YouTube:

Without further ado, let’s dive in.

The Temptation of Active Investing

When most people start investing, they want to pick stocks and companies that they’re familiar with — and that they believe will be successful.

It’s exciting. It feels smart. It feels like you’re really doing something.

This is referred to as Active Investing, or Active Management.

There are a few reasons we fall into this trap:

The Potential for Higher Returns: To an untrained eye, the 10% average return of the S&P500 can seem low. But a consistent 10% return is extremely difficult to beat, as we’ll discuss shortly.

The Dunning-Kruger Effect: Many beginner investors recently built competence in their careers, which can boost their confidence. But this confidence may make you feel like you are a great stock picker.

Hindsight Bias: Looking at Nvidia or Tesla now makes it easy to think, “I would’ve seen that coming.” But when those companies were small, they looked risky, boring, or overhyped.

Selective Memory: We tend to forget unpleasant memories and remember positive ones, which can trick us into believing that we were better investors than we were.

Self-Serving Bias: We often attribute our success to internal factors and our failure to external factors. If a stock you picked does well, you’ll think it’s because you’re a genius. If a stock you picked does poorly, it’s because of something else.

Despite these warnings, many of us will still try our hand at active investing.

I made this mistake too.

Many of us do. Some of you may even need to try active investing to understand why it’s so hard to win that game long-term.

But there is a reason that the vast majority of people who have invested for more than a couple of years highly recommend passive investing instead.

If you read the next section and still think you can beat the market, at the very least, I’d recommend active investing with a small portion of your overall portfolio (e.g. 10%).

Why Passive Investing Wins

People lie. Numbers don’t.

The numbers are overwhelmingly clear: passive investing beats active investing for the vast majority of investors.

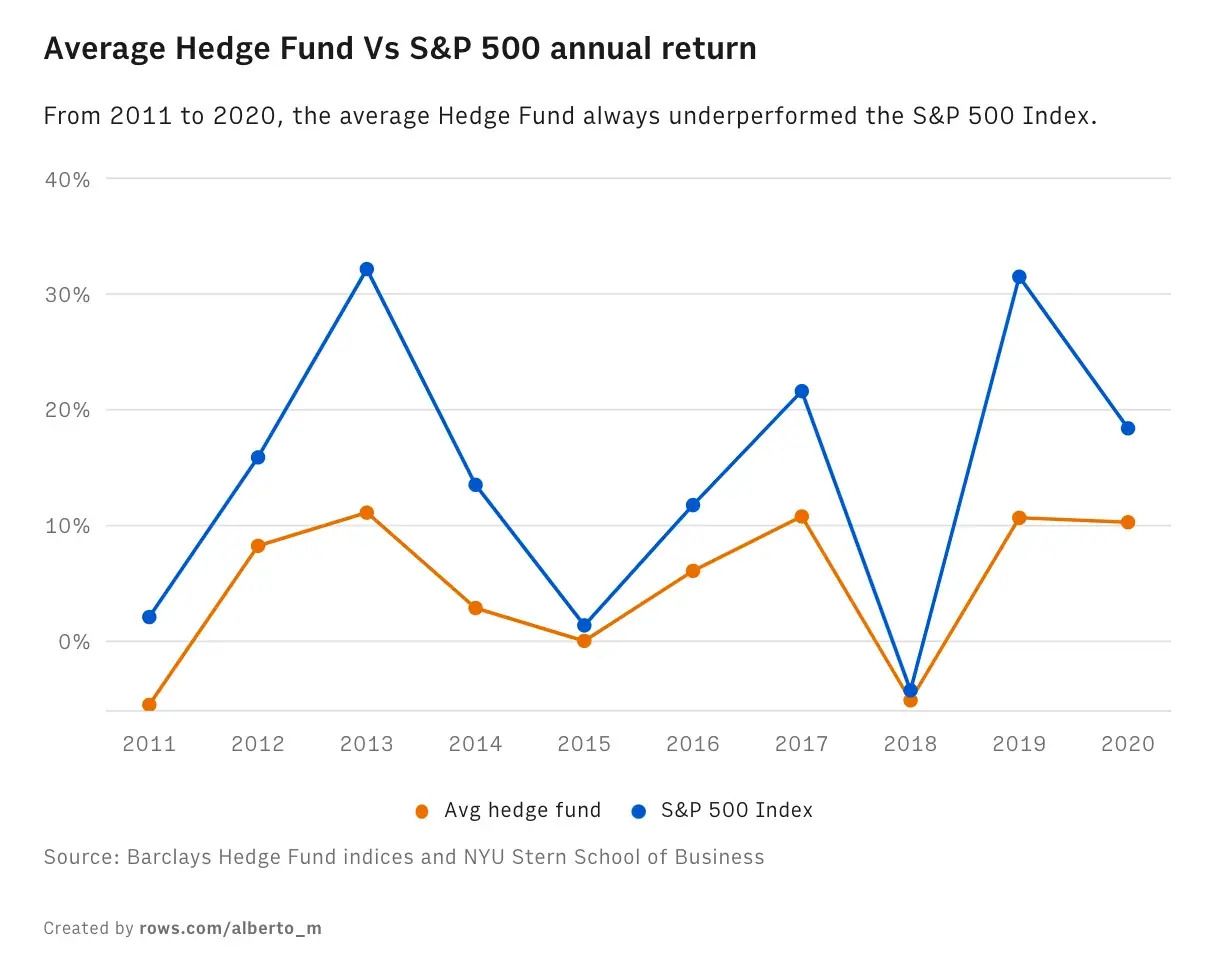

Even professional investors on Wall Street can’t consistently beat the S&P 500.

If the top hedge funds and Wall Street pros can’t reliably beat the market... what makes you think you can?

You might beat the market for a year or two. But over a decade is extremely unlikely.

So why does passive investing win? Well, a few reasons:

Hands Off: Because passive investing rejects active management, it completely removes the bias of human emotion in decision making.

Easy and Simple: It’s extremely easy to pick an index ETF, set up automatic purchases, and then wait.

Well Diversified: Assuming you invest in an index ETF*, you’re getting a maximally diversified portfolio of company that reduces risk.

*You can “passively invest” in vehicles other than an index ETF, and this is exactly what we’ll cover in Level, so stay tuned. In other words, you lose the benefit of being well-diversified, but you can trade that off for superior returns.

In my experience, it’s the “Hands Off” component that is most powerful for creating long-term gains.

As we saw in the graph above, the average hedge fund manager consistently underperform the S&P 500. And this is largely because it is their job to make decisions, and tweak their portfolios throughout the year.

And with each decision, they risk destroying some of their gains.

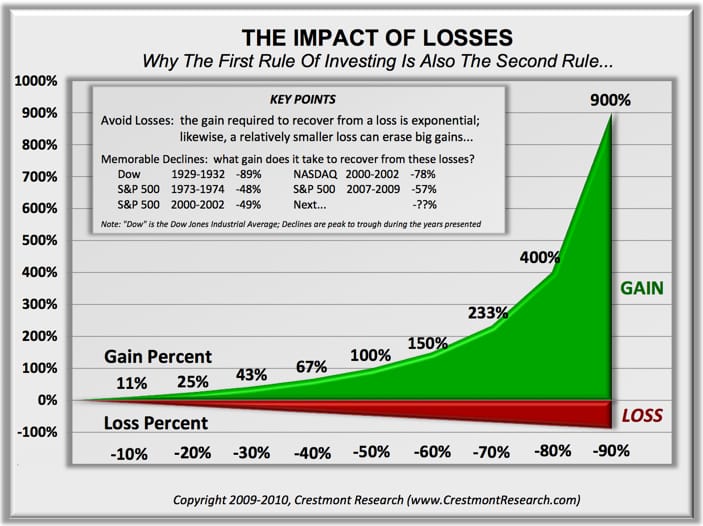

This is demonstrated mathematically through something called loss asymmetry.

Simply put, in investing, your losses hurt your wealth more than the gains help:

“Rule #1 of investing, never lose money.” - Warren Buffett

Lose 10%, and you need an 11% gain to recover.

Lose 50%, and you need to double your money (100% gain) just to break even.

Lose 90%, and you need to 10x your money to make it all back.

Meanwhile, the S&P 500 has averaged ~10% annually for nearly 100 years. It’s not flashy, but it’s consistent. And consistency is a necessary ingredient for compounding.

If you still don’t believe me, just take it from one of the best investors in the world:

“The active investors will have their returns diminished by a far greater percentage than will their inactive brethren. That means that the passive group – the "know-nothings" – must win.”

How to Start Passive Investing

As mentioned, one of the benefits of passive investing is the simplicity. It’s easy to set up, and it’s easy to manage.

Here’s how to get started, step-by-step.

Open a brokerage account (e.g. Wealthsimple in Canada, Robinhood in the U.S.)

Deposit cash — Preferably into a tax-advantaged account (see Level 3).

Choose an index ETF — Example: $VOO (Vanguard S&P 500 ETF) or a Total Market ETF.

Buy shares — Do a lump-sum buy, or set up Dollar Cost Averaging (more on that in our next newsletter 😉).

Wait. — This is the hardest (and most important) step. Buy and hold. Let compounding work its magic.

Passive investing is so simple, it can feel like you’re doing something wrong.

But you’re not. Once your brokerage shows you own those ETF shares—you’ve done it. You’re an investor.

I know for a lot of beginner investors, it can still feel daunting to be depositing large sums of cash into an online mobile app, and then purchasing stocks or index ETFs for the first time.

If you have any questions or worries about this process, let me know and I’m happy to cover more topics around the mental hurdles or common challenges.

To your prosperity,

Brandon @ Wealth Potion

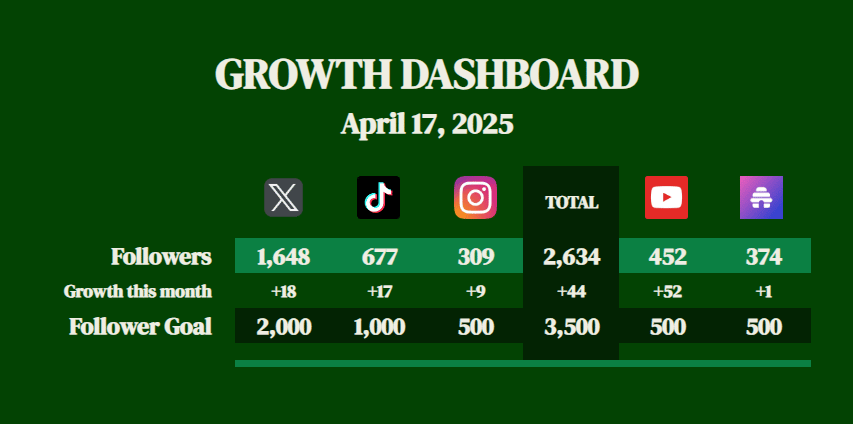

Build in Public Update

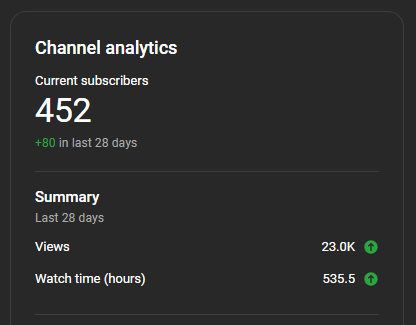

It’s been great to see my YouTube growth continuing it’s momentum.

Being honest, when I first started on YouTube, I had a very warped view of what the # of subscribers meant.

I have a much deeper appreciation of just how many YouTube creators are out there working hard to put out high-quality content.

It’s not much, but it’s honest work.

One of my goals this month is to optimize my process for re-sharing YouTube Shorts onto other platforms, such as X, TikTok, and Instagram.

I also polled my 6000+ LinkedIn connections and it sounds like short video clips are what most people want over there too. So I’ll start cross-posting to LinkedIn as well.

And perhaps most importantly, I need to work on a lead magnet resource that can drive more subscribers to this newsletter. I’ve found that the newsletter is by far the hardest platform to grow, because there is no built in discovery functionality like a social media platform. It requires more deliberate investment.

See you next week.