After 3 long years of rate hikes, the Fed has finally cut rates.

Inflation has been defeated. Mission accomplished!

Jerome Powell declaring victory over inflation, 2024 (colorized)

Or… has it?

The Federal Reserve’s target inflation rate is 2%, but inflation is still 2.5%. So why is the Fed cutting rates? Why are we declaring victory?

Inflation is a tricky topic because it seems simple on the surface, but there’s a lot more to it once you start digging.

Today, we’re breaking down the concept of inflation by challenging some common myths about inflation:

Myth #1: “When inflation comes down, prices come down.”

Myth #2: “Economics is a science.”

Myth #3: “Inflation is good, and deflation is bad.”

Let’s dive in.

Myth #1: “When inflation comes down, prices come down.”

This is by far the most widespread misconception about inflation.

The misunderstanding lies in the fact that inflation, measured by CPI, is demonstrating the rate of change in prices, not the level of prices themselves.

“When inflation comes down, it does not necessarily mean that prices are coming down.”

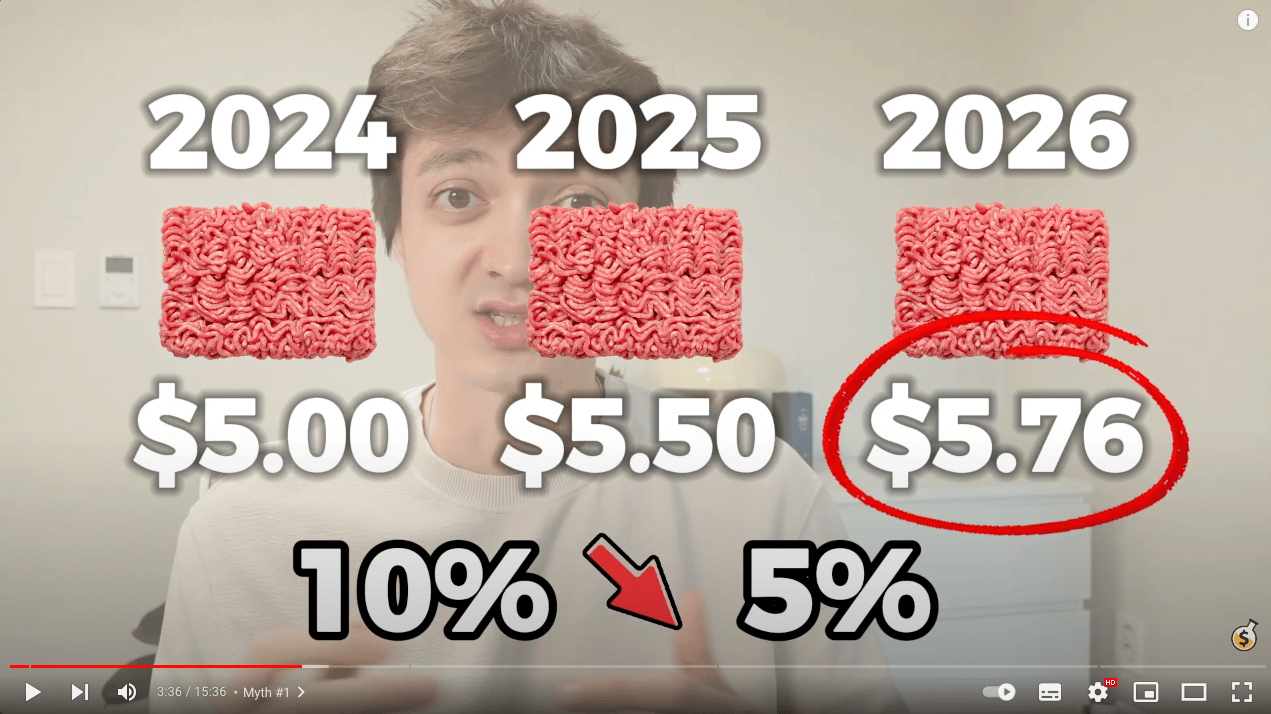

If ground beef is $5.00/lb, and 1 year later the price goes up to $5.50/lb, then that represents 10% inflation.

If another year later, the price goes up to $5.76/lb, then that represents ~5% inflation.

Inflation went down from 10% to 5%... but prices are still going up!

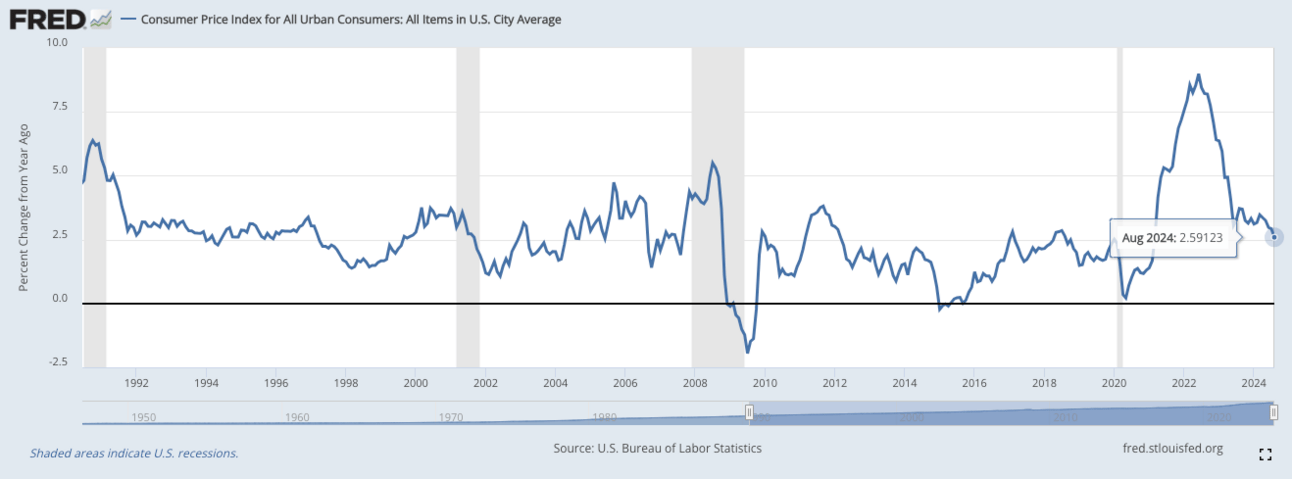

Now, if we look again at the latest CPI data from the U.S Bureau of Labor Statistics, we can see that inflation “came down” from about 9% to 2.5%.

But it’s important to understand that prices are still going up by 2.5% year-over-year, on average.

And in the long run, inflation will always be approximately 2%.

Why?

Because the Federal Reserve has an inflation target of 2%.

And so, you might ask again…

Why?

Why would the Federal Reserve want prices to go up by 2% per year?

Before we can answer that question directly, we need to clear the air…

Myth #2: “Economics is a science.”

Economics is considered a social science.

But it is not a physical science, or a hard science.

Economics is much more akin to an art than a science.

Just like there are different styles of painting - abstract, realism, impressionism, and so on - there are many schools of economic thought.

And just like there are many artists who are frustrated with the current state of modern art, there are many economists out there that disagree with the mainstream.

To be precise, most mainstream economists have been heavily influenced by the Keynesian School of Economics.

Paul Krugman single-handedly ruining the reputations of economists

By ‘mainstream’, I don’t just mean the economists and pundits that you see on the news. I mean economists that work at the Federal Reserve, in the federal government, and that ultimately determine economic policy in the U.S. and around the world.

This topic deserves an article all on it’s own… so subscribe to Wealth Potion if you aren’t subscribed already:

But in short, what you need to know is that Keynesian economics is founded upon the belief that total demand in the economy is the primary driver of economic activity.

Therefore, when the economy is showing signs of weakness, the Keynesian would advocate for active government intervention to stimulate the economy.

Economics is much more akin to an art than a science.

What does this have to do with inflation?

Because it is extremely important to take everything in economics with a grain of salt.

Economics is ultimately the study of human behaviour at a societal scale. It cannot be tested in a lab like a physics experiment.

And because of this, economists are often wrong.

Over 90% of economists thought the Fed would raise rates by 25 bps, not 50 bps. Oops!

When you hear economists on TV talking about the economy, you should always imagine them saying “according to our school of economic thought, I believe xyz”.

This applies to Wealth Potion, and any other Content Creator you follow as well.

Anything else is dishonest.

So without further ado, according to my school of economic thought, we need to bust a one more myth…

Myth #3: “Inflation is Required for a Healthy Economy”

So why does the Federal Reserve have an inflation target of 2%?

First, let’s look at the 2%

Why 2% and not some other number?

Now that’s a funny story.

Yes, you read that right…

The year is 1988. New Zealand has just endured a very rough bout of inflation surpassing 15%.

Put on the spot in an interview, New Zealand’s governor of the Reserve Bank is asked if he is satisfied with the central bank’s curtailing of inflation to the low single digits.

He answers “No”, adding that he’d “ideally want an inflation rate of between 0 and 1%” as reported by Quartz.

This was later rounded up to 2%.

This off-hand remark in a TV interview from New Zealand became the basis of an inflation target that would dictate the monetary policy of the Federal Reserve, the Bank of England, and practically every other central bank in the world as a result.

Ok, so the origins of the 2% inflation target are questionable at best.

Forget the 2% number, then…

Why do we target inflation at all?

Is inflation a good thing?

Is deflation a bad thing?

In the book, ‘The Price of Tomorrow’ by Jeff Booth, Booth argues that technology is inherently deflationary. There is no escaping it.

Having worked in tech for the last 10 years, I have to agree.

Technology exists to save us time and money. Every invention from the wheel, to the printing press, to the internet, to your favorite SaaS platform… technology reduces aggregate demand by making things faster and cheaper.

And as technological innovation accelerates, deflation will accelerate.

The idea that “deflation is bad” comes from Keynesian economics.

The belief is that if prices fall, this would result in lower consumption.

Wait, what?

You would think that if prices went down, then consumers would consume more! Not according to Keynesians. Their belief is that when prices fall, consumers would delay spending, expecting prices to fall further.

If ground beef is $5/lb but next year it’ll be $4.50/lb, I’ll just delay my consumption.

If we accept this ridiculous premise, then you can see where their concern lies. Modern economists believe that lower consumption would result in more deflation, which would result in a feedback loop, further lowering prices and lowering consumption.

Central Banks all around the world are largely Keynesian.

I wish I were joking.

This is the logic that is used to justify 2% inflation. And when you really think about it, inflation is synonymous with debasement. Our money can purchase fewer and fewer goods over time.

And monetary debasement is theft.

“Inflation is theft, and deflation is inevitable.”

I’m not going to convince you that deflation is good and inflation is bad in one article.

But I hope I’ve at least planted a seed.

What if 2% inflation isn’t ideal?

What if deflation isn’t necessarily a bad thing?

What if central banks… don’t know what they’re doing?

Why must we buy assets just to protect our wealth from inflation?

How much more abundant could our world be if we let technological deflation run its course?

I’ll leave you with this illustration based on a speech by David Foster Wallace:

The point of the fish story is merely that the most obvious, important realities are often the ones that are hardest to see and talk about.

Perhaps inflation is the water that we’re swimming in.

All I propose, is that you stop and ask…

“What the hell is water?”

Build in Public Update

I’m trying out a different newsletter platform this week, and I’d love your feedback! How do you like the new look and feel of Wealth Potion?

How do you like the new look and feel?

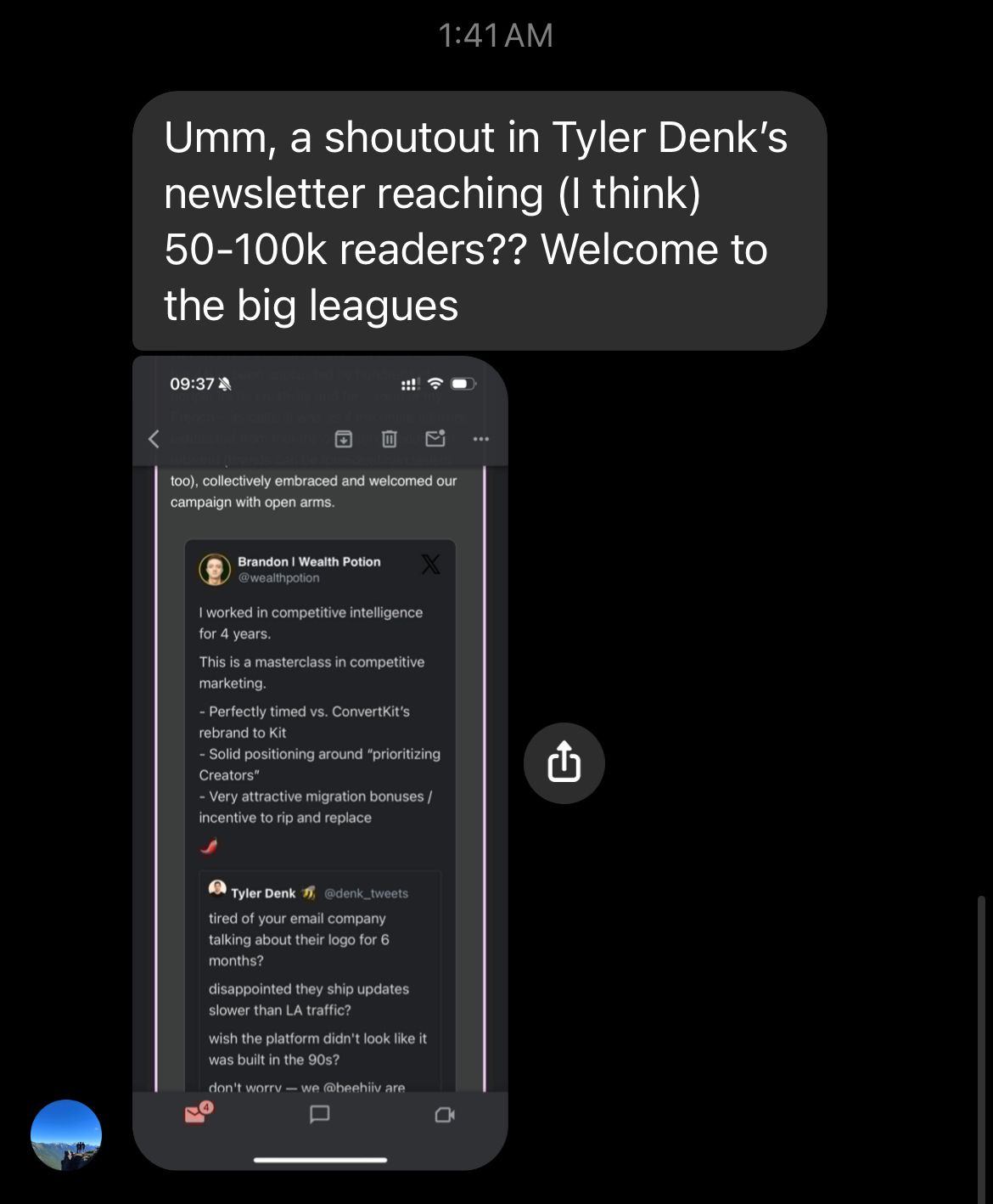

In other news, it’s been a pretty eventful past couple of weeks:

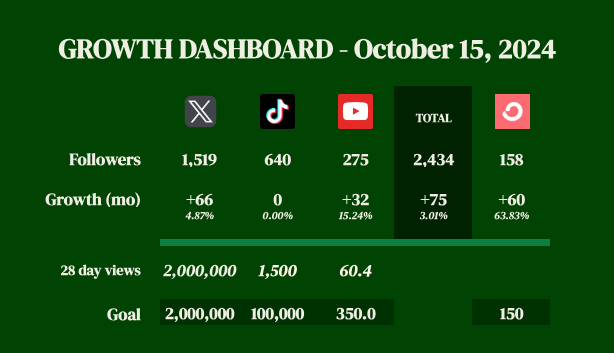

I hit 1,500 followers on Twitter

I hit 250 subscribers on YouTube

I hit 150 subscribers on the newsletter

I got a shout-out on Tyler Denk’s newsletter ‘Big Desk Energy’ (Beehiiv Co-Founder)

And last but certainly not least, I was a guest on Robin Seyr’s Bitcoin Podcast:

The stressful part of entrepreneurship is that there is always more to do. My to-do list grows faster than I can tackle items off it.

But that’s also what makes it fun :)

To your prosperity,

Brandon @ Wealth Potion