Following Trump’s electoral victory, asset prices soared.

Among them, Bitcoin was the fastest horse. It climbed over 40% in the span of weeks.

This is rekindling an ages-old debate in the Bitcoin / FinTwit space:

Is Bitcoin a risk asset? Or is it an inflation hedge?

In short, the answer is “Yes”.

By the end of today’s article, you’ll better understand what makes Bitcoin perform alongside high-risk tech stocks, but also perform strongly when inflation expectations heighten.

Let’s dive in.

Did you know you can watch all Wealth Potion articles in video format over on YouTube? If you aren’t subscribed yet, what are you waiting for 🙂

Bitcoin’s Correlation With Risk Assets

As usual at Wealth Potion, we’ll look at things as simply as possible before diving in deeper.

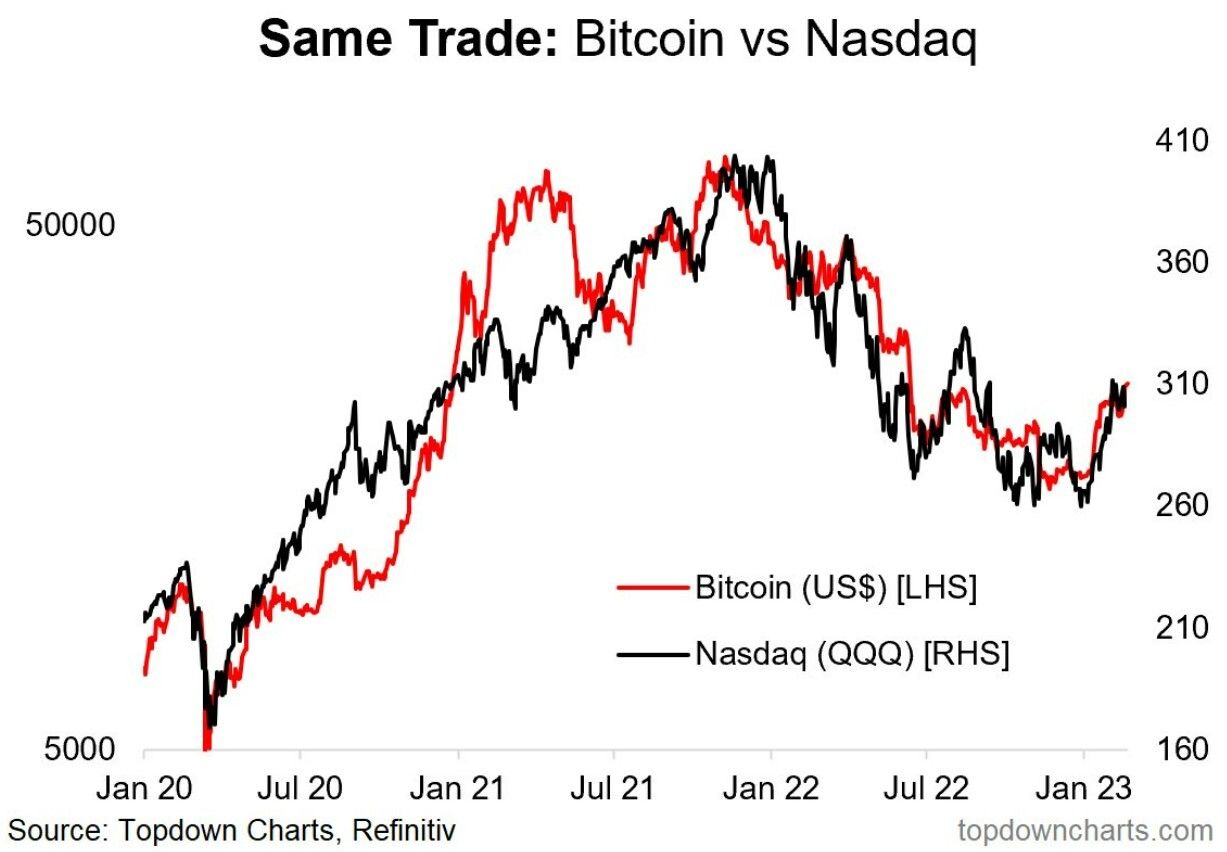

If we simply look at the price performance of Bitcoin and compare it to other risk assets, we can clearly see the correlation.

Using the NASDAQ as a proxy for risky tech stocks, we can see Bitcoin’s strong correlation.

When (high risk) tech stocks go up, Bitcoin goes up. When tech stocks go down, Bitcoin goes down.

Simple enough, right?

This also can be observed by looking at the past few weeks following the US election.

As we discussed last week, asset markets are generally bullish following Trump’s win. During a bullish run-up, we generally see riskier assets perform better.

And that’s exactly what we see:

The S&P500 is up ~4%

The NASDAQ is up ~5%

Tesla stock ($TSLA) is up ~35%

Bitcoin ($BTC) is up ~40%

Just as we expected, risk assets are performing well, and riskier assets are performing best.

So if Bitcoin is actually a risk asset, does that mean it’s not an inflation hedge?

What Is An Inflation Hedge?

First, we need to understand the concept of an inflation “hedge”.

We’ve discussed inflation many times in the past, but put simply: Inflation is the process of our money losing purchasing power over time.

2% inflation can be understood as “the same amount of dollars is able to purchase 2% fewer goods”.

Austrian economists generally weren’t a fan of inflation.

When inflation occurs (or is expected to occur), many investors will move their money from dollars to some sort of asset that can protect them from the effects of inflation.

This is what a “hedge” is: Just like a hedge around a lawn, a hedge protects your investments from risks.

For thousands of years, humanity’s inflation hedge of choice has been gold.

Why gold?

Because gold is a scarce mineral that is hard to procure more of, which allows it to hold it’s value over time.

In fact, the scarcity of gold is one of the main reasons that gold was used as money for thousands of years. We’ll definitely be doing a future article and video about gold, so stay tuned.

The Original Purpose of Bitcoin

Why was Bitcoin created?

We covered this briefly in a previous article comparing Bitcoin to crypto. But in case you missed it, Bitcoin was created as a protest against government money printing.

Shortly after creating Bitcoin, Satoshi Nakamoto posted this message on the Peer-2-Peer Foundation Forums:

They key quote is the following:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

Fiat means “by authoritative or arbitrary order”, and it describes the money we use today.

The dollar has value not because it is backed by anything, but because the government declares it to have value.

It’s clear that Satoshi Nakamoto agreed with Milton Friedman’s take on the cause of inflation:

Milton Friedman was very outspoken about inflation.

Inflation is created when the government prints more money. And Bitcoin is a form of money that the government cannot arbitrarily print more of.

In other words, Bitcoin was created as an inflation hedge.

Bringing It All Together

Let’s recap:

Bitcoin performs similar to other risk assets. When tech stocks go up, Bitcoin goes up. When tech stocks go down, Bitcoin goes down.

Bitcoin was created as an inflation hedge. Satoshi Nakamoto did not trust the central bank to resist the temptation of money printing.

I’m known in many of my social circles as “The Bitcoin Guy”. I used to resist it, but I’ve grown used to it.

When I’m asked by my friends and family to describe Bitcoin to them, this is how I generally reply - especially if they have a background in B2B tech:

Technology companies are trying to solve problems with technology all the time. Some of them fail, but some of them alter the course of history.

Imagine a startup that was trying to solve the problem of money. Except this startup has no employees, has no office, has no CEO, and has no stock on the stock market…

Instead of buying the company’s stock, you simply participate in the monetary network by buying this new form of money. That’s Bitcoin.

Wouldn’t this new form of money perform exactly as Bitcoin has? Both as a risk asset, and as an inflation hedge?

I’ll leave you with this final question:

If a new form of money for humanity were to emerge… how would it emerge?

I would argue that if such a thing were to exist, it would emerge very similar to the way Bitcoin emerged.

First, on a random internet forum of cryptographers and tech nerds. Then, it would grow… slowly but surely, with the majority of people rejecting it and calling it a scam… until finally, it’s being bought by hedge funds, banks, and even entire countries.

If you don’t understand Bitcoin yet, that’s ok. I don’t understand Bitcoin. No one really understands Bitcoin. It is emerging and evolving right before your eyes.

All I ask is that you open your mind, and resist the urge to reject it as a scam.

Your future wealth might just depend on it.

Top Card Offering 0% Interest until Nearly 2026

This credit card gives more cash back than any other card in the category & will match all the cash back you earned at the end of your first year.

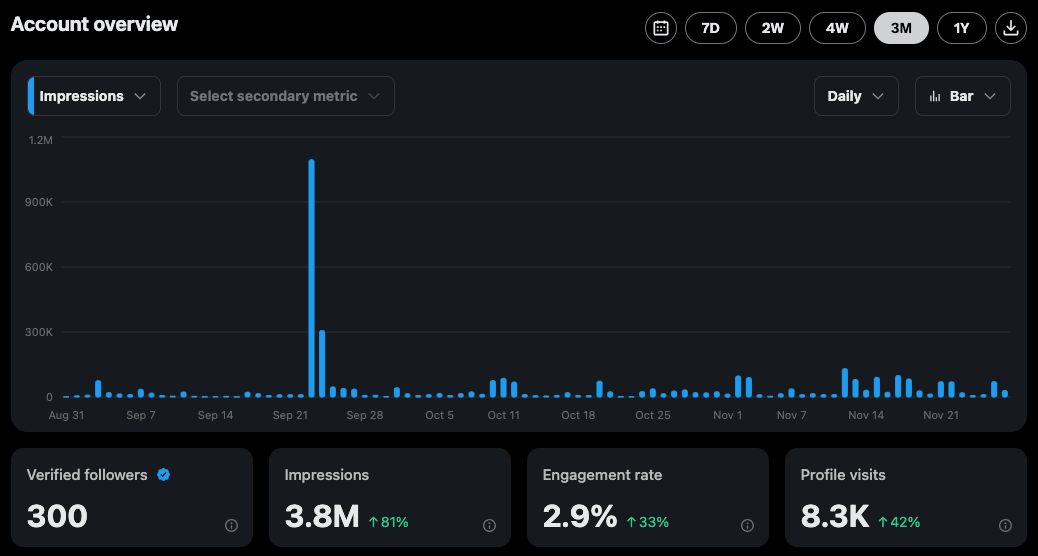

Build In Public Update

I made a silly arithmetic error last week.

To achieve X monetization, yes I need 1.2M more impressions in the next ~20 days… but I forgot to account for the impressions that will drop off the chart on the left.

So I need 1.2M more impressions than what I got in September.

Still do-able. But it’ll be a close race. Needless to say, I need to post more on X.

I also have been having more success promoting my YouTube videos on X. X is by far my largest audience, so using it as a top of funnel (TOFU) seems to be the right play.

Right now, YouTube and my newsletter are the end goal. But when I have digital products in the future, YouTube and the newsletter will become the bottom of funnel (BOFU), and my paid products will become the destination.

Happy to share more on this strategy in the future if it’s interesting to you all.

To your prosperity,

Brandon @ Wealth Potion