When I speak with people from my “past life” in B2B tech, they often point out that I made a huge pivot in my career.

From ~10 years working in sales, product and marketing at tech startups to… creating content about money?

Today’s article is about the a-ha moment that I had:

Your job in B2B tech is directly impacted by the financial system.

And even if you have no intention of leaving the B2B tech world…

I believe that you should have at least a basic level of understanding of these financial concepts to make better decisions for your career.

And that’s what Wealth Potion is all about.

First, we have to go back in time… to 2008.

The 2008 Financial Crisis and Interest Rates

For those old enough to remember, 2008 was a very significant financial crisis in the US, and across the world.

We won’t be covering the whole financial crisis. Instead, we’re going to focus on what happened immediately after 2008.

Most notably, what did the Federal Reserve do to help get the economy out of a recession?

The interest rate went to ~0% and stayed at 0% for close to a decade.

They lowered interest rates.

What does this mean?

As we’ve discussed in previous articles, the Federal Reserve (the Central Bank of the US) wants to ensure maximum employment in the economy. And they have limited tools to achieve this.

2008 resulted in massive unemployment. So the Fed lowered interest rates to stimulate the economy, and hopefully create more jobs.

In the span of 6 months, they lowered the Fed Funds Rate from 5.25% to 0.15%.

And then interest rates stayed at ~0.15% for almost 10 years.

So how exactly do low interest rates stimulate the economy?

And how does it impact tech?

Cheap Money and Tech on “Easy Mode”

When interest rates are low, investors often refer to this as “money being cheap”.

Why?

Because you can think of the interest rate as the cost of borrowing money. Low interest rates = borrowing money is cheap.

Interest rates impact the economy in many ways, but here’s a simple example to grok it:

When interest rates are low, businesses can take on more debt, providing them with more funding, which they can then use to hire more people.

But something else happens, which will be extremely important later…

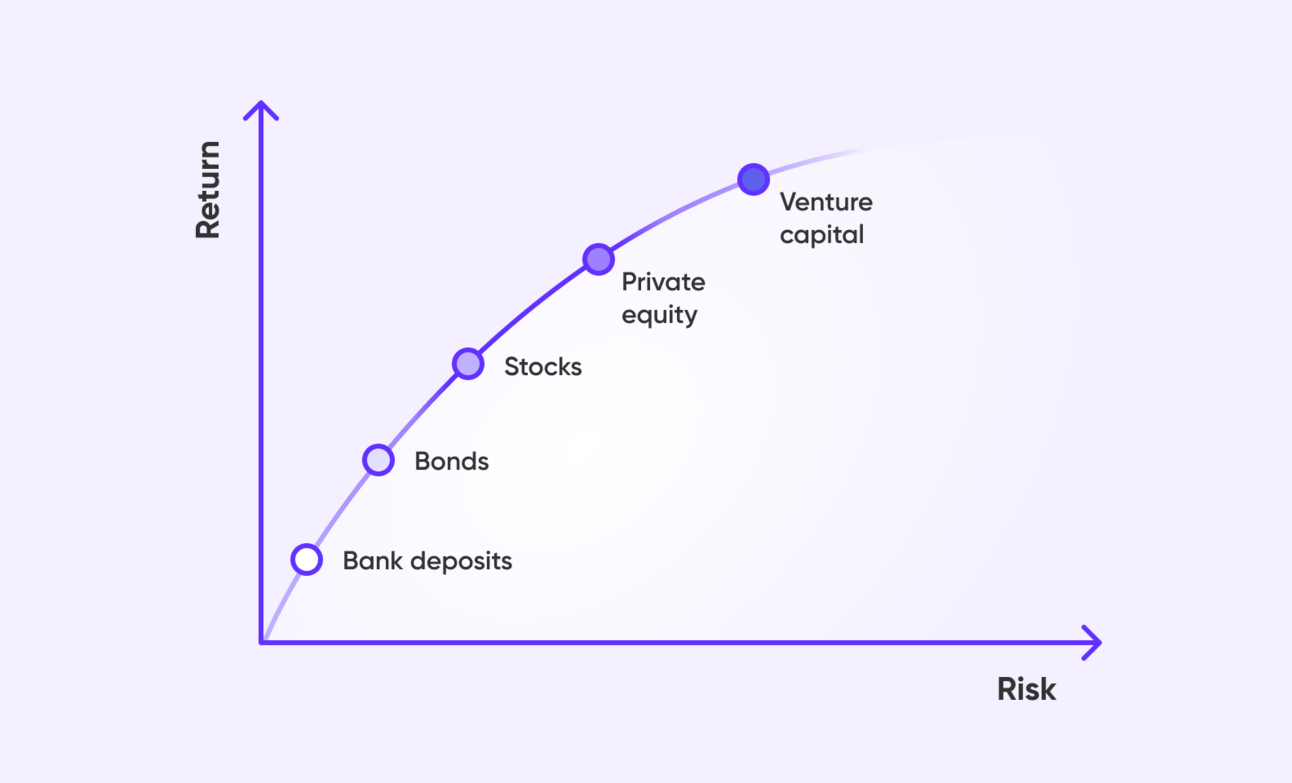

When interest rates are low, bonds provide lower returns. So investors re-allocate money away from bonds into more risky investments. To put it simply:

Lower interest rates push investors out the risk curve.

As interest rates lower, investors take on more risk to seek higher returns.

See where I’m going with this yet?

Alright, I’ll lay it all out.

Interest rates have been low (close to zero) for nearly 2 decades.

When interest rates are low, money flows into riskier assets, like venture capital.

When venture capital has lots of money to invest, technology companies get lots of funding.

When technology companies get lots of funding, it creates lots of jobs in tech.

That’s awesome news, right?

It is. Until it isn’t.

What happens when interest rates go up?

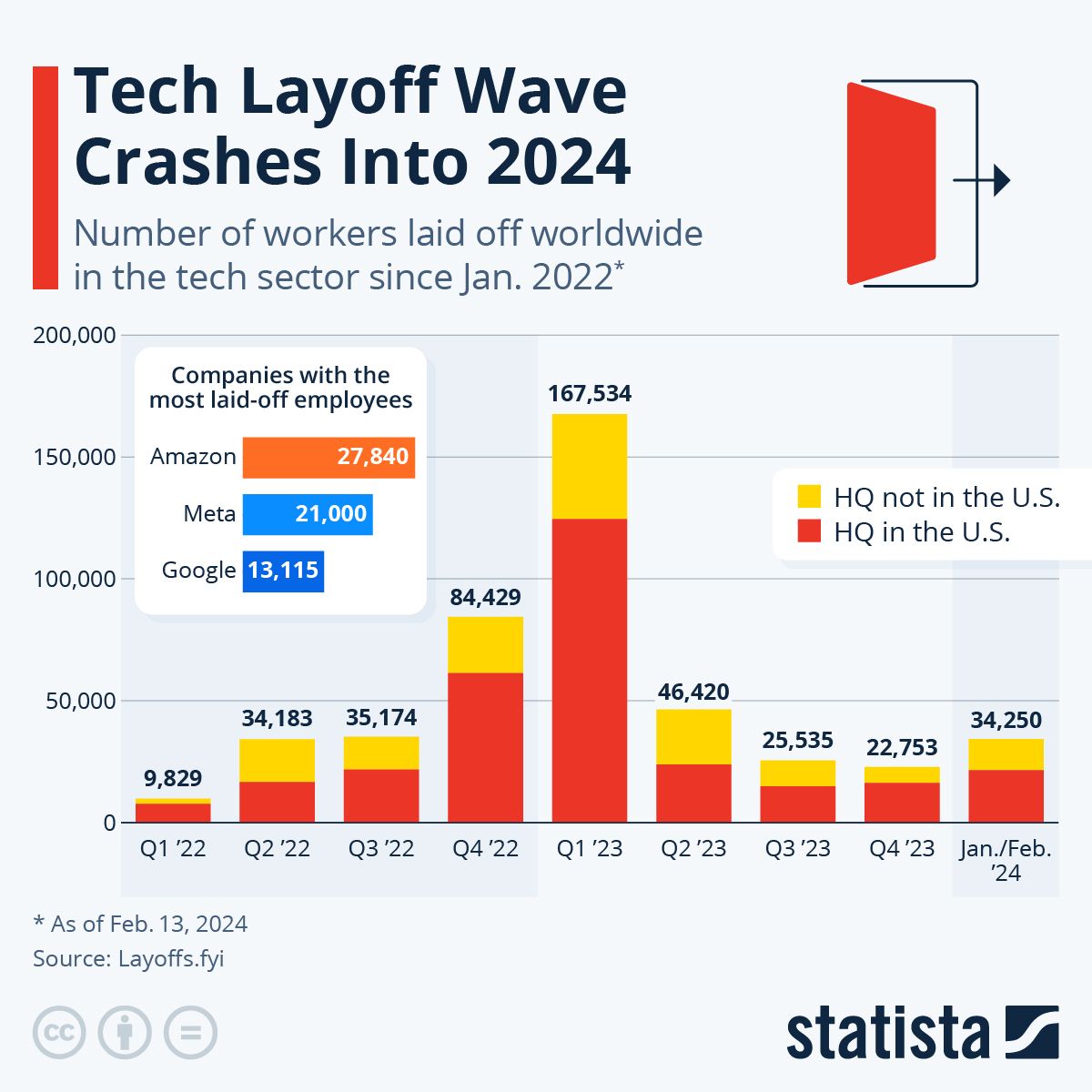

To answer this question, we simply have to look at 2022.

The fastest rate hike in recent history - from Feb 2022 to Aug 2023.

If you worked in tech in 2020 and 2021, you remember how awesome it was.

Tech companies were hiring across the board

Budgets were flush with cash, spending on all the newest technology

Startups were raising massive rounds of funding every 1-2 years

But all the monetary stimulus (which many would argue was necessary due to the pandemic) resulted in something we’ve talked about a lot recently:

Inflation.

And to tamp down inflation, the Federal Reserve was forced to hike rates.

What happened when the Fed hiked rates?

The VC money train came to a halt.

Budgets froze. Hiring froze. And then, a lot of technology companies were forced to do layoffs.

I mentioned this in my interview with Robin Seyr recently.

If you worked in tech between 2021 and 2022, you experienced this monetary rollercoaster first hand.

Your technology company went from easy mode to hard mode, practically overnight. If you didn’t get laid off, your job got a lot harder.

And it had nothing to do with the technology, or your company.

It had everything to do with money.

This is ultimately what I hope everyone takes away from this article.

All this talk about inflation, interest rates, the Federal Reserve, Jerome Powell…

It might all seem boring to you.

But it has a direct impact on your startup, your career, and your livelihood.

If you’re not as passionate about this stuff as me, don’t worry!

That’s exactly why I created Wealth Potion:

To keep you informed, in 15 minutes per week, so you can make better decisions for your financial future, and focus on the career you love.

To your prosperity,

Brandon @ Wealth Potion

Whiskey: A Hedge Against Market Volatility

Looking to protect your portfolio from the next recession?

Consider investing in rare spirits like whiskey.

Whiskey investing provides a proven hedge against stock market dips driven by inflation and other factors.

With Vinovest, you can invest in high-growth segments such as American Single Malt, emerging Scotch, Bourbon, and Irish whiskey. Thanks to established industry relationships, Vinovest overcomes industry barriers that have made historically whiskey investing expensive and opaque. As a result, you can enjoy high-quality inventory that boosts your portfolio value and enhances liquidity.

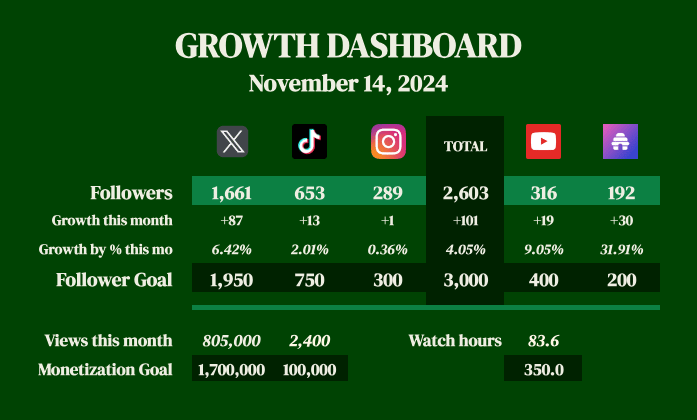

Build In Public Update

I am making some solid progress toward my Twitter impressions goal, and I feel like monetization is within reach.

Because of a huge spike I got about a month ago, that gives me about 1 month to get 1.7m impressions.

Should be easy, right?

Once I hit that threshold, I should be eligible for X Creator Revenue Sharing.

Onwards and upwards!