Last week, a billionaire went on MSNBC and said the following:

“All roads lead to inflation.”

Today, we’re going to break down:

Who is Paul Tudor Jones?

Why should we listen to him?

How did he conclude that “all roads lead to inflation”?

What does this means for our investments, and

How can we protect our wealth from inflation?

Let’s dive in.

Private Market Access for Accredited Investors

All investments have the risk of loss. UpMarket is not associated with or endorsed by the above-listed companies. Only available to eligible accredited investors. View important disclosures at www.upmarket.co

UpMarket brings accredited investors closer to the potential tech giants of tomorrow. Trusted by over 500 investors, our platform has facilitated over $175M in investments in private companies like OpenAI, ByteDance, and SpaceX. UpMarket simplifies access to exclusive deals that could help you redefine your investment portfolio. Embrace the future of investing with UpMarket and gain a foothold in nascent industries and sectors that are changing the world.

Who is Paul Tudor Jones?

Paul Tudor Jones (let’s call him PTJ) is an American billionaire who built his wealth in the hedge fund industry.

His estimated net worth is 8.1 billion USD.

Much of PTJ’s success is due to his firm, Tudor Investment Corporation, which was founded in 1980 and is considered one of the pioneers of the modern day hedge fund industry.

What exactly did he pioneer?

Essentially, he was one of the first “macro investors”. His firm looked at global macroeconomic trends when making investments, and they invested in a wide array of assets (bonds, stocks, commodities, currencies) in order to bet on those hypotheses.

Think of it this way:

Traditional investors were playing a single game of chess, while PTJ was playing multiple games at once.

Or, imagine that scene from the Netflix series “Queen’s Gambit”

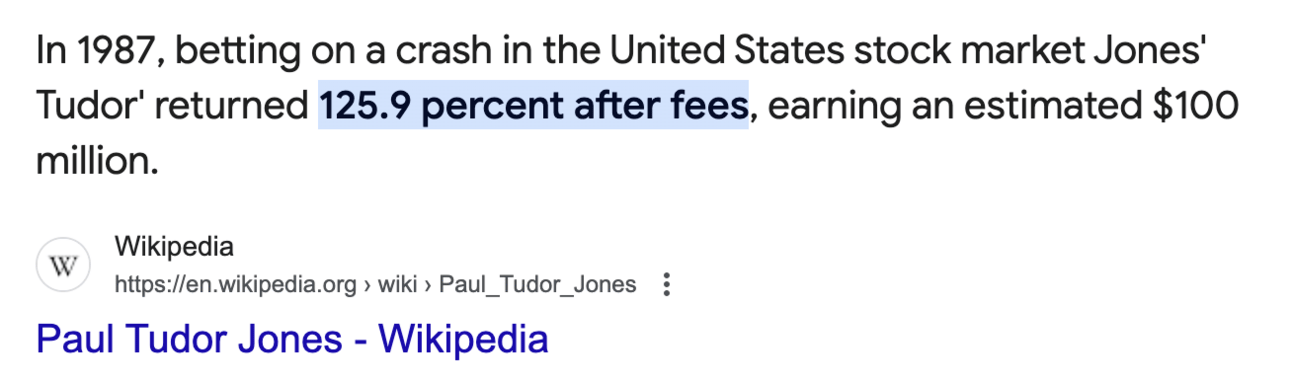

As a prime example of this strategy, PTJ predicted the 1987 stock market crash and positioned his firm to make 125% gains that year.

I don’t claim to be able to predict the next recession… but I am confident that understanding macroeconomics is one of the best ways of protecting your wealth in the face of the next recession, whenever that occurs.

Which takes us to his comments he made last week.

“All Roads Lead to Inflation”

Last week, on October 27th, PTJ said this:

I’ll break down his logic as simply as possible:

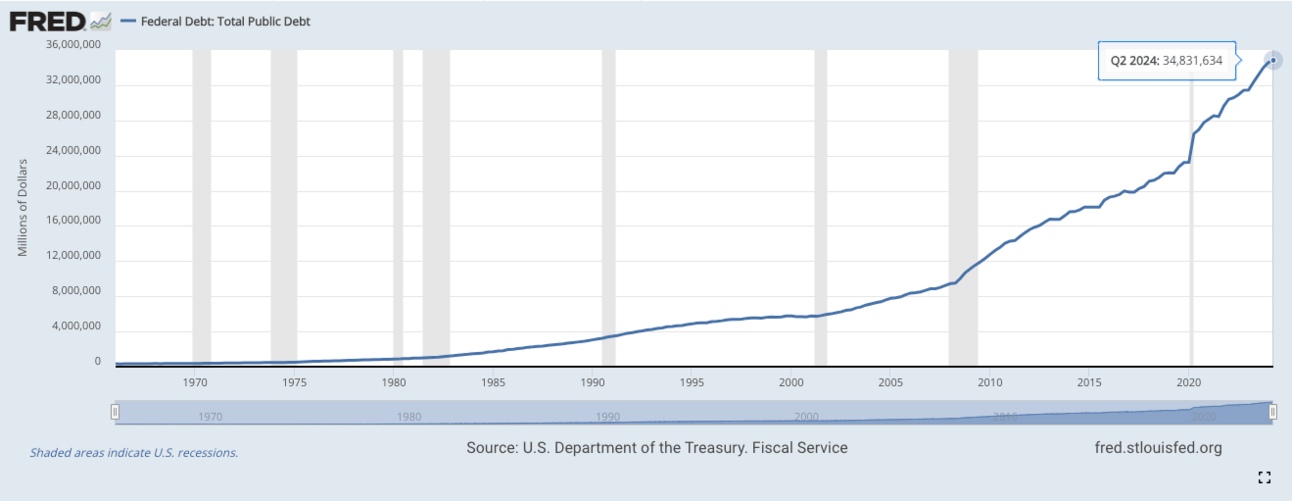

The US Debt is Growing Exponentially. Federal debt grew as the Trump and Biden administrations spent loads of money. This stimulated the economy, but it also led to inflation, which forced the Federal Reserve to raise interest rates.

The US federal debt is now >$34,000,000,000,000 (34 trillion)

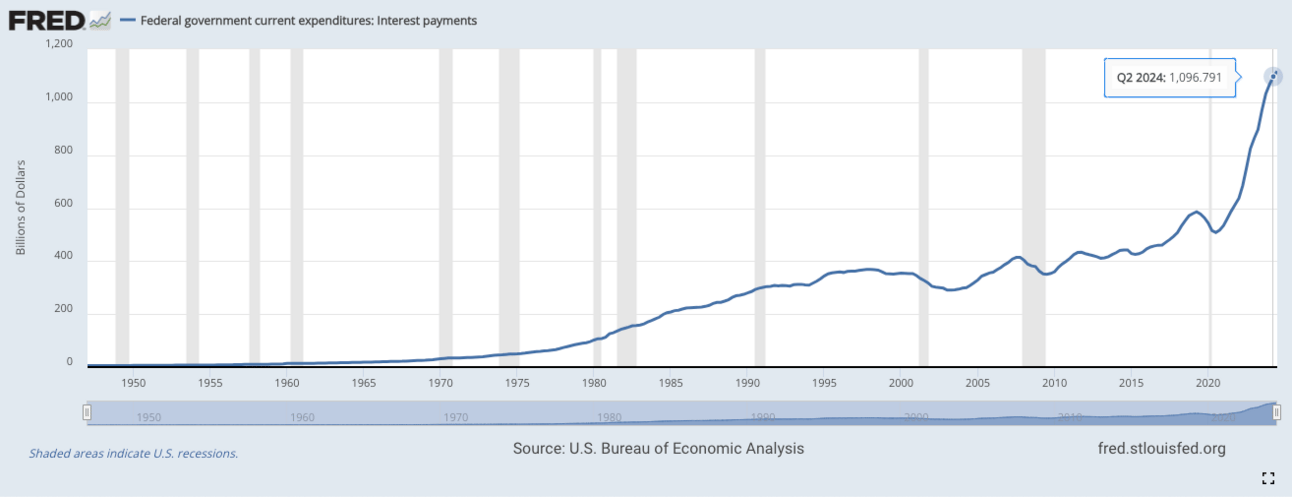

It’s becoming less feasible to allow the debt to continue growing. The federal debt is like an elephant in the room. An elephant that’s growing bigger really fast... You can ignore it for a while, but not forever. Lots of debt + high interest rates = expensive interest payments. This takes more money away from other investments that the government could make into the economy, and perhaps just as importantly, it reduces investor confidence in the US bond market.

The interest payments on the federal debt is over $1 trillion per year, which is >3% of US GDP.

The government now has limited options to reduce the debt. They could raise taxes (politically unpopular), reduce spending (politically unpopular), default on the debt (has never happened in history) or allow inflation to run hot. The latter-most is the most likely.

How does inflation help manage the debt? As explain in last week’s article, inflation reduces the value of the dollar, making future interest payments easier to pay back - because you’re paying it back with “cheaper” dollars.

In other words, Paul Tudor Jones does not think a Trump or Harris administration will meaningfully raise taxes or reduce spending.

That ultimately leaves them with one remaining option - allow inflation to run hot and reduce the “real” value of the debt.

“The playbook to get out of this (debt problem) is that you inflate your way out.”

If you missed last week’s article, here’s what “inflate your way out” means. Imagine the following:

I borrow $10,000 from you at 2% interest

In 1 year, I will pay you back $10,200

Inflation that year is 3%

The $10,200 that I pay you back will be able to buy fewer goods and services than the $10,000 I borrowed a year ago

Put another way - I pay you back with less valuable dollars

Of course, the US government could ignore the problem altogether, and let the debt continue to climb.

The risk with this option is that this would make the US economy more fragile if there were to be another shock like we experienced in 2020.

As a rough example, if a war were to break out, it would be more difficult for the US government to fund that war.

Which is exactly what the enemies of the US want.

The above clip is just a highlight from PTJ’s interview on CNBC. You can watch the whole interview here, where he elaborates on why raising taxes and cutting spending are also potential solutions, but that they also would not make a significant enoughh impact on the debt.

PTJ could be right, and he could be wrong. So what should we do if we think he is right?

How Can We Protect Our Wealth From Inflation?

The short answer is buy assets.

Assets will go up in dollar value as inflation erodes the value of the dollar.

Which assets?

This is not financial advice, but let’s re-listen to what Paul Tudor Jones’ said on CNBC:

“I’m long gold, I’m long Bitcoin, […] I’m long commodities. I think most young people find their inflation hedges in NASDAQ (tech companies and growth stocks). And I own zero fixed income (bonds).”

Why these assets?

Gold is a traditional inflation hedge that has been used for thousands of years. It tends to retain its value because it is hard to produce more of.

Bitcoin is viewed by many as a “digital gold”. It is also scarce, in that there will never be more than 21 million Bitcoin. And it was explicitly created as a peaceful protest against government money printing.

Commodities are often directly linked to the very consumer goods that are increasing in price due to inflation, so they stand to gain when inflation hits.

The Nasdaq is largely made up of tech stocks and high-growth companies, which are able to grow rapidly and can outpace the rate of inflation.

And why no fixed income?

Because bonds provide the bondholder with fixed payments (hence why they are called fixed income) denominated in dollars, but those dollars are losing value each year.

And of course, this is just one billionaire’s view. Take it all with a grain of salt.

Whether or not you agree with his outlook, I hope this week’s article has taught you about the importance of macroeconomics when it comes to investing.

Especially in the face of growing uncertainty.

Build in Public Update

Since moving to South Korea, I’ve had weekly chats with my dad back in Canada.

We catch up, talk about our week, but then our discussion often goes down some rabbit hole - Bitcoin, the economy, God, Austrian economics, you name it.

So we thought we’d try having our weekly chats on X Spaces, so that other people could join in or listen in.

Last Sunday, we hosted our first spaces. About 5 people listened in and 2 joined us on stage as speakers. It was a lot of fun, and we’ll likely do it again.

If you want to check out the recording, you can find it on X here:

We talk about Peanut the Squirrel, anarcho-tyrrany, Bitcoin, Christianity, praxeology, and more. We tried our best to avoid politics 🙃

To your prosperity,

Brandon @ Wealth Potion