Today’s article is a wake-up call.

I speak with a lot of young adults and I hear a common complaint among many of them.

“If only I were making more money, then everything would be fine!”

Let me be clear… money absolutely solves problems. But most of you are thinking about money in the wrong way.

Making more money is not the solution you need. You need to be spending less money.

And in the next 1000 words or so, I will:

Demonstrate how someone making $50,000/year can retire earlier than someone making $150,000/year

Give you 5 actionable tips for saving more money

Tell my story of how I left a $100,000/year salary to move across the world and start my own business

Share with you a new FREE tool for calculating your financial freedom date 👀

As always, you can watch along on YouTube as well:

Let’s dive in.

The Early Retirement Math That Broke My Brain

Let’s say there are two people:

Alex earns $150,000 a year, spends $120,000, and saves 20%.

Jamie earns $50,000 a year, spends $25,000, and saves 50%.

Who's going to retire earlier?

You might think Alex. Triple the income, seems obvious…

Assumptions: 5% investment returns, 4% withdrawal rate, after-tax income

But according to the math, here’s how it actually plays out:

Alex (20% savings rate): ~37 years to retirement

Jamie (50% savings rate): ~17 years to retirement

That’s a 20-year difference. Jamie retires in less than half the time as Alex.

Note: When I say “retire”, this does not necessarily mean buying a boat and sailing off into sunset. “Retirement” in this context means complete financial freedom. You could go work-optional, start your own business, or simply take a long sabbatical.

Now I know what some of you might be thinking.

In this hypothetical comparison, there is a significant difference in lifestyle.

Alex, spending $120,000 per year, is presumably living a much more lavish (and comfortable) lifestyle than James, who is only spending $25,000 per year. True, but this is an extreme example to demonstrate a simple truth:

Financial freedom isn’t about how much you make, it’s about how much you keep.

The less money you need to live, the faster you can exit the rat race and play your own game.

The faster you exit the rat race, the sooner you get to experience true financial freedom.

And even a 10% increase in your savings rate can help you achieve freedom several years sooner.

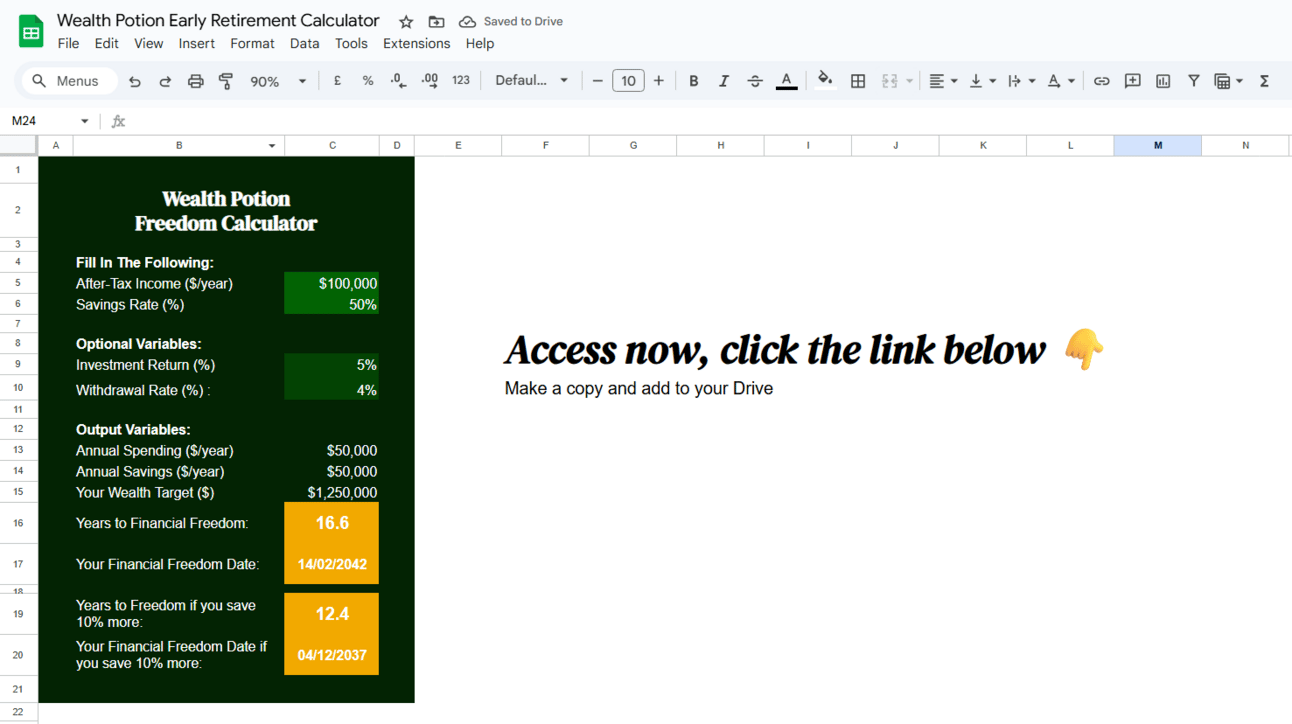

This concept was so life-changing to me that I wanted to create a simple tool that you can use to calculate your financial freedom date. Click here to access the Wealth Potion Early Retirement Calculator.

Because although Alex is living a lavish $120,000/year lifestyle, he is a slave to his income.

“But I can’t just cut my expenses in half…”

Perhaps not overnight…

But you can control the trajectory. And if you keep chipping away at your expense over the next 6–12 months, you can absolutely achieve this.

Me, enjoying a similar lifestyle in Seoul for half the price of Toronto

In fact, since moving from Toronto to Seoul, my living expenses have been reduced by more than half.

And unlike trying to 2x your income (which requires convincing a boss, the market, or your clients), spending less money is 100% in your control.

Note: Increasing your income is of course, still valuable. I have a whole Career Advice playlist on YouTube covering topics like how to ask for a raise, how to interview for a higher-paying job, etc. But too many of you ignore the costs side of the equation.

Now, let’s talk about the 5 actionable tips for cutting your expenses, after a quick word from our sponsor:

Influencer code protection made simple

KeepCart: Coupon Protection partners with D2C brands like Quince, Blueland, Vessi and more to stop/monitor coupon leaks to sites/extensions like Honey, CapitalOne, RetailMeNot, and more to boost your DTC margins

5 Actionable Tips for Slashing Your Expenses

Alright, so how do you increase your savings rate?

Here’s a ranked list of the most powerful levers to cut costs, along with how I personally used them:

1. 🏙️ Relocate

Rent and housing are most people’s #1 cost.

And there are many ways you can relocate to reduce your living expenses:

Move to a smaller apartment

Move to a new city

Move further from the city center

Yes, living in a big city is convenient. But you’re also paying for status inflation and soul-sucking commutes.

Personally, I moved to a bigger city (Toronto to Seoul) and still experienced a decrease in my rent. As more and more work becomes possible to do over the internet, geoarbitrage will become an even more powerful wealth building tactic.

Which takes us to #2:

2. 🌍 Find Location-Independent Work

Remote work is here to stay.

If you can earn a decent wage working from anywhere, you can live in Seoul, Chiang Mai, or Lisbon for a fraction of the U.S. cost, and still bank more than your NYC friends making $90K.

I understand that for many people, remote work isn’t an option. But you can still choose to work somewhere closer to home, or explore opportunities that give you more location freedom.

Some examples include:

Sales

Marketing

Software Development

Coaching

Graphic Design

3. 🧮 Create a Budget

“You can’t improve what you don’t measure.”

Most people avoid budgeting because it feels like restriction. Or, because they’re lazy.

But it’s actually the opposite. Budgeting gives you freedom from restriction. Because without a budget, you don’t know what you don’t know.

There are plenty of resources out there, such as:

YNAB (You Need a Budget)

Monarch

Google Sheets (the Wealth Potion Quest Log is coming soon, stay tuned 👀)

Just knowing your average spend per category can instantly shift behavior. It's like tracking calories: you become more intentional just by looking.

4. ✂️ Cancel a Subscription

We all have that one streaming platform we forgot about…

Or the meditation app we haven’t opened in 3 months…

Or the $6/month Apple Cloud fee we keep ignoring.

Go through your card statement and kill at least 1 recurring subscription this week.

The less digital clutter in your life, the less financial friction in your brain.

Cancel a few subscriptions and you could easily save yourself $500–1,000/year.

5. 💸 Pay Yourself First

If all else fails, simply set aside money before you have a chance to spend it.

Set up an automatic transfer that moves 10-20% (or more) of your income into a savings or investment account before you spend a single dollar. Or better yet, automatically invest it in via a brokerage account, like we discussed a few articles ago:

If the money’s not in your checking account, you’re less likely to blow it.

This is the final fail-safe. Override your imperfect human discipline by making saving an automatic process.

If you struggle to do items 1 through 4, at least do this.

🧠 TL;DR: You Don’t Need More Money. You Need More Control.

“High income is not the goal. High control over your time is the goal.”

Of course more income is always nice... But it also might just raise your lifestyle inflation, and delay your freedom even more.

Instead of waiting for your boss to give you a bigger paycheck, give yourself a raise by cutting your expenses and reclaiming your time.

That’s true freedom.

To your prosperity,

Brandon @ Wealth Potion