(For an easy, quick, and free way to support Wealth Potion, click the logo above)

Andreessen Horowitz, the prominent Venture Capital firm out of Silicon Valley, recently released their annual “State of Crypto” Report.

This is my analysis of their report. And I’ll lead with my conclusion:

Crypto VCs are still missing the forest for the trees. And it is possibly by design.

Today, we’ll break down:

a16z’s key crypto takeaways and why they’re underwhelming

Uncomfortable truths about crypto that a16z doesn’t mention

Their ulterior motive (tl;dr - you are their exit liquidity)

Why Bitcoin is fundamentally different

As always, you can tune in on YouTube for some additional, spicy clips 🌶️

Let’s dive in.

Their “State of Crypto” Takeaways in a Nutshell

What data is a16z presenting, and what are their takeaways? They claim:

The crypto industry is growing, and blockchain use cases are expanding

Financial institutions are embracing crypto, and AI will too

Stablecoins are going mainstream, with the US leading the charge

These are their unabridged takeaways, which I’ve combined into 3 key points

You can read their full report here.

According to the report’s executive summary, crypto fundamentals are strengthening despite market volatility, and financial institutions and AI will increasingly adopt blockchain technologies.

Some of this is true. Indeed, stablecoin usage has exploded. The Trump administration is the most pro-crypto administration the U.S. has ever seen. And financial institutions from MicroStrategy to Blackrock are gradually changing their tune on Bitcoin, as well as crypto.

But there are serious problems with how they frame the data.

Home insurance costs continue to climb, with premiums rising over 9% this year and more than 60% in the past five years. However, coverage hasn’t kept pace, leaving many homeowners paying significantly more for less protection. With affordability becoming a growing concern, it’s more important than ever to compare options—check out Money’s handy home insurance tool to find the best fit for you.

The Crypto Industry Has Been Underwhelming

Using a16z’s own data, we can already notice a much less optimistic development in the crypto industry.

Despite their claim that “crypto is stronger than ever” and that the industry is “big, global, and growing”…

Crypto developer activity is basically flat since late 2021.

Developers are the lifeblood of the non-Bitcoin, “crypto” industry.

Alternative cryptocurrencies (altcoins) are constantly in need of new “products” and “use cases” to offer to the market.

Most of these so-called “products” are circular in nature. In other words, they provide no real-world value outside of speculating within the crypto industry. Some examples include:

Web3

Yield farming

Decentralized Finance (DeFi)

Crypto gaming (play-to-earn)

Online gambling platforms

Perpetual futures (“perps”)

Have you used any of these products? Probably not. Because all of these use-cases are completely insulated within the crypto economy. This is a feature, not a bug, of the non-Bitcoin “crypto” industry.

Now, what does a16z have to say about Bitcoin?

In the 2025 report, the term “crypto” appears 67 times, while “Bitcoin” is mentioned just 9 times.

Meanwhile, Bitcoin accounts for more than 50% of total market capitalization, and its dominance has been rising since 2022.

It begs the question: why?

Why mention crypto 650% more than Bitcoin, when Bitcoin is more than half of crypto market capitalization?

Why are they pushing this narrative that crypto is alive and well, when the vast majority of the ecosystem is (and will continue to be) Bitcoin?

In order to answer “why”, we have to look at Bitcoin and crypto from first principles.

Assessing Bitcoin from First Principles

Bitcoin was created in 2008 by an anonymous individual (or group) named Satoshi Nakamoto.

The idea was first formulated and discussed on obscure internet communities such as the Cryptography Mailing List, the P2P Foundation Forum, and the Bitcoin Talk forum.

The idea was simple on the surface, but incredibly difficult to solve for: money for the internet.

There is perhaps no better way to understand why Bitcoin was created, than to read the words of its creator, Satoshi Nakamoto:

The archived post can be found here: https://satoshi.nakamotoinstitute.org/posts/p2pfoundation/1/

“The root problem with conventional currency is all the trust that’s required to make it work.”

Bitcoin was created to separate money and state.

Or, to put it another way, Bitcoin minimizes the amount of trust required to transact and store your wealth.

With U.S. dollars, you have to trust the central bank to not debase the currency.

With a high yield savings account, you have to trust your commercial bank.

With stocks, you have to trust the management team of the company.

Bitcoin’s design leaves no room for insider advantage. There are no equity rounds, no private token sales, no venture allocation. It’s the purest open-source money experiment in human history.

But then, the copycats came…

Assessing Crypto from First Principles

Ethereum was created in 2013, promising to be a cryptocurrency that is more “programmable”, allowing for more “use cases”.

Fast forward to today, and there are tens of millions of cryptocurrencies. a16z admits it themselves: over 13 million memecoins have been launched in the past year alone!

To the OG Bitcoiners and cypherpunks, this is not a surprise.

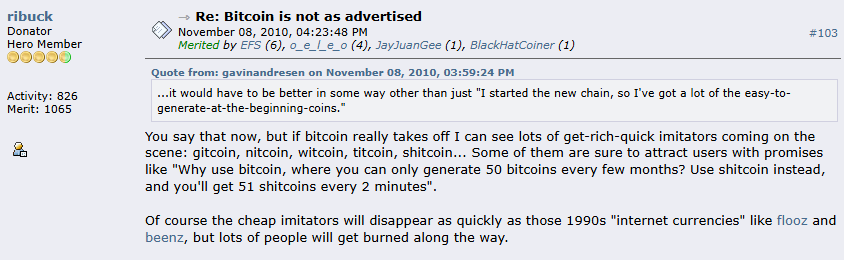

In fact, this was predicted on the BitcoinTalk forums back in 2010… that copycats (“get-rich-quick imitators”) and additional blockchains would be spun up to distract people from Bitcoin.

This exact forum post is still up, and can be found here: https://bitcointalk.org/index.php?topic=1647.msg20646#msg20646

The big problem with “crypto” is that the vast majority of these alternative cryptocurrencies (altcoins) are not solving a specific problem or use-case.

At best, altcoins are startups without product-market fit.

And because of the speculative and unregulated nature of the crypto industry, these cryptocurrencies are able to grow to massive, multi-billion dollar valuations with very little real-world application or value creation.

At worst, altcoins are outright scams.

Do Kwon, founder of the Terra/Luna altcoins that erased $60 billion of investor funds, faces up to 25 years in prison.

Perhaps the most notable exception is stablecoins.

Stablecoins have proven to provide a very real use-case: access to U.S. dollars, instantly and globally.

But again, stablecoins do not solve the problem that Bitcoin solves. Stablecoins still require trust in the U.S. government, the U.S. dollar, and the central bank. Even a16z admits that stablecoins strengthen U.S. dollar dominance:

To put it simply, crypto re-introduces the attack vector of trust.

Stablecoins still rely on the stability of the U.S. dollar, and are subject to debasement as the central bank prints more money.

Altcoins and their various use-cases require you to trust the constellation of VCs, developers, executive teams, boards, and Foundations to create a useful application that generates revenues into the future.

So let’s re-visit the question from earlier: why?

Why would a16z focus so much more on alternative cryptocurrencies than Bitcoin?

Why do they want to position this narrative that the crypto industry is strong, and growing?

There is one answer that the “crypto” folks really don’t like to hear.

You Are Their Exit Liquidity

It should come as no surprise that Andreessen Horowitz is heavily invested in many alternative cryptocurrency protocols and startups.

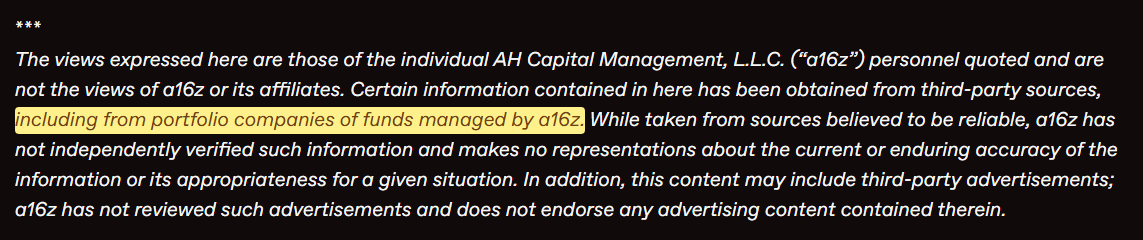

As noted in the disclosure at the bottom of their report:

And to make matters worse:

So not only do they have investments in companies and protocols that are directly related to their report, but they use data from these companies in the report, and they may or may not have investments that are unnamed but could be related to the report.

Let’s at least take a look at the investments that they’ve made public:

Led a $300m+ investment via private token sale in Solana1

Led $15m round in stablecoin firm MakerDAO, holding 6% of all tokens2

a16z acknowledges that they “stake a portion of [their] ETH holdings via Lido”, which gives them direct voting control within the protocol3

A lead investor in Worldcoin, a global surveillance cryptocurrency that is tied to your digital identity4

Large, early investments in altcoins such as XRP, Aptos, Avalanche, Uniswap, Sui, and more.5

The list goes on and on.

The point is that a16z is arguably not a neutral observer of the crypto market publishing their findings.

They have hundreds of millions of dollars invested in the crypto ecosystem and, as their own disclosures note, they ‘are acting in their own financial interest, not necessarily in the interests of other token holders.’ It is therefore rational, not conspiratorial, to assume their reporting will be very optimistic.

In contrast, Bitcoin has:

ZERO venture capital firms that got an insider round before Bitcoin was publicly available

ZERO pre-mined tokens where coins were reserved for VC firms and other insiders

ZERO board meetings, executive team, management “Foundation”, or paid employees

This is why VC firms generally ignore Bitcoin (and focus on altcoins).

They need you, the retail investor, to buy these other tokens… so they can exit.

Bitcoin’s lack of venture capital influence isn’t an accident. It is Bitcoin’s “feature not a bug”, and it ensures no one has privileged access to the monetary network.

Want to try to surf the wave of VC liquidity and try to buy low and sell high? Be my guest. I won’t be joining you.

Instead, I’m going to buy Bitcoin… and chill on the beach.

To your prosperity,

Brandon @ Wealth Potion

Disclaimer: This article represents my personal analysis and opinions based on publicly available information. It is not financial advice, nor does it claim insider knowledge. All cited sources are linked for verification. Andreessen Horowitz (a16z) and the companies mentioned are referenced solely for commentary and critique under fair-use provisions.

2 https://cointelegraph.com/news/andreessen-horowitz-invests-15-million-in-stablecoin-firm-makerdao

3 https://a16z.com/announcement/investing-in-lido/

5 https://www.coingecko.com/en/categories/andreessen-horowitz-a16z-portfolio?utm_source=chatgpt.com