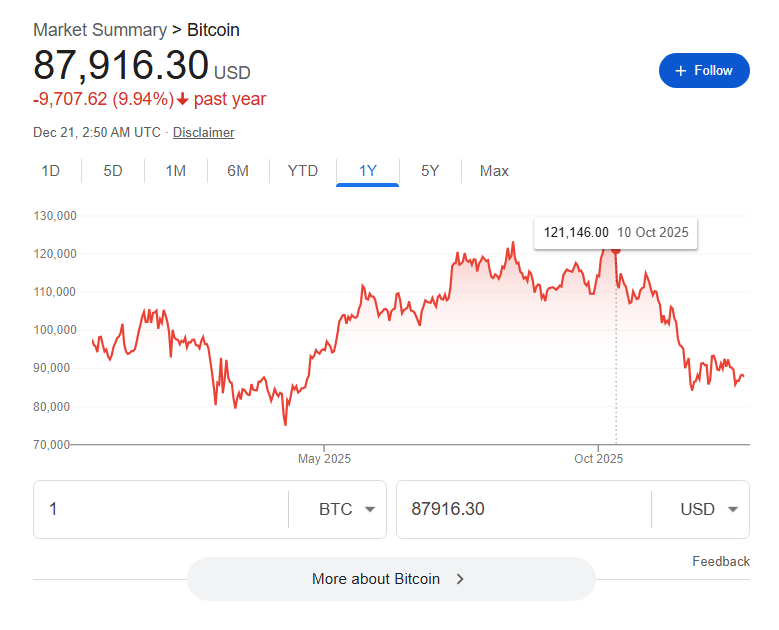

As of writing, Bitcoin is down 30% from it’s all-time highs.

From $124k to ~$90k in just 3 months.

So why is Bitcoin crashing?

Thankfully, I don’t go into the office anymore!

And despite this massive drop, why am I not worried about my Bitcoin investment?

Today, we’ll answer both of these questions. Specifically, we’ll cover:

Why Bitcoin’s price is down 30% from October 2025, where we’ll learn about:

Leveraged crypto trading

Risk-off vs. risk-on

The 4-year cycle

Bitcoin Whales

Possible scenarios for 2026

Why I’m not concerned

Let’s dive in.

Why is Bitcoin Crashing?

As with most global markets, the answer is not so simple.

With that said, there are a few reasons that most analysts are pointing to:

Leveraged crypto positions were liquidated

Broader markets are entering a risk-off period

Macroeconomic and geopolitical uncertainty

The 4-year cycle is signaling a bear market

Bitcoin OGs are selling

If this sounds like a foreign language, don’t worry - I’ve got you covered. Let’s discuss each of these briefly.

Leveraged Crypto Liquidations

If we look at the Bitcoin price chart, the price drop started in earnest around October 10th.

This is because on October 10, 2025, the crypto trading market experienced a record liquidation.

It was the largest liquidation in crypto history, by dollar value

To understand this, we have to understand the broader crypto space.

A huge use-case within the broader crypto industry is market speculation. In other words, trading for quick profits.

In order to maximize profits, many traders use leverage. It is not unheard of for crypto traders to use 10x, 25x, or 100x leverage.

Sadly, YouTube is full of scammy clickbait like this, which gives Bitcoin a bad reputation.

This means that they have the potential to make massive gains, but also the potential to lose all of their money.

When a lot of traders use leverage, this builds up in the system.

Imagine a pressure cooker. More and more traders add pressure to the system, and when it explodes, the explosion is much more violent.

Unfortunately, because Bitcoin is technically a cryptocurrency, and is often used as a store of value for many crypto traders, Bitcoin crashed along with other cryptos.

This was the catalyst that kicked off the crash.

Broader Markets Go Risk-Off

This is a topic we’ve touched on in the past here, but let’s review.

What is “risk on” and “risk off”?

Broadly speaking, investors around the world tend to follow cycles.

Importantly, this is not unique to Bitcoin investors.

In optimistic, “bullish” periods, investors around the world think that market conditions are improving, and therefore, that prices will rise. This is good for risk assets, like stocks and Bitcoin. This is often referred to as going “risk-on”.

In pessimistic, “bearish” periods, investors around the world think that market conditions are declining, and therefore, that prices will fall. This is bad for risk assets, like stocks and Bitcoin. This is often referred to as going “risk-off”.

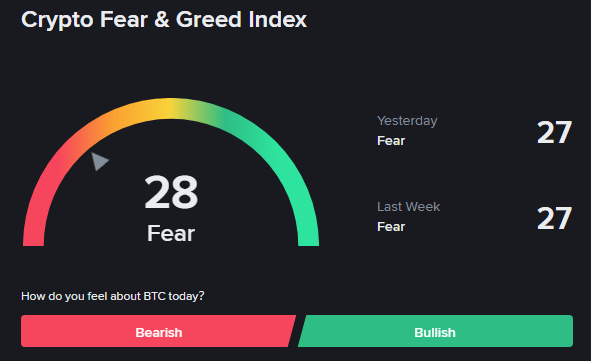

And ever since October, the global market has turn bearish. They’ve gone “risk-off”.

In many ways, investment markets behave like a self-fulfilling prophecy. What investors believe often becomes reality.

So this begs the question — why are investors going risk-off?

Macroeconomic and Geopolitical Uncertainty

Uncertainty is one of the strongest signals for a bearish, risk-off period. And it’s another topic we’ve covered in the past.

So let’s take a look at the state of the world right now:

Hot war in Russia / Ukraine and Israel / Palestine

Rising tensions in China and Taiwan

Fed rate cuts and policy stance weaker than expected (read more here)

Trade tensions due to tariff policy and China

That’s just to name a few. I’m sure there are headlines I missed.

When the world is uncertain, risk assets tend to underperform.

The Bitcoin 4-Year Halving Cycle

One of the properties that makes Bitcoin unique (and a superior money, IMO) is it’s supply schedule.

Unlike the U.S. dollar which can be printed at a whim by the central bank, Bitcoin’s supply schedule is fixed.

I could write an entire article and do a whole YouTube video on this topic (and perhaps I will, so subscribe!) but in short, here’s what you need to know:

There will only ever be 21 million Bitcoin

As of today, only about 20 million Bitcoin are circulating

New Bitcoin are “mined” at a rate of 3.125 Bitcoin per block, and each block takes about 10 minutes to be mined

Every 4 years, that rate of new Bitcoin is halved

The next Bitcoin halving is scheduled to occur around April 2028.

So why does this matter?

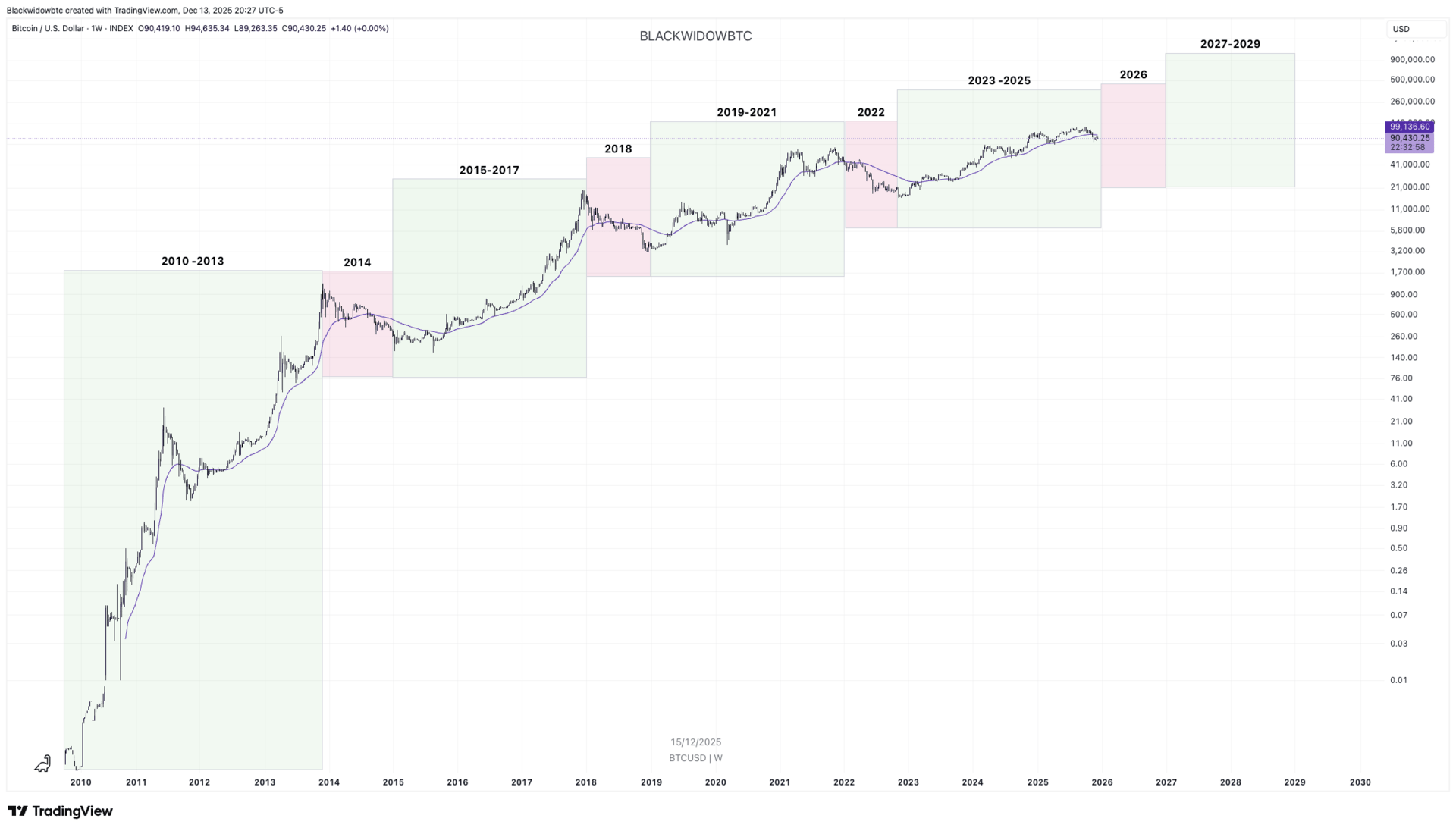

Because the Bitcoin halving affects the supply of Bitcoin, many investors look at Bitcoin’s price as following a 4-year cycle accordingly.

The 4 year cycle theory forecasts a bearish 2026

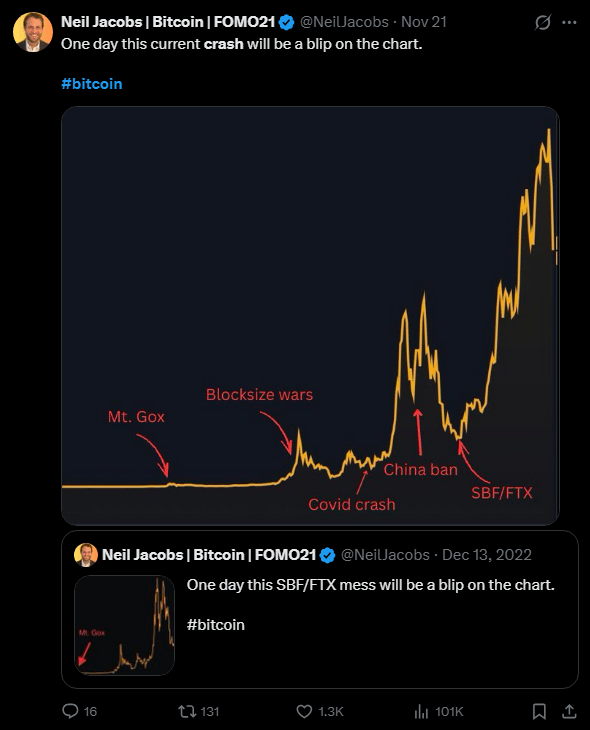

And looking at prior 4-year cycles, it’s around this time (18-24 months after the last halving) that Bitcoin’s price starts to fall.

Again, it’s the self-fulfilling prophecy taking hold. Investors expect price to drop, so they sell, which causes the price to drop.

Important to take this with a grain of salt. Technical analysis (forecasting prices by looking at charts) is basically astrology with extra steps.

Bitcoin Whales are Selling

Out of all the reasons, this one is the most interesting to me.

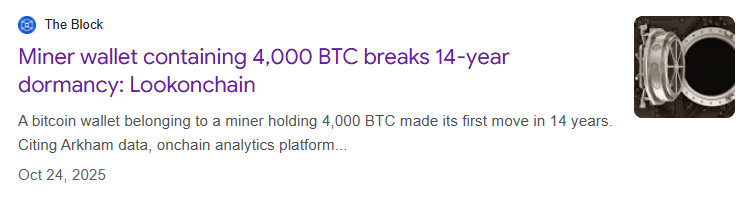

Many of you may be aware that Bitcoin is not fully anonymous, but pseudonymous. In other words, the Bitcoin network is transparent in that you can see people’s wallets, but you can’t tell whose wallet is whose.

Because of it’s pseudonymity, we can see Bitcoin wallets that have held huge amounts of Bitcoin since the early days, like 2010-2012.

We don’t know who these individuals are, but we often refer to them as Bitcoin OGs (slang for original gangsters), Bitcoin Whales, or Satoshi-Era Bitcoiners.

And here’s the rub:

Many Bitcoin OG wallets sold significant amounts of Bitcoin in 2025.

Many are speculating why these Bitcoiners are selling now.

But I think Occam’s Razor applies here. The simplest answer is that these OGs hold billions of dollars in Bitcoin. Locking in those gains secures them generational wealth. Who wouldn’t sell?

So Why Am I Not Worried?

You might be thinking, geez, those are a lot of bearish signals for Bitcoin!

So why am I not worried?

Put simply, the fundamentals of Bitcoin (and the Bitcoin investment thesis) haven’t changed:

Bitcoin’s supply, security, and network are unchanged

Fiat dollars can still be printed out of thin air

Governments (especially the U.S.) show no ability to reduce their exponentially growing federal debts

It really is that simple.

There’s another reason why I’m not worried, and in fact, I’m excited.

Bitcoin is on sale.

Not just for my own purchases, but for other investors who want exposure to Bitcoin, but were worried about buying the top.

At the end of the day, Bitcoin’s telos is to take money out of the hands of the state and give it back to the people. And lower prices should lead to more distributed ownership.

Bitcoin Whales selling their Bitcoin to new buyers is a perfect example of this.

Bitcoiners can stomach the massive price drops because we have developed a deep conviction that fiat dollars are on borrowed time.

Not to mention, there are already some signals building that 2026 will be a very good year for risk assets:

When Jerome Powell’s term ends, Trump will very likely bring in a dovish Fed chair

Global M2 Liquidity (which is historically correlated to Bitcoin) continues to rise

The U.S. Federal Debt shows no signs of slowing down

Trump trying to cut taxes further (TBD)

Inflation is easing, finally

I know many of you reading this will still think I’m crazy… and that’s okay!

Let me be clear:

I know that my Bitcoin position is not for everyone.

But hopefully, these articles and YouTube videos teach you about the economy, markets, and investing more broadly.

And if you gets you curious about Bitcoin as an investment, that’s just a bonus.

To your prosperity,

Brandon @ Wealth Potion

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.