(For a free and easy way to support Wealth Potion, click the logo above!)

The stock market is at all time highs. Bitcoin has been above $100k for 6 months.

But the spotlight lately, has been on gold:

The 1Y and 10Y charts for the price of gold look equally parabolic.

Gold is up 50% year-to-date, putting it on pace for its best performing year ever.

Today’s article will help you better understand why gold is ripping to all-time highs. Specifically, we’ll cover:

tl;dr on why the price of gold has been rising

A brief history of money from gold to US dollars

The geopolitical environment and central bank activity

Investor psychology, and the trending “debasement trade”

If you should invest in gold (and alternatives to consider)

And in this week’s YouTube video, we discuss how gold fits into the “debasement trade”:

Let’s dive in.

tl;dr on Why the Gold Price is Increasing

The short answer is that there are more buyers of gold than sellers of gold.

All markets follow basic supply and demand. And as we’ll cover in a moment, gold has traditionally been prized for its low new supply rate.

Meanwhile, demand has been increasing steadily from both individuals and nation states:

Retail investors lining up to buy gold in Sydney, Australia in October. Many similar photos and videos are going viral across the globe.

And because the supply of gold is relatively low (its hard to mine more gold) and inelastic (higher prices don’t budge supply very easily), an increase in demand can move the gold price quite dramatically.

So naturally, I’m sure you’re wondering…

Why is the demand for gold increasing?

In one sentence:

The demand for gold is increasing because people (and nations) are losing trust in the US dollar-based financial system.

In order to break this down further, we need to study a bit of history. Specifically, the history of money.

Strap in, because it’s one of the most fascinating and important stories in modern finance.

Gold Was Used as Money for Millennia

In ancient times, human beings used a variety of things as money.

Rice, beads, cattle, seashells, giant stones… and of course, precious metals.

The famous Rai Stones of Yap Island, which were used as money. Not very portable, or divisible!

These things were used as money because they had a certain set of characteristics:

Durability: they don’t erode over time

Portability: they are relatively easy to move around

Divisibility: they can be divided into smaller parts

Fungibility: individual units are interchangeable

Verifiability: they can’t be easily counterfeit

But most importantly for our discussion on gold today, is that they all exhibited some level of scarcity.

Put simply, it was hard to make / find / procure more of these things.

And when these monies failed on one of these criteria, they failed as money.

Beads were used as money by many ancient peoples, until more advanced societies were able to mass-produce these beads and flood the economy, destroying its scarcity.

This is a speedrun of the history of money, and there’s so much more that we could cover… so I’ll definitely be writing more on this topic in the future. So if you haven’t yet, subscribe to the Wealth Potion newsletter and YouTube channel.

Over time, gold eventually “won” in the free market of monetary technologies because it was the most scarce.

No one could produce more gold than approximately 1-2% per year, which remains the new supply rate of gold to this day.

Gold was then used as money all the way up until the 20th century.

But there are still some issues with gold…

From Gold Standard to Fiat Standard (US Dollars)

Despite being one of the best monetary technologies known to humanity, gold lacks in portability, divisibility, and verifiability.

Being a heavy metal makes it difficult to store large amounts.

As the price of gold went up, it became difficult to divide for small transactions.

As technology improved, counterfeit gold became a real problem.

So the U.S. government offered a solution.

The banks would hold the gold in vaults, and then issue paper currency that is redeemable for gold.

This is often referred to as the “Gold Standard”.

U.S. dollar notes used to say that they were quite literally “redeemable in gold”.

Again, we’re going to speed through a bit of monetary history, but here are the big milestones:

1821 - The Gold Standard officially begins, led by Great Britain, with many countries gradually following suit. This monetary stability fuels much of the growth of the 19th century.

1914 - The Gold Standard is put on pause for World War I. Governments print money to fund the war.

1933 - Executive Order 6102: The U.S. Government bans gold ownership… we will definitely discuss this in more depth in the future, so stay tuned.

1944 - The Bretton Woods agreement where the U.S. dollar becomes the world’s reserve currency, pegged at $35 per ounce of gold.

1971 - The Nixon Shock: President Nixon ends dollar-gold convertibility “temporarily” (spoiler: it still hasn’t ended)

Today - The U.S. dollar continues to be the world’s reserve currency, but is not pegged to gold.

And voila, the U.S. dollar is now what we call a fiat currency.

fiat: by arbitrary order, or by decree

The U.S. dollar does not derive it’s value from gold anymore.

The U.S. dollar has value because the U.S. government and the global financial system says it has value.

This arrangement has been used for decades without catastrophic failure (yet), largely due to the steady growth of the U.S. economy (and military).

Basically, humans went from trusting gold for its money… to trusting the United States

But it’s like that age-old saying: trust takes years to build, seconds to break, and forever to repair.

This is how we can understand the recent rise of gold.

Declining Trust in the U.S. Dollar

There is plenty of evidence that the world is losing trust in the United States.

Trump’s presidency (whether you like him or not) has introduced uncertainty via foreign policy and trade (tariffs).

The U.S. federal debt is increasing exponentially, recently hitting $38,000,000,000,000 (that’s 38 trillion)

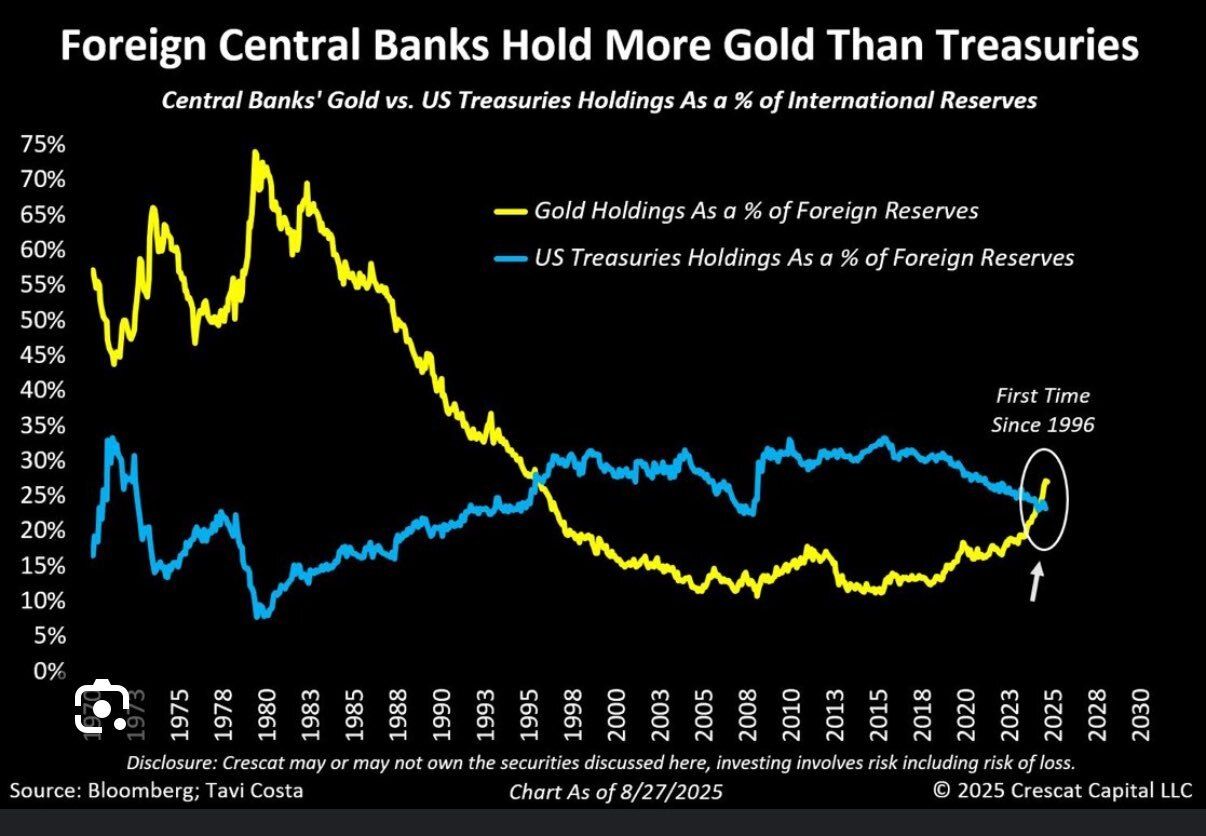

Central banks around the world have been gradually selling U.S. treasuries and buying gold

And with this greater uncertainty around the stability of the U.S. dollar, central banks are turning to ol’ faithful gold.

This chart has been going viral recently - I break it down in this week’s YouTube video.

Then, we add fuel to the fire, which is the retail frenzy.

Gold is a prized commodity in many cultures from America to Asia to Africa. It’s used for jewelry, religious temples, and was probably used by your ancestors as money not so long ago.

Maybe you’ve even heard one of your older relatives talk about gold as an investment.

And once gold started to catch a bid (i.e. the price started to rise) earlier this year, retail investors piled in at a record pace.

Be fearful when others are greedy…

So although central banks have been buying gold, and although there is some more uncertainty around the U.S. dollar, a huge factor in the meteoric rise in the gold price is due to retail investor FOMO.

Which takes us to our takeaway.

Should You Buy Gold Now?

Gold is a globally-recognized safe haven asset. It generally holds its value during times of uncertainty.

However, just like any other investment asset, it is prone to bubbles. The price is simply of function of how many people want to buy gold vs. how many people want to sell gold.

Could gold continue to trend upward in the coming years due to increased global uncertainty?

Of course it could. Some would argue this is likely.

Even JP Morgan put out a report recently talking about the “Debasement Trade” i.e. gold and Bitcoin

But I would be very cautious investing right now… especially after gold has gone on one of its strongest rallies in history.

Investor sentiment is “frothy”. People are getting FOMO. And they are chasing gains emotionally.

My general rule of thumb is if you hear your Uber driver talking about an investment… it’s probably overhyped, and you’re probably too late.

Invest for the long term. If you weren’t paying attention to gold 6 months ago before this huge rally, ask yourself:

What value would gold add to my portfolio?

Does gold align with my outlook for the global economy in the coming years?

Would I be comfortable holding my gold investment for years if I buy right now, and then it drops 30% back to its price earlier this year?

Beware of FOMO, and stick to your plan.

To your prosperity,

Brandon @ Wealth Potion

PS. This week’s newsletter is brought to you by:

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.