Let me be clear: this is not a political article. I'm not here to argue for OR against Elon Musk’s DOGE initiative.

Because, frankly, that’s irrelevant.

What I’m going to lay out today is something different.

DOGE was never going to work. Period.

And before you freak out… I’m going to explain why this is a very good thing for you and I as investors.

Specifically, we’ll break it down as follows:

The Problem: The Growing U.S. Government Debt

The Proposed Solution: DOGE Cutting Government Spending

The Laws of Gravity: The System Cannot Let Spending Fall

Bottom Line: Stop Waiting for Austerity… and Invest Accordingly

And as always, I walk through this hypothesis in this week’s YouTube video.

Let’s dive in.

Keep more of what you earn

Collective helps members keep more of what they earn — saving an average of $10,000 a year in taxes* — while taking countless hours of administrative work off their plates.

Your membership includes LLC and S Corp formation, payroll, monthly bookkeeping, quarterly tax estimates, annual business tax filing and more.

*Based on the average 2022 tax savings of active Collective users with an S Corp tax election for the 2022 tax year

The Problem: The Growing US Government Debt

To understand the problem, we need to zoom out.

Long-time subscribers know I love using FRED data. Raw, unfiltered data from the US government.

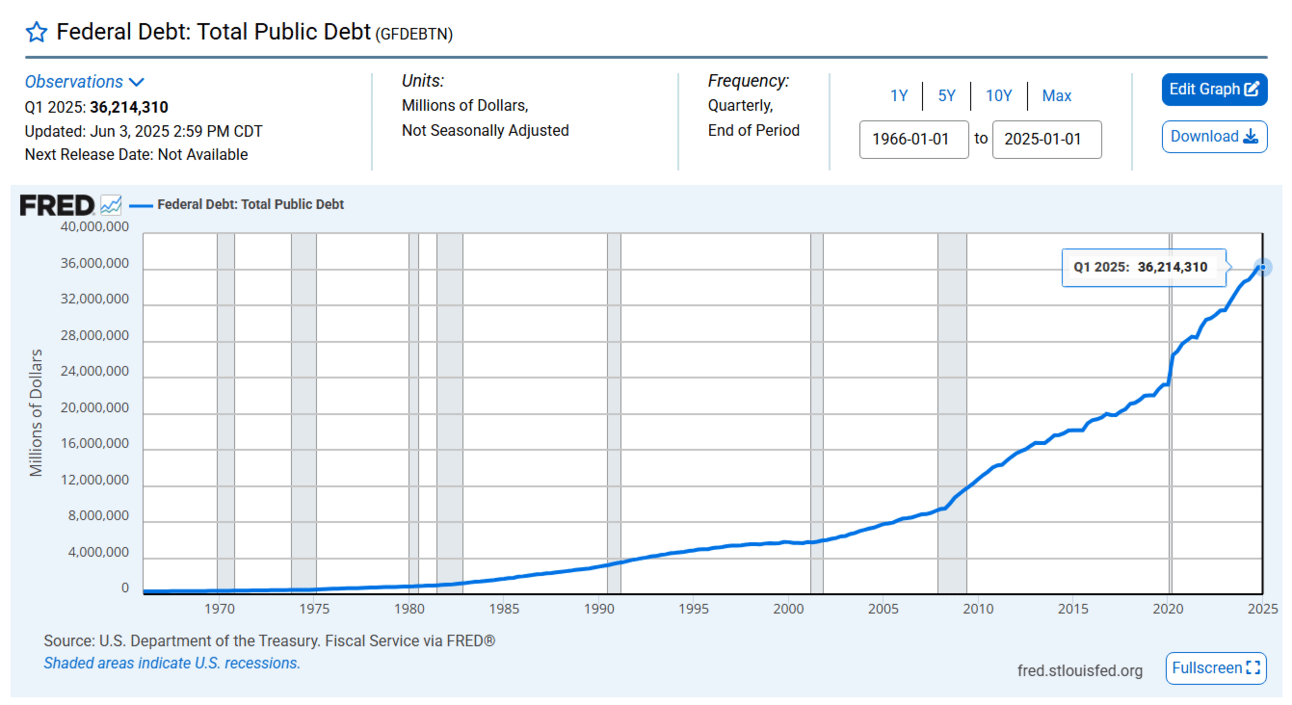

As of 2025, the U.S. national debt is over $36 trillion, and growing.

In fact, it’s accelerating.

Why? Because the US government has structural (mandatory) spending that cannot be easily stopped. Examples include social security, Medicare, defense, and interest payments on the debt.

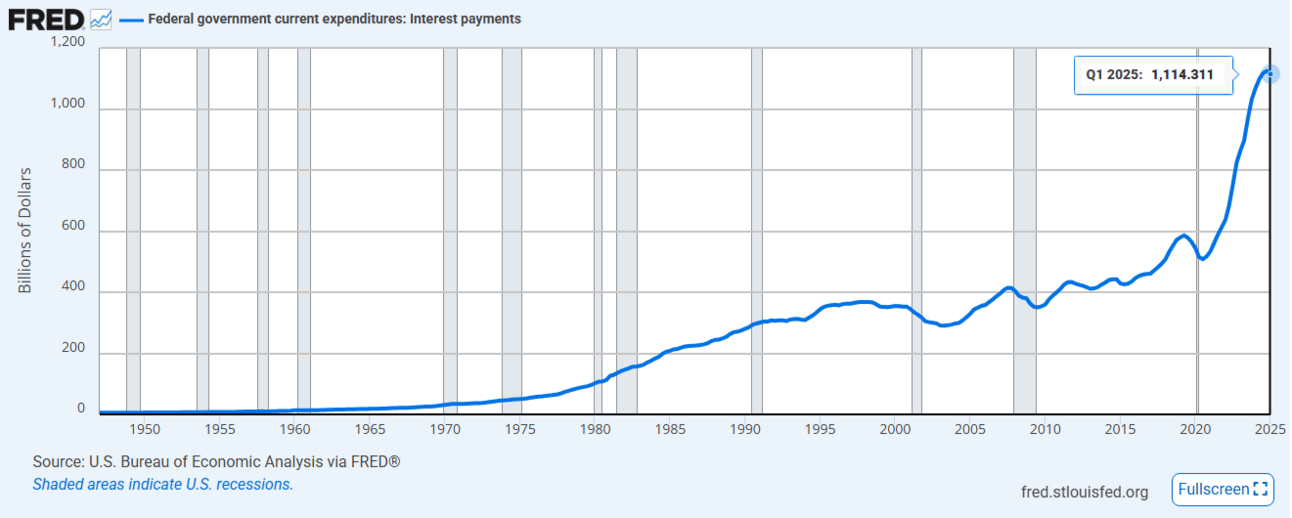

The last one (interest expense on the debt) is especially important.

As the federal debt grows, so do interest payments. And with interest rates spiking after COVID to fight inflation, the cost of servicing the debt has gone vertical.

The annual interest expense on the US federal debt is over $1 trillion.

Imagine your household like this:

You’re supporting your retired parents

Your healthcare costs are rising

Your credit card interest is eating your paycheck

And you’re spending more than you earn every year

You might think the fix is simple: just cut spending!

Let’s test that theory.

The Proposed Solution: Elon Musk and DOGE

Enter Elon Musk and DOGE (the Department of Government Efficiency).

DOGE is sadly a nod to Elon Musk’s favorite sh*tcoin, Dogecoin

Launched in early 2025 under Trump’s second term, DOGE aimed to eliminate wasteful spending using first-principles thinking and private-sector talent.

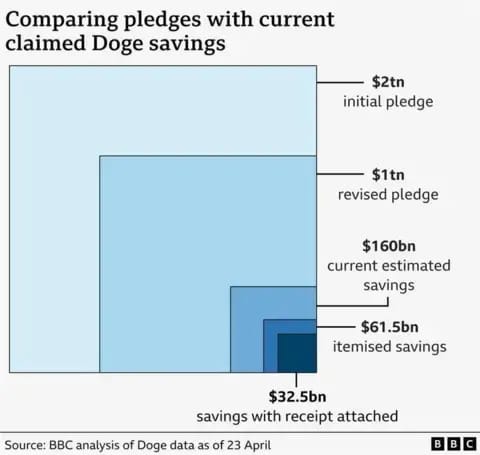

The goal was ambitious… but the results have been disappointing:

Initial target: $2 trillion in savings

Later revised target: $1 trillion

Actual result (according to DOGE): $160–180 billion in “savings”

Meanwhile: Federal spending increased by $500 billion during that same time period

And it might be even worse than this. Independent estimates suggest the real savings were closer to $15–70 billion, which would be a rounding error in the federal budget.

If only Elon understood the fiscal machine behind the scenes, he’d know something from the start:

DOGE was never going to succeed.

Not because the intent was bad… but because the system cannot allow it to succeed.

Here’s why.

Nothing Stops This Train: Why DOGE Was Doomed From the Start

Earlier, we compared the U.S. government to a household spending more than it earns.

Here’s the catch: the government earns money through taxes. And tax revenue depends on GDP growth. If GDP slows, tax receipts fall and the debt problem worsens.

And if the deficit grows too high, then the tools at the government’s disposal stop working properly.

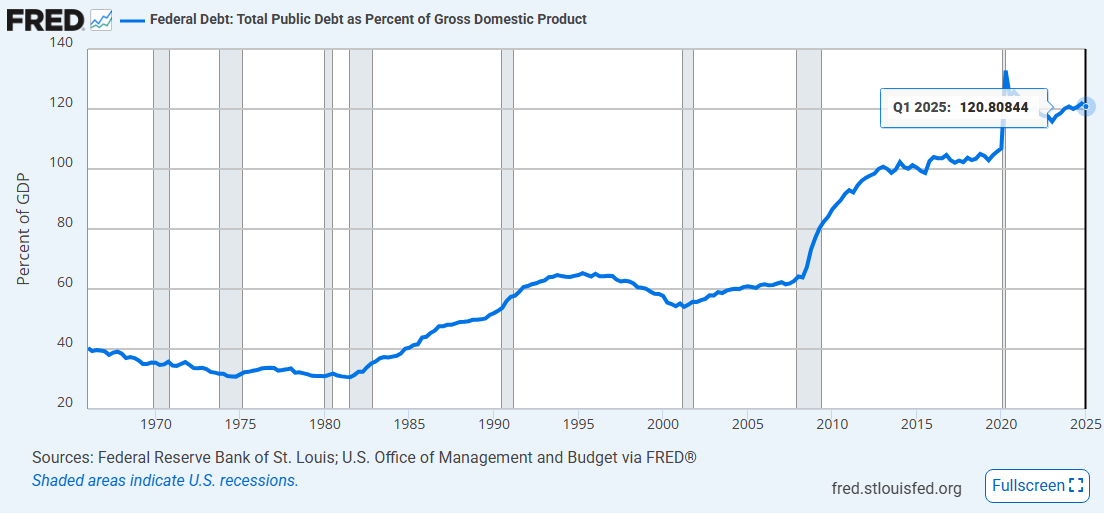

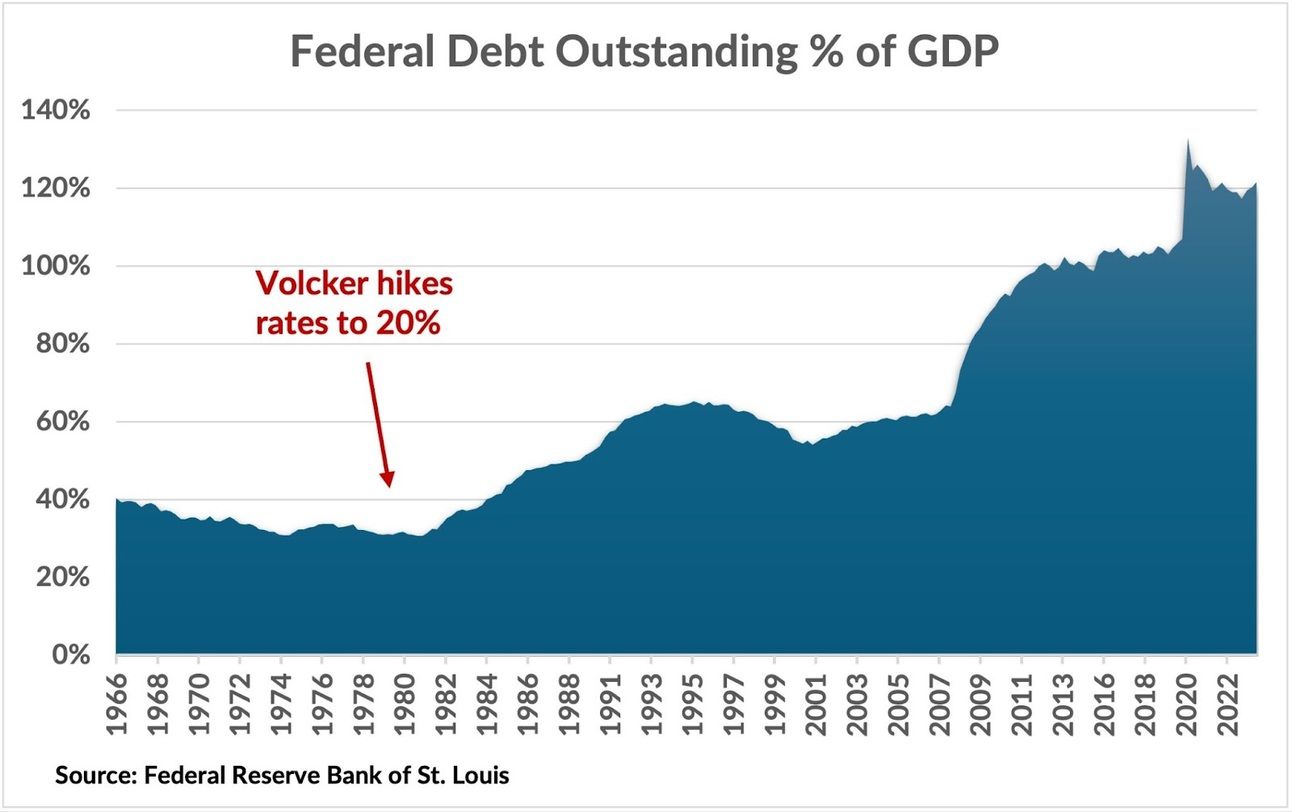

Another way to understand the problem: the federal debt is now 120% of GDP

This creates a dynamic known as fiscal dominance: when the government’s need to fund deficits takes priority over the central bank’s mandate to control inflation.

Lyn Alden, a Bitcoiner and macro analyst sums it up with a line from Breaking Bad: Nothing stop this train.

In this scene, Walter White was talking about the US federal debt

In a normal economy, when credit growth is too hot:

The Fed raises interest rates

Borrowing slows

The economy cools

Inflation comes down

Those are the brakes on the train.

But today, the problem isn’t too much private credit. It’s public credit driven by trillion-dollar government deficits.

So when the Fed raises rates, it makes the government's debt more expensive without actually slowing the economy enough to tame inflation. It’s like hitting the brakes and watching the train go faster.

And that’s why the Fed can’t keep raising rates indefinitely, and why government spending can’t meaningfully fall.

The Laws of Gravity: Why Government Spending Can't Fall

And that takes us back to DOGE:

Government spending can’t fall. Not for long, and not meaningfully.

Why? Because it would trigger a deflationary spiral the system is built to avoid.

Government spending is a major part of GDP. One person’s spending is another’s income. When the government cuts spending, jobs are lost, income dries up, and growth slows. Tax receipts drop. Deficits grow even faster.

The Fed better hope they never have to raise rates again. Because look at what happened under Volcker…

It’s a doom loop. And it ends with the Federal Reserve stepping in to pump liquidity.

That’s why:

The Fed backstopped Treasury markets

QT (quantitative tightening) keeps getting delayed

Bailouts keep happening — from banks to defense contractors to zombie firms

In fact, despite inflation still being above 2%, the Fed is currently considering lowering rates.

To put it simply, this is a systematic issue with the current financial system. And it’s a topic we’ll come back to in the future.

What This Means for Your Investments

Now here’s the part that matters for investors:

If government spending can’t fall, and deficits must grow, then global liquidity will continue to rise.

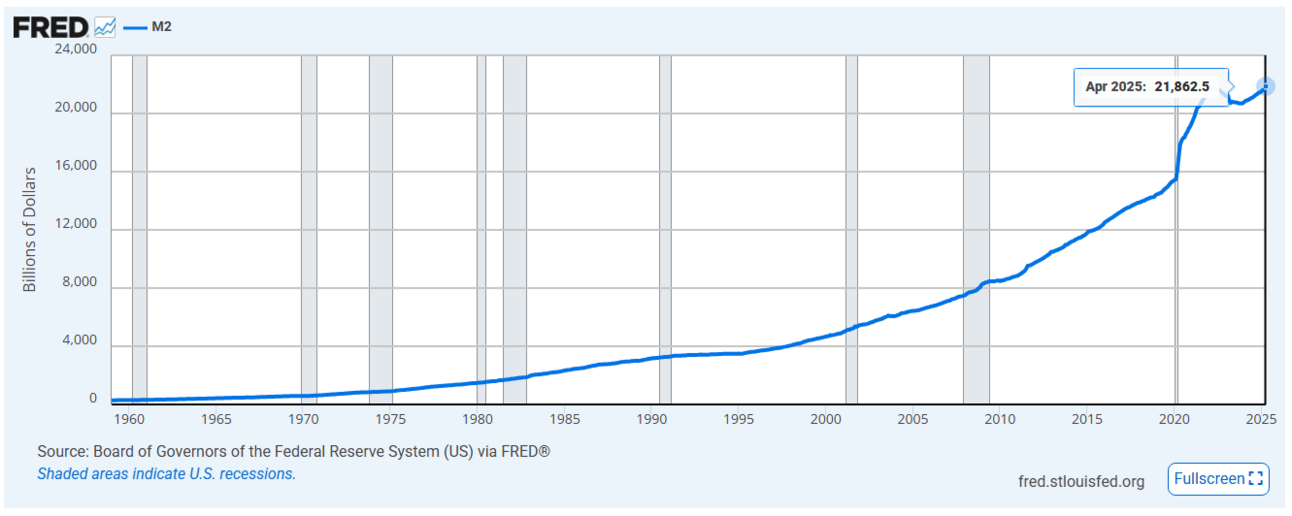

M2 money supply isn’t a perfect measure of global liquidity, but it’s good enough.

And if history is any indicator, more liquidity means higher asset prices.

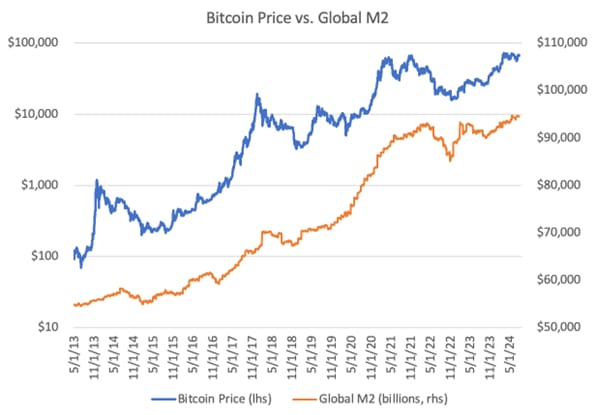

Bitcoin is a particularly strong barometer of global liquidity, but liquidity helps practically all investment assets.

This is why we see stocks ripping despite rising debt. Why Bitcoin keeps catching a bid whenever the Fed even hints at a pivot. Why real estate hasn’t cratered the way everyone expected.

It’s not because we’re in a particularly strong global economy.

It’s because the train can’t stop.

tl;dr - Buy and hold assets. Don’t hold cash. And be skeptical of politicians who say they will cut government spending. It just ain’t happening.

To your prosperity,

Brandon @ Wealth Potion