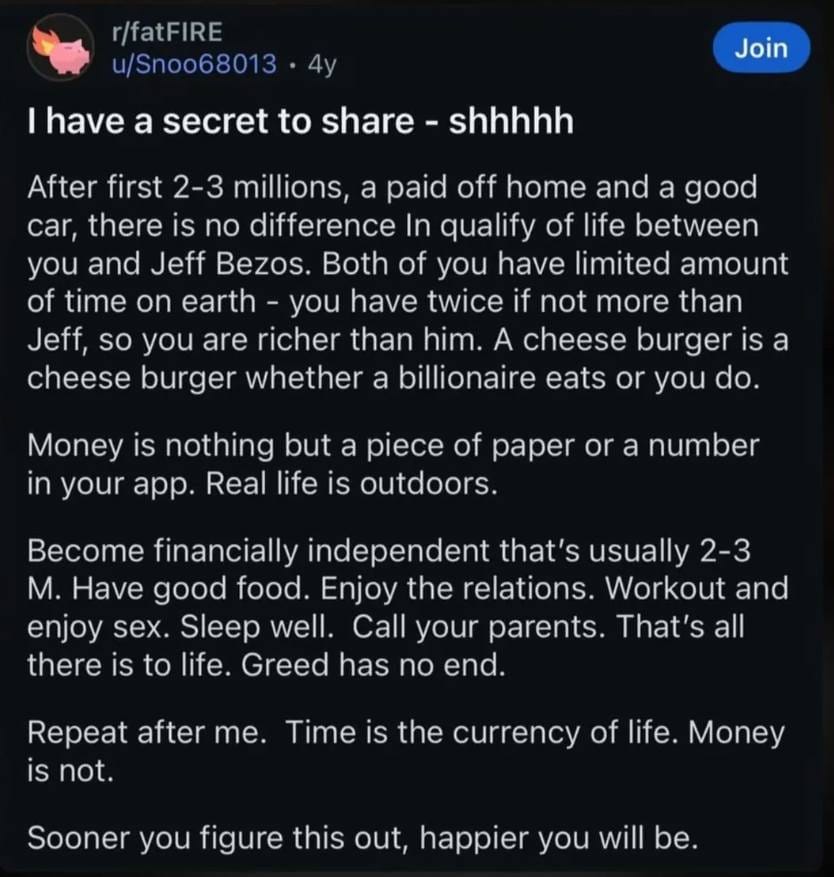

There’s a viral Reddit post that is doing the rounds on X right now:

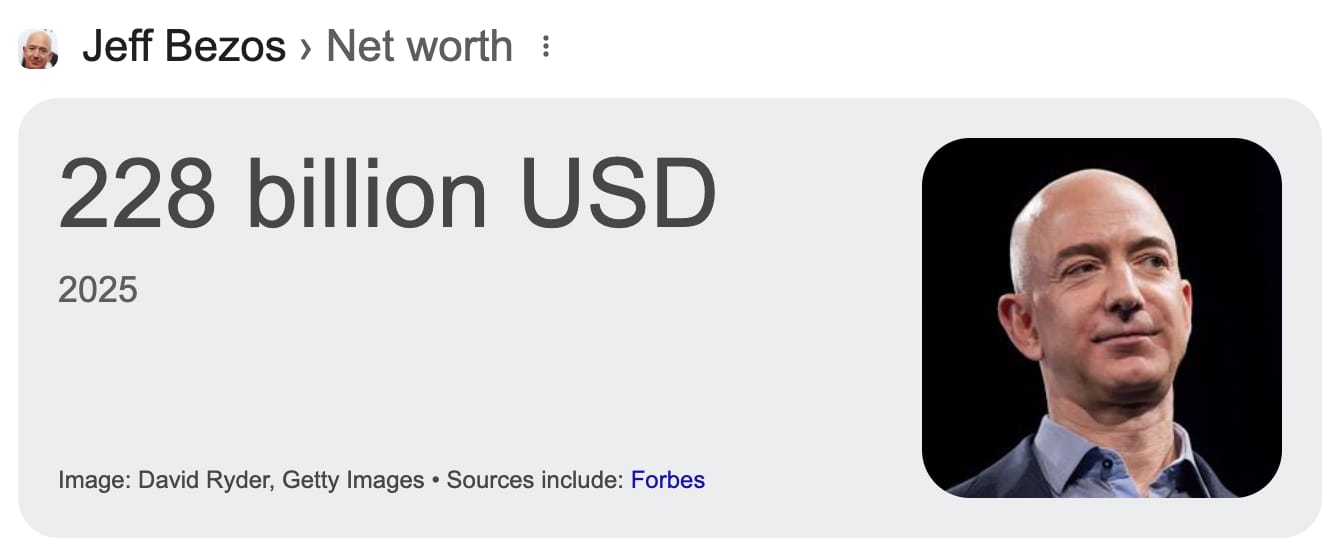

This Reddit user makes the bold claim that a $2-3 million net worth provides a lifestyle that is not substantially different to that of Jeff Bezos… who is worth 100,000x times more.

And despite being posted 4+ years ago, it’s still resonating with the personal finance community.

As someone building a platform around financial freedom, and as I personally grew my wealth throughout my career, this post struck a chord with me as well.

And even though I’m aware that for many people reading this, $2–3M feels like miles away… there is a very valuable lesson here, regardless of where you’re at in your journey.

Today, we’re going to break down:

Why people get stuck on the hamster wheel — even after they’ve “made it”.

How to define your financial freedom number — and get clear on what “enough” means for you.

What to do before you hit your number — because it’s not just money that compounds over time…

And as always, you can watch this week’s article on YouTube as well:

First, a bit of context.

This Reddit post is from the /r/fatFIRE community.

FIRE stands for Financial Independence, Retire Early. These are people who prioritize saving and investing their money early in their life (often sacrificing in the process) so that they can retire sooner than the average person.

Basically, FatFIRE is the more luxurious cousin of FIRE.

As the “fat” prefix suggests, these are people that want to retire early, but with a “fat” nest egg. There’s no universal number, but most fatFIRE folks aim for $5–10 million in investable assets, depending on lifestyle and location.

So that brings us to the Reddit post:

After the first 2-3 millions, a paid off home and a good car, there is no difference in quality of life between you and Jeff Bezos.

This flies in the face of a lot of the fatFIRE ethos, where most people are trying to hit that next decamillion dollar milestone.

As mentioned, I know many of you reading this are still striving for your first $2-3 million.

But there is an important lesson here that we can all take note of.

The Hamster Wheel of “More Money”

Making money is a skill. And once you start making good money, you realize that you’re starting to get good at it.

Many people build their identity around making more money.

And there’s nothing inherently wrong with this. In fact, a lot of articles and videos on Wealth Potion are about exactly this — to help you get better at making money, and investing your money.

However, it can be taken too far.

And even if you’re not at your financial freedom number yet, it’s important to be aware of the hamster wheel, and how easily it can ruin your life.

Firstly, your financial freedom number will move.

Here’s Tim Ferriss when asked about his “number”:

The number for most people will move. That’s both unsurprising and dangerous. A lot of my friends were like “Once I have $5 million, I’m going to create a woodworking shop in Oregon and just do the things I really enjoy doing…” and then they get to 5, and it goes to 10, then it goes to 50, then it goes to 100…

He goes on to say that this partly due to the fact that they haven’t developed other “gears”, or other interests — which we’ll re-visit in the final section.

Another reason this happens is due to a topic we’ve covered several times here on Wealth Potion: Lifestyle Creep.

People upgrade their lifestyle, and then get comfortable with those upgrades. But more importantly, they get comfortable with the pace at which they are upgrading. And so naturally, they keep wanting more.

This leads to a very dangerous trap.

Figure Out Your Number, and Your Definition of Wealth

There are plenty of tools online to determine your financial freedom number.

Personally, I like to take a simple approach based on how much you’re currently spending per year. This is why I created the Wealth Potion Financial Freedom Calculator, which is available for free at wealthpotion.com

However, you have to recognize that your number will likely change when:

You get married

You have children

Your children have grandchildren

You (God forbid) have a health emergency

So first and foremost, don’t get fixated on you number forever. Be open to updating it, and reflect on it regularly.

Then, and more importantly, you have to define your version of wealth.

A good place to start is to think about wealth not as money, but as time.

e.g. If you already achieved your number, and you had $1m/$5m/$10m etc. in your bank account…

What would you spend your time doing?

Would you:

Quit your job?

Travel the world?

Move closer to family?

Have more children?

Start a business?

Whatever those things are, define them. Write them down. Draw pictures of them. Make them concrete.

Just like your financial freedom number, these things will inevitably change over time. But if you don’t even know what you want… you’ll get stuck on the hamster wheel of “more money”.

Shaan Puuri puts it very elegantly. He shares that many of his very rich friends have not reflected on what they want, so they keep doing what they know best — make more money. And then he says:

So now they’re trading great hours for useless dollars. Which is such a (…) bad trade to make.

Don’t end up like them.

Figure out your financial freedom number. Figure out what you want once you achieve that number.

Do those two things, and I promise your days will be imbued with a lot more purpose, and you’ll likely feel a lot less financial anxiety as well.

I’m working on some more resources like the Financial Freedom Calculator, and I’d love to hear from you. What tools or resources would be helpful to you in your wealth-building journey? Reply to this email and let me know - I read every single reply.

To your prosperity,

Brandon @ Wealth Potion