Here are some stats that might scare you:

They certainly scare me. Reading these stats were one of the reasons I started Wealth Potion in the first place.

Today, we’re focusing on this 3rd stat — almost HALF of all 6-figure earners are struggling to build their wealth???

How could this be?

The biggest culprit is lifestyle creep. And I strongly believe lifestyle creep is the most dangerous hurdle when building wealth.

Today, we’ll cover:

The definition of lifestyle creep

Actionable tips for avoiding lifestyle creep

The hard-hitting truth about the math behind building wealth

In this week’s video, I share my personal experience with lifestyle creep, and how I avoided it:

And I won’t bury the lede. Here’s the hard-hitting truth:

The date which you retire is solely dependent on what % of your pay-cheque you save, not the absolute $ value of your income.

Or to put it another way:

The person making $50k/year and saving 50% of it will retire sooner than the person making $500k/year and saving only 30% of it.

Do I have your attention now?

What Is Lifestyle Creep?

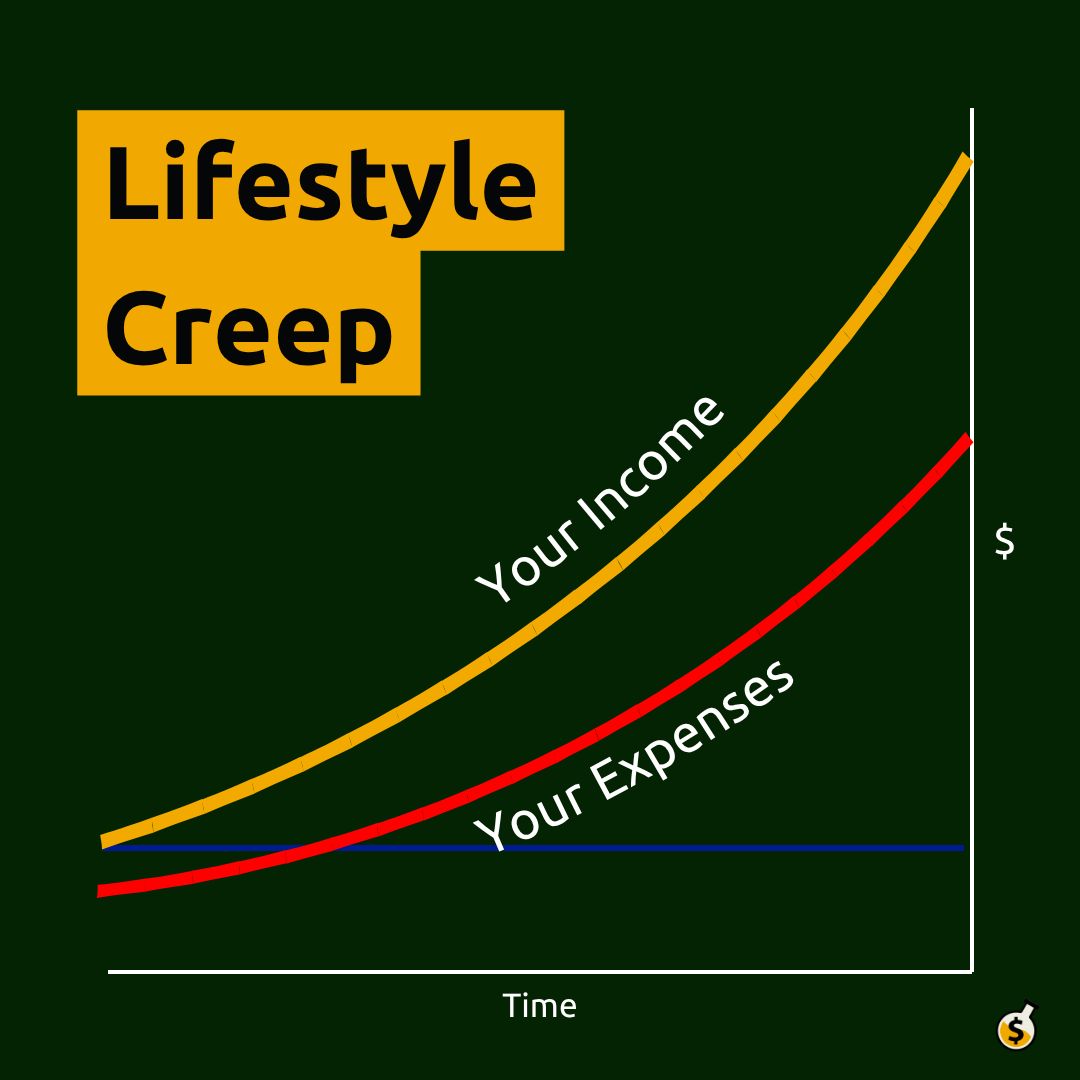

Lifestyle creep (or lifestyle inflation) happens when your spending increases as your income rises.

Picture this:

You finally get that big promotion you’ve been striving for.

You feel like you’re on top of the world!

And then, two weeks later… it’s the moment of truth.

Your paycheck lands in your account. That extra-fat paycheck. Oh, how glorious!

🍽️ You take your partner out for a fancy dinner to celebrate…

🥩 Next time you go grocery shopping, you grab the expensive steaks…

🏋️♀️ Did you hear about that new luxury gym that just opened up?. All your friends are raving about it…

🏠 Hmmm… your apartment is feeling a little cramped. Maybe it’s time for an upgrade…

🚗 Maybe it’s time to upgrade the car, too…

Pure dopamine.

The above is a textbook example of lifestyle creep.

Instead of saving or investing more, you funnel the extra money into luxuries, or “nice-to-haves”. But over time, those luxuries gradually become “necessities” that you can’t live with out.

These lifestyle upgrades are rarely one-time expenses. They often come with recurring costs that permanently raise your financial baseline.

Before you know it, your new lifestyle demands more income just to maintain, leaving little room for savings, investments, or financial flexibility.

Over time, you earn more money, but you also spend more money.

Keep more of what you earn

Collective is the first all-in-one financial solution exclusively for solopreneurs. Members save an average of $10,000 a year by optimizing their taxes via an S Corp.*

Membership includes:

LLC and S Corp formation

Payroll

Monthly bookkeeping

Quarterly tax estimates

Annual business tax filing

Access to a team of experts

Enjoy peace of mind while maximizing your profits, and enjoy extra time to focus on growing your business.

Use code SPRINGFREE at checkout and get your first month free!

*Based on the average 2022 tax savings of active Collective users with an S Corp tax election for the 2022 tax year

Actionable Tips for Combatting Lifestyle Creep

To combat lifestyle creep, you simply have to resist over-spending. And there are many ways you can do this:

Create a Budget. Having a budget means that you know what you’re spending money on. That’s already a huge win.

Watch out for Recurring Expenses. Netflix, Spotify, YouTube. Or even phone bills and internet bills. These recurring expenses add up over time.

Reflect on your Biggest Expenses. This will likely be your rent and your vehicle. You don’t have to downgrade, but you should be critical of your next upgrade.

Calculate your Net Worth. This forces you to look at your wealth in the form of assets, as opposed to income. Once you measure it, you can work on improving it.

What resource would be most helpful for your financial journey?

The key here is to be intentional about your spending increases.

To be clear, defeating lifestyle creep does not mean that you can’t ever increase your spending. Many of us are building our wealth to improve our lifestyles over the long-term, after all.

But maintain a healthy rate of increase. And ideally, increase your savings rate as a percentage of your income over time.

Which brings us to what is (in my opinion) the most mind-blowing truth about building wealth:

When You Retire is Determined by Your Savings Rate as a %

The person saving a higher percentage of their income will retire sooner.

It doesn’t matter if you are making $50k, $500k, or $5 million per year.

The math is quite simple:

Assumptions: 5% investment returns, 4% safe withdrawal rate (very achievable)

The reason this math works is that the inverse of your savings rate is your cost of living.

So if you make $200,000 per year and you are only saving 25%, that means your cost of living is $150,000 per year. And to maintain that cost of living in retirement, you need a much bigger investment portfolio. Therefore, you can retire in 32 years.

But if you make $100,000 per year and are saving 50%, that means your cost of living is $50,000 per year. You don’t need as big of an investment portfolio to maintain that cost of living, which means you can retire in 17 years.

To state the obvious, high income earner might find it easier to save a higher percentage of your money.

But it’s not always the case... because of lifestyle creep.

This is why almost 50% of all Americans earning more than $100k/year are still living paycheck-to-paycheck.

There is nothing wrong with striving to earn more money. But cutting back on your spending will be much more impactful toward building long-term wealth.

Timeless Wisdom on Lifestyle Creep

I’ll leave you all with a quote.

This comes from Marcus Aurelius, one of the most prolific emperors of the Roman Empire, well-known for his book “Meditations” which is a cornerstone of the modern stoicism movement.

“Treat what you don't have as non-existent. Look at what you have, the things you value most, and think of how much you'd crave them if you didn't have them. But be careful. Don't feel such satisfaction that you start to overvalue them—that it would upset you to lose them.”

This quote was written at some point during the 2nd Century AD, and yet it still very much applies today.

Be grateful for what you have. Remember a time when you desired the things you already have, and cherish them.

When you start taking those valuables for granted, that’s when lifestyle creep attacks.

To your prosperity,

Brandon @ Wealth Potion