Last week, I attended the Seoul Bitcoin Conference — the largest Bitcoin-only conference in South Korea.

Today, I’ll be sharing my takeaways from the conference, including:

Latest Bitcoin trends that were being discussed: Bitcoin Treasury Companies, and Physical Bitcoin Communities

What this means for Bitcoin, the global Bitcoin ecosystem, and South Korea

Why you should attend events and conferences in general

You can watch my video recap of the Conference on YouTube as well:

Let’s dive in:

Bitcoin Treasury Companies are Spreading Like Wildfire

I remember back in 2020 when Michael Saylor and MicroStrategy bought their first chunk of Bitcoin and placed it on the company’s balance sheet.

Each orange bubble is a Bitcoin purchase by MicroStrategy. They currently hold 580,955 BTC.

Everyone in Bitcoin was excited in 2021 that this would trigger a wave of publicly-traded companies that would follow suit.

That didn’t happen.

Fast forward 5 years, and only a handful of companies have followed in Saylor’s footsteps. Metaplanet being one of the only popular examples.

But now, times are changing. We are seeing a huge wave of new Bitcoin Treasury Companies.

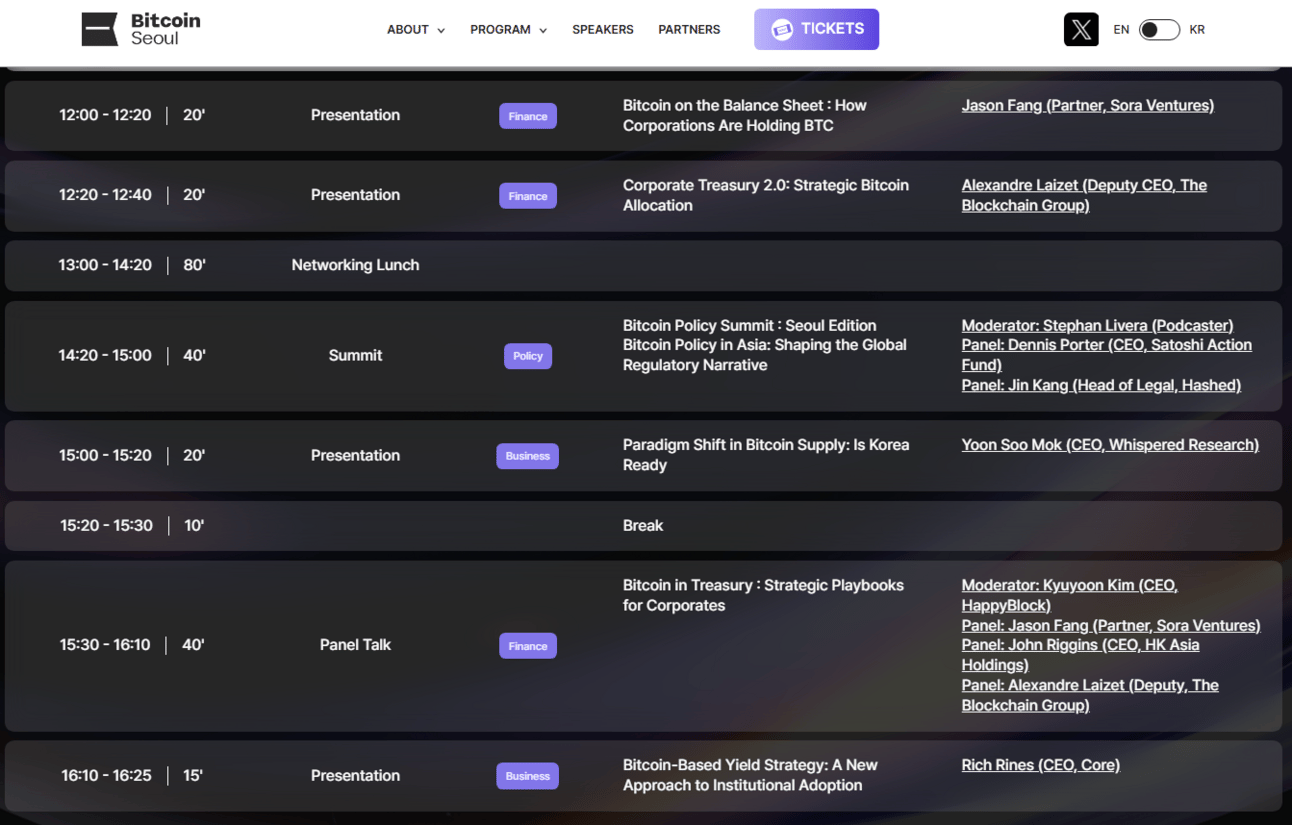

Four sessions on Day 1 were about holding Bitcoin on a company’s balance sheet

I won’t bore you with the details, but a lot of this recent surge has to do with recent accounting changes that make it more financially beneficial for companies to do so (If there’s interest in this topic, let me know).

At the Seoul Bitcoin Conference alone, we had presentations and panels from:

Jason Fang of Sora Ventures $NASDAQ:TOPW (Hong Kong and China)

Alexandre Laizet of Blockchain Group $ALTBG.EN (France and Europe)

John Riggins of HK Asia Holdings $HKG:1723 (Hong Kong and China)

This is an exciting development but just like other Bitcoin bull markets in the past, there is some skepticism here. Will all of these companies survive the next Bitcoin bear market?

I dive a bit more into the risks of Bitcoin Treasury Companies in this week’s video, if you’re interested.

LLC, S Corp, or Sole Proprietor? Download Besolo’s Free Guide

Each business structure has unique benefits, risks, and financial implications. Our definitive Solopreneur’s Guide breaks down LLCs, S Corps, and Sole Proprietorships in easy-to-follow terms, ensuring you’re fully informed to make strategic choices for your solo business.

Physical Bitcoin Communities Are Popping Up Across Asia

Bitcoin Treasury Companies are exciting for the investors and price speculators.

Personally? The advent of physical Bitcoin communities get me way more excited.

Tokyo Bitcoin Base opened up earlier in 2024

At the Conference, we heard presentations from:

Teruko Neriki of Tokyo Bitcoin Base

Keypleb of Bitcoin House Bali

JP of Bitcoin Sydney Meetup

Piccolo of BOBSpace Bangkok

For those that aren’t familiar with the Bitcoin ecosystem, many Bitcoiners choose to use pseudonyms instead of their real names. Some people even wear masks at conferences! It’s a bit jarring the first time you encounter it, but you get used to it.

South Korea doesn’t yet have a physical space yet, but there were a lot of exciting conversations among local Bitcoiners about getting a similar project off the ground.

Physical Bitcoin spaces are great not just for the local Bitcoin community, but for Bitcoiners that are visiting other countries around the world. It’s an awesome feeling to fly into a new country and know that there is a place to hang out and network with like-minded people.

So what does this mean for South Korea, and the Bitcoin ecosystem at large?

Slowly and Steadily, the Bitcoin Ecosystem is Growing

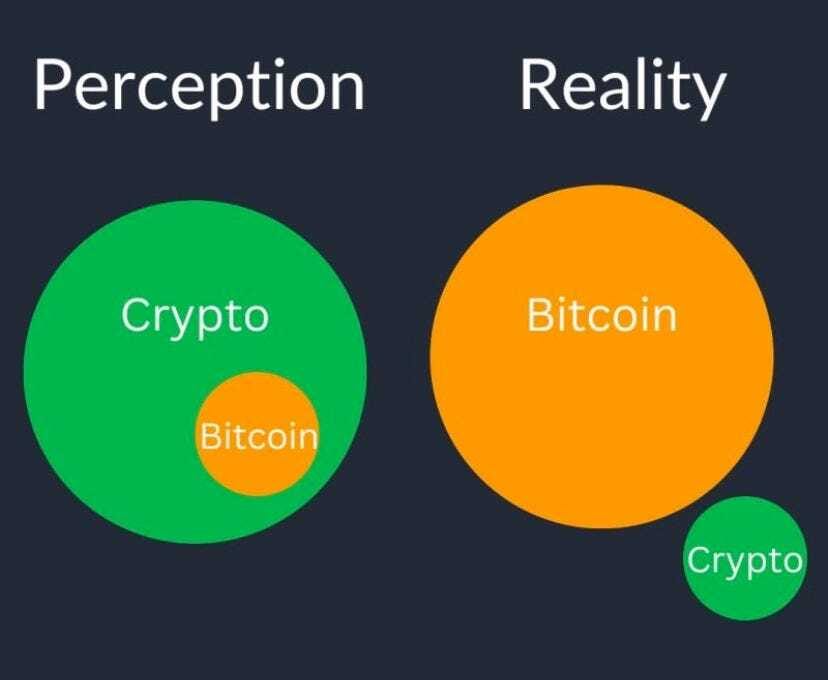

It’s important to note that these Bitcoin communities, the Seoul Bitcoin Conference, etc. are all about Bitcoin, NOT crypto.

For a quick primer on why Bitcoiners see these two things as distinct, check out my recent video on this topic:

But this is exactly why seeing these physical Bitcoin communities pop-up is extremely promising.

Crypto startups often will raise a ton of money from venture capital firms because of how rapidly these companies can monetize their proprietary token, and then dump it on retail investors.

Crypto scammers give Bitcoin a bad reputation.

This means that the broader “crypto” space is often flush with cash to do huge marketing campaigns, buy Superbowl ads, and fill massive conference halls.

Bitcoin is not like this.

I chatted with Preston Pysh, general partner at Ego Death Capital — a Bitcoin-only VC firm — and he stressed that the most successful Bitcoin companies are either exchanges (e.g. River) or custodians (e.g. Xapo).

Bitcoin is a form of money in the purest sense. Whereas “crypto” is trying to fulfill various (imaginary) technological use-cases using blockchain technology.

Bitcoin and “Crypto” are two very different industries and worldviews.

In other words, the Bitcoin ecosystem grows much more like a bootstrapped startup. Whereas the Crypto ecosystem has huge booms and huge busts due to the VC funding that pours into these companies… until they inevitably crash and burn.

So these physical Bitcoin communities are likely here to stay. These Bitcoin Treasury Companies (although I suspect some will execute poorly or their stocks will underperform) are likely here to stay. And the Seoul Bitcoin Conference is likely here to stay.

On Attending (and Supporting) Physical Events

I started my career at a tech startup that sold event management technology. And being in sales, I literally spoke with event planners every single day.

It gave me a very deep appreciation for in-person events.

Preston Pysh on “Why Bitcoin?”

They are extremely difficult to organize and manage. Event planners are some of the busiest people, and yet they are often extremely positive and bubbly in person.

And events aren’t exactly the most financially lucrative business model.

But if you attend an in-person event, you know that you get so much value out of it that is intangible.

Sure… you could go watch all the same sessions I attended when they get posted on YouTube.

Some of my best friends in Korea were met through attending Bitcoin events

But to meet other Bitcoiners, to chat with speakers and business leaders that I’ve respected for years, to feel the energy of being around other like-minded people… it truly is a priceless feeling.

So even if you’re not a Bitcoiner like me, I highly recommend looking up events in your local area for things that you’re passionate about. And ideally, not something related to your full-time job.

I am confident that you won’t regret it.

To your prosperity,

Brandon @ Wealth Potion