It’s called “Personal” Finance for a Reason

I’m in Tokyo, Japan this week.

Being on vacation affects our psychology around spending quite significantly.

And it is what inspired this week’s article.

If you’re like me, you’ve picked up personal finance beliefs from a number of sources:

Friends and family

Self-guided research and trial and error

Content Creators and personal finance influencers

Today, we’re going to pause and reflect to see if these beliefs are serving us.

And in particular, I’m going to pick a bone with Group #3…

Because many personal finance influencers have forgotten that personal finance is exactly that – personal.

Let’s dive in:

Dave Ramsay is one of the biggest personal finance content creators on the internet.

And his perspective on credit cards is clear: Don’t ever use them.

In this video, he gets a question from a viewer that pays off their credit card every month and never carries a balance.

And yet he still is against it. He even insults the viewer several times…

Credit cards are powerful tools if used responsibly. They build credit score, they provide cash-back, and many of the wealthiest people use debt / credit to leverage their wealth.

And while it’s important to recognize that credit cards are extremely profitable for banks, it does not mean you should discard them as a financial tool altogether.

tl;dr – If you never carry a balance, using a credit card will likely be a net benefit to your finances. If you are struggling with debt, then you might want to avoid the temptation of credit cards because of the high interest rates.

Ramit Sethi has exploded onto the personal finance scene with his book “I Will Teach You To Be Rich”.

And a lot of his advice is sound. I agree with 90% of what he talks about in this video.

But he also takes a very rigid stance on a very popular debate in the personal finance space.

He argues that you can’t get rich saving money on avocado toast and lattes.

He points out that for a down-payment on an average mortgage in America, you’d need to forego 2,500 avocado toasts, or 12,000 lattes.

It’s a cute example, but it uses a straw man logical fallacy.

No one is arguing that you could pay for a down-payment strictly with avocado toast savings.

But if reducing your spending on nice-to-have items can get you 10%, 5% or even 1% closer to buying your first home, that’s a win. Period.

In fact, it’s a huge win.

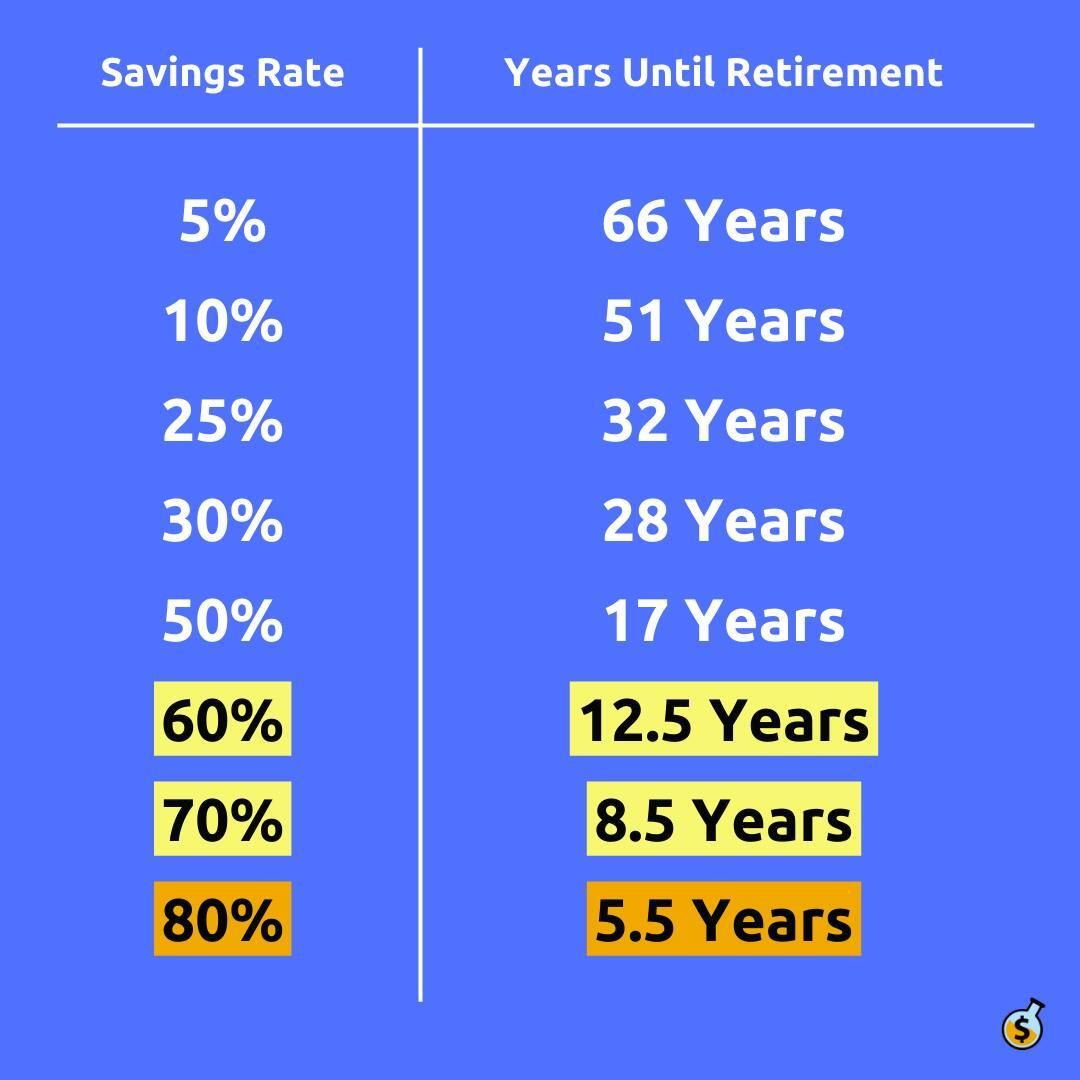

Most people underestimate just how powerful their savings rate is. In fact, the % of your post-tax income that you save is the single most important factor in determining when you can retire:

Increasing your savings rate from 5% to 10% will allow you to retire 15 years earlier.

tl;dr – Be honest with yourself. You know deep down if you’re spending too much on nice-to-have luxuries. While these small purchases might not be a significant chunk of your expenses, they certainly add up over time. And they also might affect your psychology around spending.

Alright, that’s enough fights picked for one week

The moral of the story is that personal finance is personal.

And while I’m certainly not perfect, I will do my very best to not give prescriptive personal finance advice and claim that it applies to everyone. Because it doesn’t. Everyone’s situation is different.

That’s one of Ramit’s messages I can absolutely get behind:

If someone tells you “do this” or “don’t do this”, ask yourself what they stand to gain from it.

Build In Public Update

I feel like I’ve cracked the code on Twitter / X engagement and am on pace to be monetized within the next 90 days. (Threshold = 5,000,000 impressions in 90 days)

TikTok engagement has been falling simply as a function of # of videos posted. I haven’t been posting enuoghh lately. Looking to fix that with some fresh Japan content.

YouTube is slow and steady, as expected. Once I’m back from Tokyo, I am strongly considering increasing my upload cadence to twice per week… stay tuned.

PS. I want to give a special shout-out to my subscribers who have been replying to my emails with feedback, questions and compliments. It means a lot! I read them all and try to reply to everyone.

To your prosperity,

Brandon @ Wealth Potion

Follow Wealth Potion on social media for more exclusive content:

+

If you enjoyed reading, consider forwarding to someone who would find this valuable.

You can read all our previous newsletters here.

The post Personalized Finance appeared first on Wealth Potion.