Earlier this week, we talked about why the recent market correction.

If you missed it, you can read the article here or watch the video here.

tl;dr – I cautioned investors from selling their investments out of fear (not financial advice)

Less than a week later, the markets seem to be… recovering?

In other words, if you had sold on “Black Monday 2.0”, you’d be kicking yourself right now.

Today, we’re going to cover a few critical topics. Once again, we’ll go from simple to advanced:

Why did the market recover? And why are expectations so important?

What is the VIX, why did it spike this week, and what is it telling us now?

What I’m doing with my investments, and what I’m watching for next.

The theme of today’s article is market expectations. And the more you learn about investing, the more you will realize how critical expectations are to the economy and the stock market.

And just like last week, this article is available in video format on the Wealth Potion YouTube channel:

Let’s dive in.

Have Markets Recovered?

The S&P500 has regained close to 100 points.

Bitcoin is back up ~12% from this week’s low.

The VIX* is back down to the mid-20’s from its peak of 55 (*we’ll come back to this)

So are we out of the woods?

Yes and no.

First we need to understand why and how the market recovered so quickly.

The short answer is that investor expectations shifted from very negative, to somewhat more positive.

Expectations drive markets.

Over the weekend, many investors feared (expected) that the Japan Carry Trade (as discussed last week) would unwind and wreak havoc across the global financial system.

Now that a few days have gone by, and the unwind seems to have been relatively contained.

Earlier this week, I mentioned one of the things I’ll be watching for is further commentary from the Bank of Japan.

Well, they made a comment. And it’s one of the reasons that investors are less fearful:

A “dovish” signal is one that signals lower interest rates / easy policy. A “hawkish” signal is the opposite.

The Bank of Japan released a statement that they won’t do any further tightening (interest rate hikes).

Essentially, they’ve said “Oops, sorry about that. It won’t happen again! (For now)”

Again, this goes back to something I mentioned in Monday’s video: forward guidance.

Central banks are so important in our financial system, that their public statements have the ability to move markets.

This is referred to as forward guidance. In summary:

BoJ sends out a dovish signal

Investors’ fears subside

Market recovers

This eases investors’ expectations of what the Bank of Japan will do next.

Let’s now look at another metric that demonstrates the importance of expectations in investing: volatility.

What is the VIX and why did it spike?

The VIX is a measure of investors’ expectations of stock market volatility.

It is measured by looking at the range of prices of put and call options on the S&P 500.

Put and call options are a vehicle for investors to bet on the stock market moving down or up, respectively.

When demand for these options rise, the price ranges widen, meaning that investors expect more volatility in the coming days or weeks.

The VIX is a CBOE product, and they have a great explainer video here.

This essentially gives us the VIX. So when the VIX is high, investors are expecting lots of volatility. When the VIX is low, investors expect relatively low volatility.

So what happened this week?

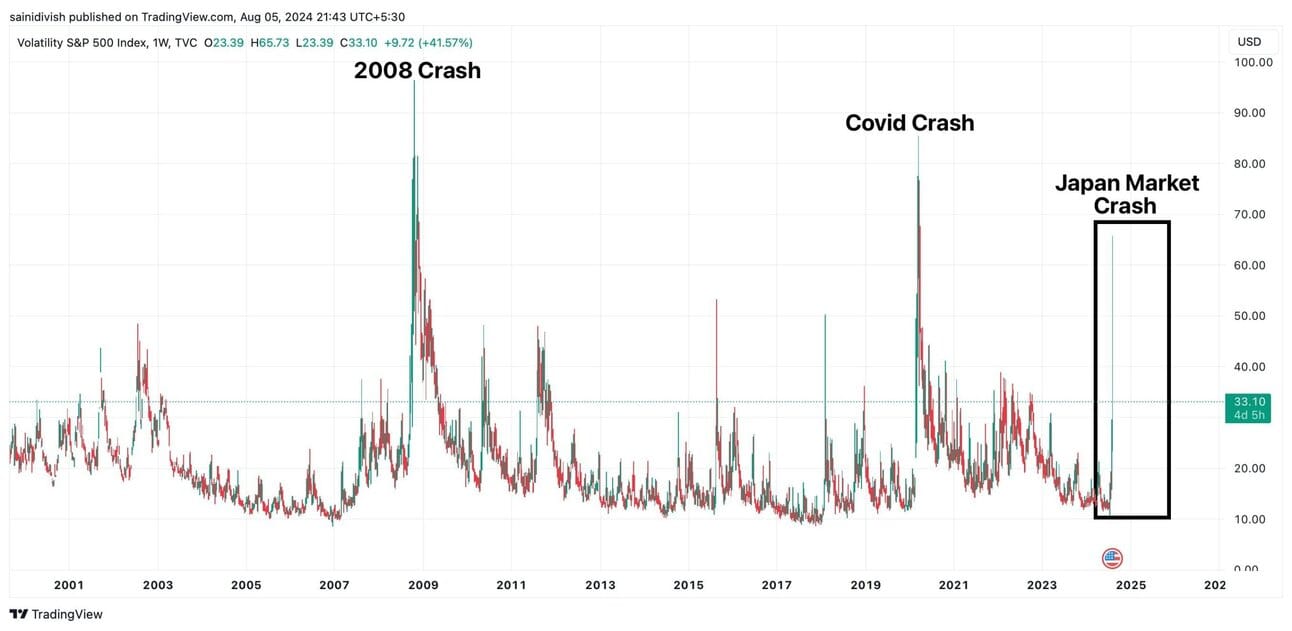

Monday was the 3rd highest level on the VIX in history.

The 1st and 2nd biggest?

The Great Financial Crisis of 2008, and the Covid Pandemic.

Needless to say, investors were freaking out on Monday.

The good news is that the VIX is now back to the mid-20’s as of me writing this.

Prior to this week, however, the VIX was in the mid-teens.

So the VIX is a perfect example to demonstrate that while the worst is behind us (for now), that we’re not out of the woods fully just yet.

In this week’s video, I also cover the yield curve which is a doozy of a topic and deserves an article of its own. Stay tuned for that soon.

What Should We Do, and What’s Next?

In many ways, the correction of earlier this week can be seen as a healthy one.

Investors with the most leverage, who took on the most risk, or that were most wound up in this Yen Carry Trade were the ones that got wiped out.

Luckily, the dominos were successfully halted before it affected the rest of the broader market.

And as I explain in this week’s video, financial crises often play out like a game of dominos. One domino, knocking down a slightly larger domino, until it becomes catastrophic.

One of my favorite meme formats. Reply with your favorite domino meme and I might feature it in next week’s article.

I think it’s a bad idea to sell out of fear. And as mentioned, if you sold on Monday, you’re probably kicking yourself right now.

I believe that stocks, Bitcoin, etc. will continue to recover over the coming days and weeks.

However, I do think it is prudent to reduce your risk.

If I had any leverage right now, I’d put an end to that immediately.

The stocks and assets that I thought about selling when the markets were down 10%+?

I’ll be trimming those over the coming weeks, little by little.

This is not financial advice. Simply what I’m doing.

So what am I looking out for?

In addition to what I shared last week (BoJ comments, Janet Yellen, and actions from the Fed) I will also be watching the credit markets.

If there is any fear or concerns in the market about credit defaults, this could signal more trouble to come.

Next week, we will discuss the yield curve in more detail, so stay tuned for that.

To your prosperity, Brandon @ Wealth Potion

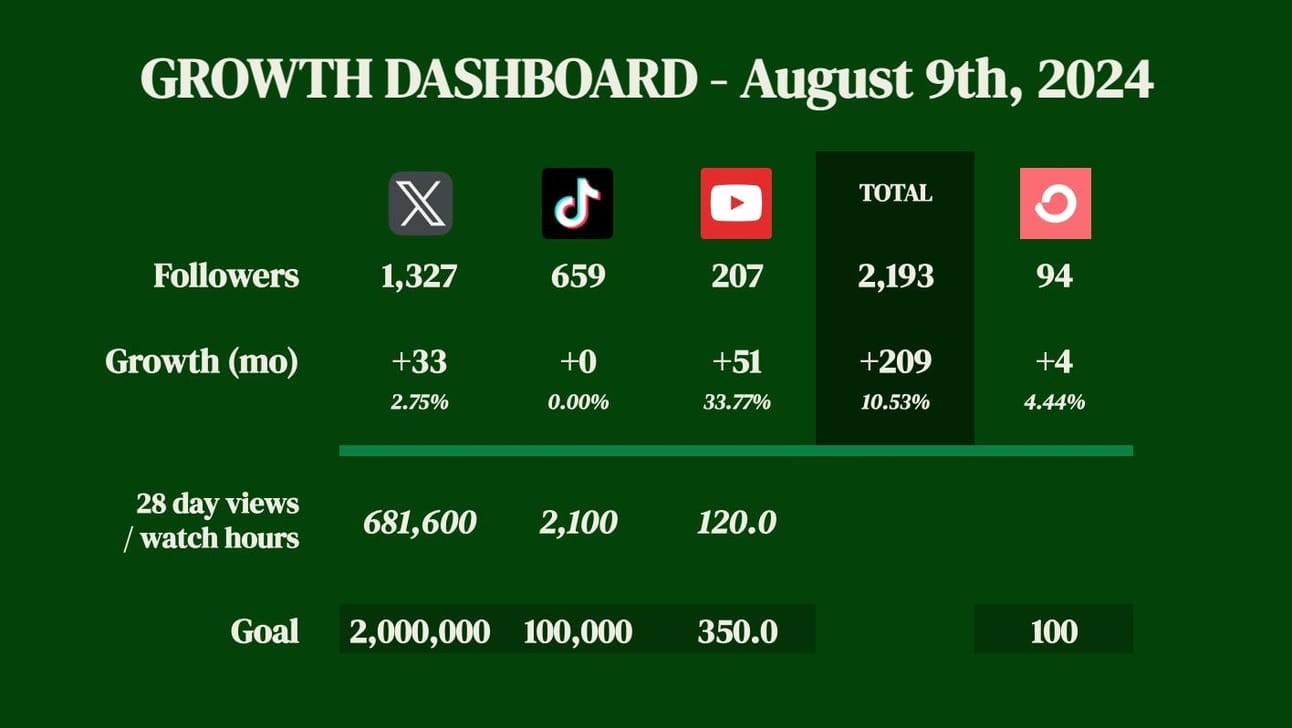

Build in Public Update

Main focus right now is YouTube. Need to re-visit TikTok and make a decision there.

I’m back from Tokyo and reinvigorated.

As I ramp up my content, I’m noticing a few things:

Quality and quantity both need to scale. Posting more videos takes more time, obviously. But improving my video thumbnails, doing deeper research, learning new editing techniques… that all takes time as well. Both need to scale in parallel and it requires good judgment to decide where to allocate more effort.

Each platform has multiple dimensions. As I focus on scaling the quality and quantity of my YouTube, I am focusing less and less on TikTok and X. In my head, this was going to be easy to juggle. But the deeper I go into YouTube, the more I have to let go of in other arenas. Focus on one thing at a time is cliche, but it’s true.

The “Off Switch” needs to be pressed. In a full-time, 9-to-5 job, your off switch is automatic. You sign off Slack at the end of the day, you leave the office, you log off for the weekend. But in content creation (and other avenues of entrepreneurship), one must proactively turn off. If you don’t, it is a fast track to burnout.

Very excited to see the progress on my YouTube so far, despite being only a few videos in. I hope to never lose this feeling – this beginner’s mindset – that makes me excited and wanting to keep going.

As always, would love to hear your feedback and questions.

The post Have Markets Recovered? appeared first on Wealth Potion.