The S&P500 is down 300 points from its high…

The Nikkei Index (Japan) is down 6% in a day…

The Mag7, tech stocks and Bitcoin are bleeding…

What is going on? And what does Japan have to do with it?

Today, we’re covering:

3 reasons (Easy, Intermediate, Advanced) why the stock market tanked last week

What we should do as investors (*its not what you think)

What comes nextand what I’m watching for

This article is also available in video format here:

Let’s start with WHY.

As with any complex issue, there is no single reason why the market is crashing.

We’re going to cover several today. We’ll start with the easiest-to-understand reasons, and work our way toward the more complex ones. And we’ll explain them all in simple terms.

Let’s dive in.

EASY: Big Tech Missed Earnings

Public companies are required to host quarterly earnings calls.

Each quarter, market analysts (commonly referred to as the “Street”) set expectations for the company to hit. This is partly based on the company’s own forecast (or “guidance”), but is also based on analyst consensus.

When companies meet or exceed those expectations, the stock typically (but not always) increases in price.

When companies miss those expectations, the stock typically (but not always) decreases in price.

Just this past week:

Amazon ($AMZN) dropped 11% after announcing a disappointing revenue forecast.

Intel ($INTC) plummeted 34% due to huge losses, poor guidance, and layoff plans.

Microsoft ($MSFT) dropped 4.6% this week after missing key Azure revenue numbers.

These are just a few examples.

In short, much of Big Tech is missing their earnings. And the pinnacle of Big Tech is the Magnificent 7 (“Mag7”): Apple, Microsoft, Amazon, Alphabet (Google), Nvidia, Meta, and Tesla.

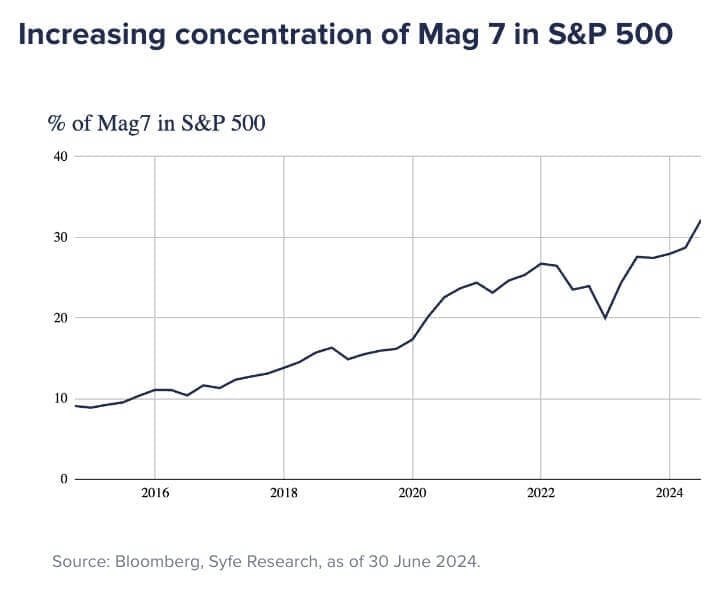

So why is this important? Because the Magnificent 7 is becoming a larger proportion of the stock market.

The top 7 companies are close to 1/3 of the S&P 500. The remaining 493 companies make up the other 2/3.

So this gives us reason #1, and the simplest explantation for the recent market correction:

The biggest companies on the stock market aren’t hitting their targets.

But there are signs of deeper trouble within the economy, and investors are taking notice…

INTERMEDIATE: The Unemployment Rate

The Bureau of Labor Statistics (BLS) releases employment data each month. One of the key data points is the unemployment rate, which calculates what percentage of the US population is unemployed.

There is no fixed number that is considered ‘good’ or ‘bad’. Obviously, high unemployment is a bad thing. And low unemployment is a good thing.

Oftentimes, what is more important is the rate of change of the unemployment rate, as well as the unemployment rate compared to expectations.

So where do these expectations come from?

The Eccles Building in Washington DC, one of the main offices of the Federal Reserve

The Federal Reserve is the Central Bank of the United States.

It has a dual mandate: stable prices, and maximum employment.

It’s no surprise then that the Federal Reserve is looked at as a trustworthy guide with regards to employment expectations. They have the most data available to them, and one of their two reasons for existing is to maximize employment.

Fun fact:

There is even an investing term (forward guidance) for the Fed’s official statements, because their statements have the power to actually shift the markets. e.g. If the Fed says the markets are healthy, investors become confident, they deploy capital, and the markets become more healthy. In other words, their statements can often be self-fulfilling prophecies.

Every 6 weeks on average, the Fed convenes at the Federal Open Market Committee (“FOMC”) meeting. This is where the Fed reviews the state of the economy, and makes policy decisions.

Many investors expected the Fed to cut interest rates at their meeting this past week. But they did not. They kept the benchmark rate at 5.25 to 5.50%.

Why would they do this? Because they believe the economy is relatively healthy.

But what if the Fed gets it wrong?

That’s also what happened this week. Or at least, that’s what many investors believe. And oftentimes, that’s enough to shake the markets.

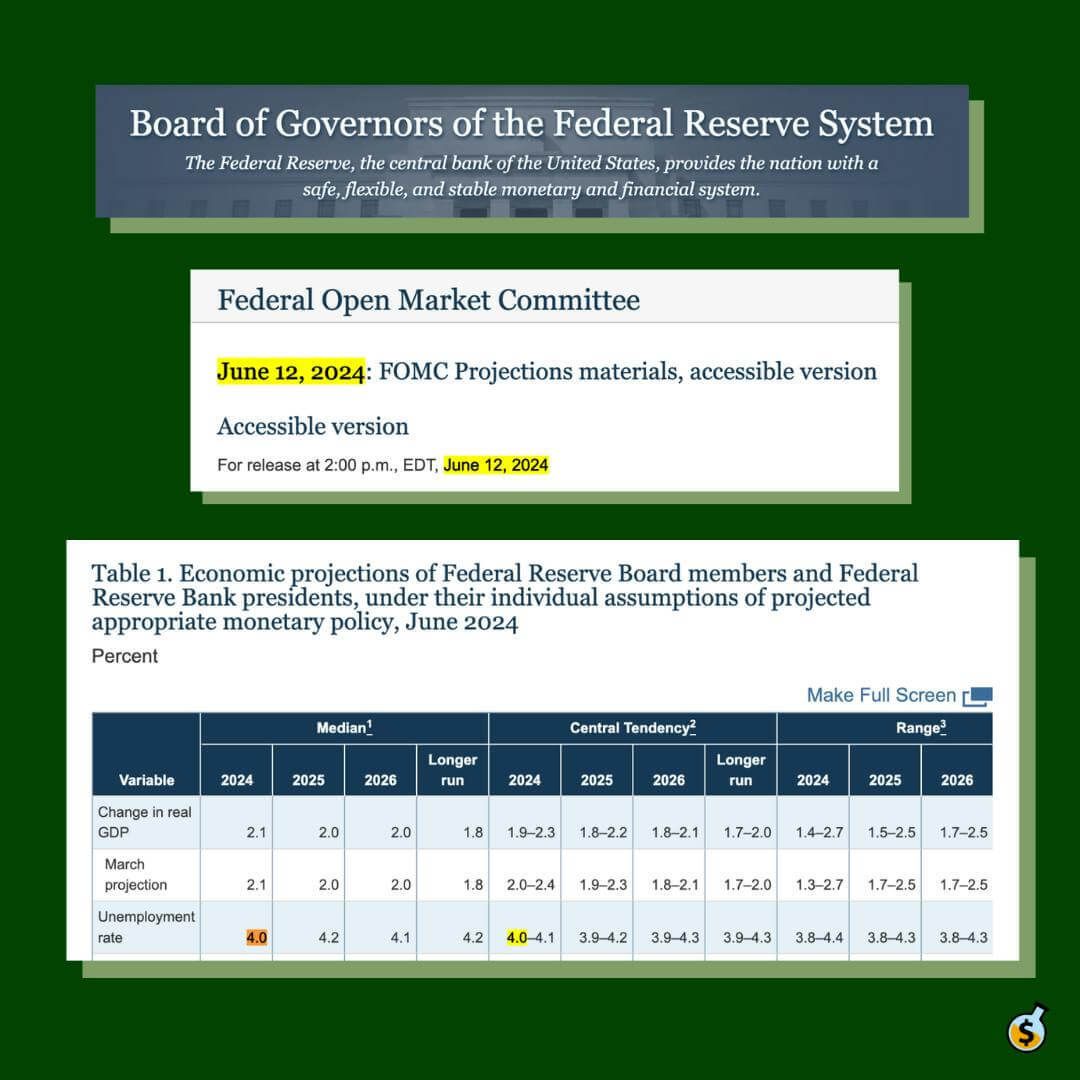

In June, the Fed said that they believe unemployment would peak at 4% this year:

It took less than 2 months for the Fed’s projection to be invalidated (Source)

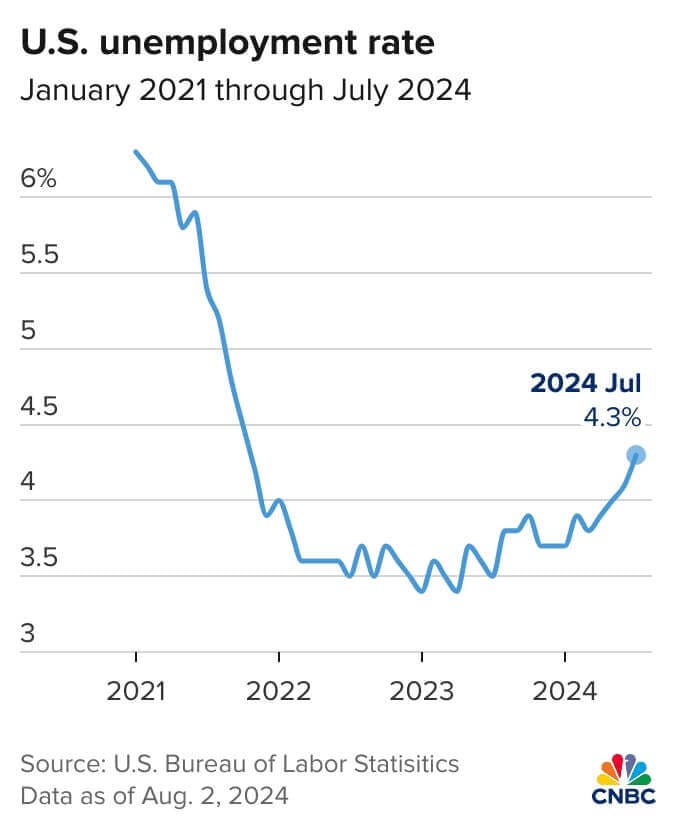

This week, just two months after the projections above were announced, unemployment hit 4.3%. The highest level since October 2021:

So to recap:

Throughout July: The biggest companies on the stock market miss their earnings

July 30-31 (FOMC Meeting): Fed doesn’t cut rates, signalling that they believe the economy is healthy

August 1: BLS releases unemployment data that is worse than expectations

This created fear in the market, which likely contributed to the sell-off in stocks.

Note:

The Federal Reserve and the central banking system is a complex but extremely important topic for anyone who is investing their money. If this section is still a bit unclear, don’t worry – this is a topic that we will be posting many future articles and videos on, so stay tuned and subscribe to Wealth Potion on YouTube

That’s the 2nd, more nuanced reason for the recent correction:

The economy is not doing as well as expected, and the Fed has not yet stepped in to help.

But many analysts are talking about a third, more complex reason. And this one, if true, could reverberate in the markets for some time.

ADVANCED: The USD/JPY “Carry Trade”

Or more accurately, the end of the USD/JPY Carry Trade.

I will try my best to explain it in simple terms.

Investors like predictability.

When something is predictable, capital can be deployed with a very high probability of returns.

The Federal Reserve (US) and the Bank of Japan are generally consistent in their behaviour over time. This makes them predictable.

The key predictable behaviours that make this trade possible are:

The Federal Reserve will likely raise interest rates to combat inflation, and keep rates relatively high

The Bank of Japan will likely lower interest rates to stimulate the Japanese economy, and keep rates relatively low

Because of this, many institutional investors have found a way to take advantage of this predictability through what’s referred to as a “Carry Trade”.

In short:

Borrow JPY (Japanese Yen) at a low interest rate of ~0%

Exchange JPY for USD

Buy US bonds at a high interest rate of ~5% (or, buy US equities)

Hold bonds to maturity, pocket the interest

Exchange USD back to JPY to pay back the loan

Imagine a bank was willing to loan you money at 0% interest, and the bank down the street would allow you to deposit money into a HYSA (High Yield Savings Account) with 5% interest. That’s the Carry Trade.

Many of the investors leveraging the Carry Trade do not publicly share their positions, so while we don’t know exactly how much money is wound up in the Carry Trade, it’s estimated to be in the trillions of dollars.

Remembers those requirements for the Carry Trade to work?

What if something happens that suggests that those requirements won’t be met for much longer?

That… also happened this week.

This is the largest rate hike by the Bank of Japan in 15 years.

The Bank of Japan’s rate hike from 0-0.1% to 0.25% seems like nothing from the North American perspective.

But for Japan, this is a huge deal. This is their biggest rate hike in 15 years.

Imagine you’re at the bar, it’s 2am, and your one friend that is always the most drunk suddenly says “I think we’ve had enough shots”… You’d probably think long and hard about how much you’ve had to drink.

Now, this news didn’t unwind the Carry Trade immediately.

But it signalled to investors that the Carry Trade might be coming to an end.

And so to get out of the trade, those investors must sell their US bonds (or US equities, if they purchased stocks with that borrowed money) so that they can exchange it back to Yen and repay their JPY loans.

Here is one financial analyst’s summary of the Carry Trade dynamics

So that concludes the third reason that we’re covering in today’s article:

Investors that were taking advantage of a unique trading opportunity between US and Japan could be forced to sell large amounts of US stocks right now.

In closing, these are not all the reasons for the market crash.

My goal with today’s article was to walk through some of the reasons, but also to help you better understand some very important concepts for investors, such as:

Earnings calls hits and misses

Central banking and the Federal Reserve

Macro investing and how institutional investors look for opportunities

So What Should We Do?

At moments like these, it can be really tempting to sell.

“The market is crashing… so what if it crashes more? Buy low, sell high… right?”

There are two main problems with this approach.

Firstly, you already missed the top.

Of course, if you sell at the top and buy at the bottom then you’d make money. But the only reason you have this urge to sell is because the market has already started dipping.

Secondly, you’ll likely miss the single best day in the market.

The days where the stock market shoots up the most are almost always immediately following a crash or correction.

And historical data shows that if you miss these best days in the market, you erase most of your investing gains altogether.

Source: JP Morgan via FMP

You already missed the top… what makes you think you won’t miss the bottom too?

What Comes Next?

I don’t have a crystal ball. But there are some things I’m looking out for in the coming weeks.

1) Japan’s further action or guidance toward tightening

If Japan indicates that they might further tighten (either by increasing interest rates further, or through other means such as reducing their buyback program) then this would be a stronger indication that the Carry Trade is unwinding. Bad news bears.

2) Janet Yellen expressing concerns

As the Treasury Secretary, Yellen cannot control the Fed. That’s Jerome Powell’s job. But she can certainly influence the Fed by making public comments. “Hint hint, Jerome… it’s time to let the markets breathe a bit.” If this happens, it’ll put political pressure on the Fed to hold…

3) An Emergency Fed Meeting

The Federal Reserve just had their last meeting on July 31, and their next scheduled meeting isn’t until September. So if the markets keep dipping, Yellen shares her concerns, and/or the BoJ says they are staying course, I think it is very likely that the Fed holds an emergency meeting where they will announce easing measures. This could be a rate cut, but this could take another form as well.

We’ll be watching.

To your prosperity,

Brandon @ Wealth Potion

Build in Public Update

An early newsletter this week! With all the news about the stock market, I was getting lots of questions from friends and family about what was going on. So I figured why not write an article (and publish a YouTube video) about it.

I sound like a broken record on this… but this is yet another reason for my “slow productivity” approach to building Wealth Potion.

Having flexibility and freedom with my time allowed me to laser focus on putting out a time-sensitive article and YouTube video about the current state of the market.

What do you think of this type of content?

My earlier articles are videos were more timeless – talking about general concepts that you could read, watch and learn at your own pace.

This article is time-bound – it’s discussing recent events in the market (while touching on concepts) to help breakdown what’s happening now.

Do you have a preference? Do you like both? Let me know. I’d love to hear from you.

The post Why is the Stock Market Crashing? appeared first on Wealth Potion.