Today’s investing environment today is very different than just a few years ago.

Specifically, many people feel like investing is harder than it used to be.

And they’re not wrong.

The stock market is at all time highs, while consumer confidence is approaching 30 year lows.

I’m sure many of you reading this are doing the “right” things with your investments.

You’re sticking to (mostly) index ETFs, you’ve got long-term mindset, and you’re not trading or gambling (ok, maybe a little)…

And yet, your portfolio is more volatile. Drawdowns feel scarier. Your confidence feels lower.

You’re not imagining things. And it has less to do with you, and more to do with this:

Interest rates going back to 2008. Seeing the issue yet?

In other words, it’s the environment you’re investing in.

For a long time, investing has been on ‘Easy Mode’.

It has been quietly shifting to ‘Hard Mode’.

Today, we’ll break down:

Why investing feels harder than it used to

What actually changed over the years, by looking at macro indicators:

The 2008 crisis and the response

The ZIRP era (Easy Mode)

The post-C***d era (Hard Mode)

How to adopt macro awareness, without reading charts and graphs all day

Basically, this week’s newsletter is a crash course on Macro Investing, and why it is the key to investing in this new paradigm.

Let’s dive in.

This week’s article and newsletter video is brought to you by LOGIC Macro Regime, the highest signal and most affordable macro framework I’ve been able to find. And they’re offering a 7-day free trial to Wealth Potion subscribers. But more on them in a moment.

The Wake-Up Call of The Great Recession

The best thing that central bankers can do for the world is to avoid such crises by providing the economy with, in Milton Friedman's words, a 'stable monetary background'

As we love to do here at Wealth Potion, we have to study a bit of history.

For those of you old enough to remember, 2008 was the most recent prolonged global recession.

Yes, the C*vid crash in 2020 was also a recession… but it wasn’t prolonged. We’ll come back to this in just a moment.

There were mass layoffs all across the economy. Major banks were on the brink of collapse. Unemployment hit 10% in the U.S. and it took years to fully recover.

Governments and central banks vowed to never let such a financial crisis happen again.

Massive stimulus programs were implemented.

The big banks were bailed out (this is where we got the phrase “too big to fail”).

And perhaps most instructive for our topic this week: interest rates were slashed to near zero.

Interest rates are a commonly-used indicator of Liquidity

We didn’t recognize it at the time, but looking back we now call the period from 2009 to ~2022 as the ZIRP era, or Zero Interest Rate Policy era.

In other words, Easy Mode.

Let me explain.

How 0% Interest Rates Created ‘Easy Mode’

When the music is on, you have to dance.

Interest rates can also be thought of as the price of money.

After all, when you borrow money, you pay the corresponding interest rate.

So when interest rates are near zero, money is “cheap”. Borrowing is easy.

This also means that investors are more willing to take risks because the alternative (holding cash or safe assets) offers little in return. This is why growth stocks, speculative assets, and long-duration investments tend to thrive in low-rate environments.

This created an environment where risk-taking was consistently rewarded.

This also provides a boon to the economy:

The U.S. ISM Manufacturing PMI is a great example of a metric that shows the economy virtually halting in 2020, and then accelerating due to government stimulus

In that kind of world, you don’t need to be too precise. You could buy broad index funds, ignore most headlines, and uninstall your brokerage app. Animal spirits!

But as time went on, investors became used to this paradigm. And young investors that started investing post-2008 never knew anything different.

The ZIRP era shaped an entire generation of investors.

But that doesn’t mean it was permanent.

Eventually, the music stopped.

The Shift From ‘Easy Mode’ to ‘Hard Mode’

The four most dangerous words in investing are: 'This time it's different.

Interest rates are the gravity of the financial system. When they’re near zero, almost everything can float. When they rise, reality reasserts itself.

As rates move higher:

Borrowing becomes more expensive

Holding cash becomes more attractive

Risk tolerance falls

A simple example is looking at the value of the U.S. dollar, compared to other currencies. If we zoom on interest rates over the past 5 years, as interest rates went up…

The U.S. dollar also went up:

The value of the U.S. dollar, compared to other currencies

And because modern markets are deeply interconnected, this change in math propagates everywhere at once: stock, bonds, real estate, private markets, and Bitcoin all feel the effects.

What we experience as volatility is often just liquidity drying up.

And this is what we experienced from ~2022 until now.

So to recap:

We had almost 15 years of Easy Mode due to ZIRP…

And we are now entering Hard Mode where rates are between 3% and 6%.

And there is an extremely important lesson here:

Macroeconomic Factors are King

The era of Warren Buffet “cigar butt” investing is long gone.

Price-to-earnings ratios, discounted cash flows… these metrics are still relevant, but it’s much more difficult to find an edge with these compared to 50 years ago when Buffett got started.

It’s much more important to be following the macroeconomic environment.

Google search volume for “macro investing” is quickly growing.

And if you’ve been paying attention, we’ve already covered several examples of macro indicators in this article:

Interest rates

Inflation

The U.S. dollar

Consumer confidence

The manufacturing index

Now, I know this sounds like a lot. Maybe you zoned out when you saw all those graphs and charts earlier in this article. And I bet 99% of you do not want to read charts all day.

That’s why I’ve partnered with LOGIC Macro Regime on this week’s article and YouTube video.

Instead of tracking all of these various macro indicators separately and manually, LOGIC Macro Regime provides one simple, systematic framework that keeps your finger on the pulse of the macro environment.

They track a slew of macro indicators grouped in 5 categories:

Liquidity Cycle - How abundant (or scarce) money is across the system.

Other Financial Conditions - US dollar trends, credit spreads, policy shifts.

Growth Cycle - Acceleration / deceleration in global economy.

Inflation Cycle - The direction of price changes.

Capital Positioning - How investors are positioned.

Hence, L.O.G.I.C.

Then, based on the real time data, they provide investors with a Risk Bias Score of 0 to 7 — 0 for Risk Off, 7 for Risk On — and indicate which macro “regime” we are in:

An example Logic Macro Regime Report, get your 7-day free trial today

Not only is LOGIC Macro Regime the most affordable and high-quality macro framework subscription I’ve been able to find, but they are providing Wealth Potion subscribers with a 7-day trial when you sign up using the code “WEALTHPOTION”.

Check them out at www.logicmacroregime.com and let them know I sent you.

Develop Your Macro Awareness

You may have noticed that despite being an investing-focused newsletter and YouTube channel, I rarely break down individual stocks or companies on Wealth Potion.

Hopefully, from today’s article you now understand why.

The macro environment is like the tide that lifts (or sinks) all boats. And especially in recent years, where central banks have become much more active participants in the global economy, the macro is much more impactful than the micro.

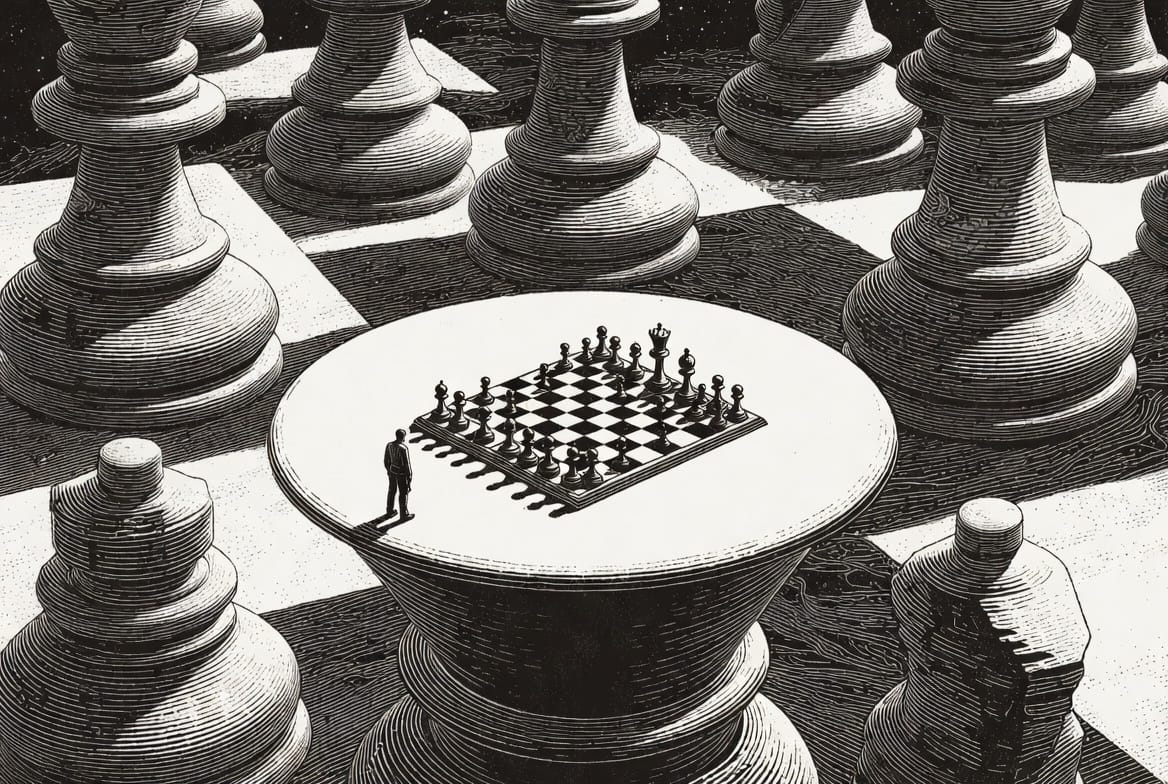

Think of it like this:

It’s not that discounted cash-flows and individual equity analysis doesn’t work anymore.

But it is akin to playing a tiny game of chess, while not paying attention to the much bigger game of chess happening underneath you.

Hopefully, by staying informed via the Wealth Potion newsletter, the YouTube channel, and via tools like LOGIC Macro Regime, you start paying more attention to the bigger picture.

To your prosperity,

Brandon @ Wealth Potion