Who doesn’t love the idea of retiring early with complete financial freedom?

This is the basic premise of the FIRE Movement (Financial Independence, Retire Early).

Work hard, save and invest aggressively, and voila! You don’t have to work ever again. Sounds like a dream come true… right?

But like many things we cover at Wealth Potion, there are pros and cons to FIRE.

Today, we’ll cover:

What is FIRE (and the popular variations)?

The positive benefits of FIRE

How to set yourself up for FIRE the right way

The downsides of FIRE and traps to avoid

I won’t bury the lede, either:

Achieving FIRE will not make all of your problems go away. In fact, FIRE can create problems of its own.

Let’s dive in.

Today’s article is sponsored by my good friends at Loonie Nest - an invaluable resource for any and all Canadians who are planning for their retirement, especially if you’re curious about the FIRE movement. More on Loonie Nest in a bit.

What is the FIRE Movement?

The FIRE Movement (or FIRE, for short) is Financial Independence, Retire Early.

It goes like this:

Save aggressively (50-80% of your income)

Invest in safe, compounding assets (e.g. the S&P500 at 10%)

Build your wealth to 25x your annual expenses (e.g. spend 50k? save 1.25m)

Retire and live off of your investments (4% withdrawal rate)

It’s a very simple and clear roadmap for attaining financial freedom.

That’s why so many people like it.

Google Search trends have been gradually increasing, along with a recent surge in 2025

In fact, it’s grown so popular that there are now sub-movements that have grown very popular in their own right. Some of the bigger ones include:

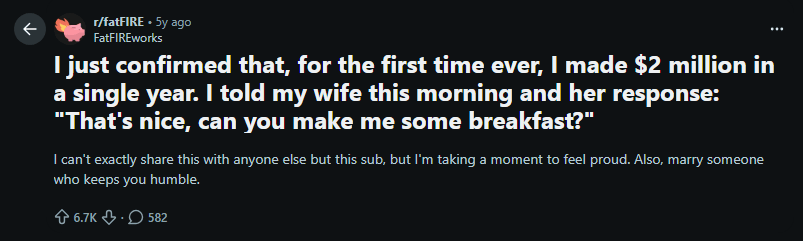

fatFIRE: Retire with a fat stash and live more luxuriously

leanFIRE: Live like a minimalist so you can retire even sooner

coastFIRE: Save enough to switch to a more fulfilling, less stressful job

Interestingly, leanFIRE started the most popular, then fatFIRE, and now coastFIRE is gaining steam.

Needless to say, the FIRE Movement is here to stay.

Before we talk about the downsides, we have to talk about the positives. Because there are many!

The Positives of the FIRE Movement

The first, huge benefit of the FIRE movement if pretty straightforward:

FIRE encourages saving and investing.

These are dire numbers.

One of the biggest reasons I started Wealth Potion was to help people learn about personal finance. And a critical component of healthy personal finances is saving money.

But wait, there’s more!

FIRE encourages you to set financial goals.

In fact, it requires you to set a very specific goal. A goal that will mathematically allow you to retire.

And goal-setting is helpful not just for your personal finances, but virtually every area of your life.

(I say should, because this isn’t always the case… and we’ll get to that.)

And last but not least…

FIRE increases your time and career optionality.

Even if you don’t achieve “early retirement”, saving and investing early allows you to take bigger risks throughout your life.

This is exemplified by coastFIRE. Instead of saving enough to fully retire, they save enough so that they can “coast” — work part-time, or at a less lucrative (but more fulfilling) job.

This is ultimately how I was able to start Wealth Potion. Candidly, I’m not ready to retire just yet, but saving and investing early allowed me to take a big risk.

By now, maybe you want to try out this FIRE thing… so how do you get started?

How to Achieve Financial Independence, and Retire Early

The first step to achieving FIRE is to do some calculations.

You’ll need to calculate:

Your savings goal (your “FIRE number”)

Your current and future annual expenses

Your current investment portfolio and rate of return

Key details like health insurance, pension, retirement accounts…

It can be a bit daunting, especially if numbers aren’t your strong suit.

Which is why this week’s article is in partnership with my good friends over at Loonie Nest.

My friend Eric has been busy building some of the best financial tools and calculators geared specifically for Canadian retirement planning. Whether or not you’re aiming for FIRE, or if someone in your life could benefit from a quick review of their numbers, you’ve got to check them out at: https://loonienest.com/

I recently went through their tools and tried out two different scenarios, and it was quite helpful:

“How Much Will I Need?” - Based on where I’m at right now, how much do I need to save to achieve that retirement plan? (ideal if you’re 5-10+ years from retirement)

“Will I Have Enough?” - Helps you understand if your savings is enough to satisfy your needs and goals (ideal if you’re close to retirement / already retired)

As many of you know, I take my personal finances very seriously. Nevertheless, the tools at Loonie Nest helped me identify real gaps in my retirement plan. You should check them out.

If you’re planning for retirement in Canada, Loonie Nest is a no-brainer. And the best part is that the tools are completely free.

Let Eric know that I sent you!

Even if you don’t use tools like Loonie Nest, the first step is to calculate your savings goal.

Most people use their current annual spending and multiply by 25x. But ideally, you should be factoring in future increases in spending, due to:

Marriage

Children

Grandchildren

Lifestyle upgrades

Once you’ve calculated your savings goal, you’ll almost certainly need to drastically increase your savings rate.

This is the essence of FIRE: save and invest as aggressively as possible, as early as possible.

That may involve:

Increasing your main source of income

Starting a side hustle(s)

Investing more aggressively

Cutting back on spending

Or a combination of the above.

The math is simple, but it is certainly not easy.

Now, let’s assume you achieve all of that. Or, you’ve set your sights on achieving FIRE.

There are a few big traps with the FIRE movement that many fall into, that need to be discussed…

Retiring Early Won’t Solve All Your Problems

In fact, FIRE can create problems of its own.

If you’re going to pursue early retirement, all the power to you. But be aware of the following traps, as reported by some of the most popular stories shared on Reddit:

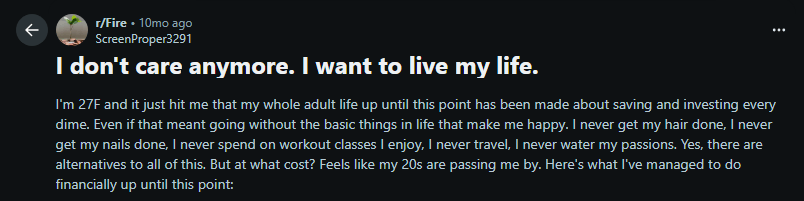

Extreme Frugality And Mental Health

In order to achieve a 50-80% savings rate, you’ll likely need to cut back quite heavily on expenses.

Living frugally can be rewarding, but it can also be very taxing. And living this way for extended periods of time can make people realize later in their life that perhaps they sacrificed too much while they were young.

Obsessing Over Money

We are realists here at Wealth Potion - we aren’t going to lie to you and say that money isn’t important.

But money isn’t everything.

And many people achieve FIRE and realize that they had taken it too far. That their main purpose in life was achieving FIRE. That money became an idol that they worshipped.

This is much more common than most people realize.

Lacking True Purpose

And last but certainly not least, many people achieve financial freedom, celebrate that they don’t have to work anymore, and then…

They go right back to work.

For some people, work is all they know. It was how they valued themselves, and so they resort to the one thing they know how to do well. A very common challenge in FIRE communities is people achieving their number but… never retiring.

To sum it up in one sentence:

Life is not guaranteed.

The FIRE Movement can be incredibly beneficial. It can teach you how to save and invest, how to cut back on unnecessary spending, and how to set financial goals.

But if you’re not careful, it can place money on a pedestal and cause a lot of regret and hardship later in your life.

To your prosperity,

Brandon @ Wealth Potion

1 https://www.sofi.com/learn/content/average-savings-by-age/

2 https://tradingeconomics.com/canada/personal-savings

3 https://www.forbes.com/sites/zackfriedman/2019/01/11/live-paycheck-to-paycheck-government-shutdown/