I’m stepping into the lion’s den again…

A few months ago, I wrote an article and posted a YouTube video debunking some of Gary’s Economics claims.

In short, Gary believes the solution to wealth inequality is to “tax wealth, not work” and I pointed out some issues with that.

And despite getting literally hundreds of negative comments from his passionate followers…

Spot the outlier!

I’ve decided to debunk him again.

Why?

Because although I agree with Gary’s identification of the problem (wealth inequality), I disagree with his solution, and more specifically, the mindset he encourages in his followers.

Quite frankly, I think his message is dangerous. And I feel compelled to call it out.

And so today, I’m going to point out the areas in which I agree with Gary’s latest video on the housing crisis, and then I will point out a critical flaw.

Finally, and most importantly, I will provide you with a message of hope and optimism, along with tangible action items you can use to improve your financial problem.

As always, you can watch along on YouTube as well:

Let’s dive in.

Rank #1 on Amazon—Effortlessly with Micro-Influencers!

Ready to reach the #1 page on Amazon and skyrocket your recurring revenue? Stack Influence empowers brands like Magic Spoon, Unilever, and MaryRuth Organics to quickly achieve top Amazon rankings by automating thousands of micro-influencer collaborations each month. Simply send free products—no influencer fees, no negotiations—just genuine user-generated content driving external traffic to your Amazon listings.

Stack Influence's fully automated platform allows you to effortlessly scale influencer campaigns, improving organic search positioning and significantly boosting sales. Trusted by leading brands who've experienced up to 13X revenue increases in just two months, Stack Influence provides complete rights to all influencer-created content, letting you authentically amplify your brand.

Start scaling your brand today—claim the #1 spot on Amazon and multiply your revenue.

Wealth Inequality is a Real Issue

Let’s start with the basics, and find some very important common ground.

Wealth inequality is extremely high. And although in my previous video about Gary, I argued that wealth inequality isn’t inherently a bad thing, I completely agree that wealth inequality in 2025 is a huge issue:

The cost of living is going up

Wages are not keeping up with productivity

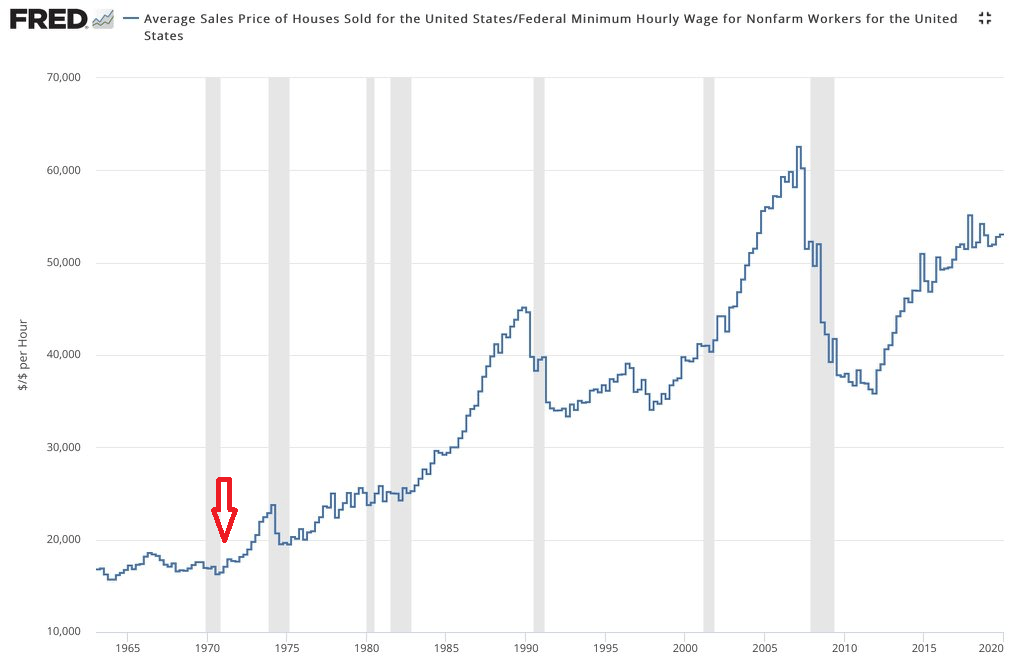

Millennials and Gen Z have lost all hope of owning a home

There is no shortage of data to show that wages have not kept up with the cost of living and productivity. Workers are losing at the expense of capital (asset holders).

So let’s clear that up.

Wealth inequality is an issue. Obviously.

But now, we have to listen very carefully to what Gary says next.

It’s Not Just Housing

It is becoming harder and harder to own your home.

I also agree with Gary when he points out that the housing crisis is not isolated to housing. It is an asset price crisis.

House prices have gone up but so have all other assets. So what’s actually happened is an asset price crisis.

In our fiat financial system, where our money loses value slowly over time, capital will flow into assets to maintain (and grow) its value.

These assets include stocks, bonds, gold, Bitcoin, and tragically… housing.

I completely agree with Gary here. It is not just a housing crisis. It impacts all asset prices.

Importantly, Gary argues that this is because the ultra-rich are hoarding these assets, which is driving up the prices of these assets.

But here is where he starts to go off the rails, but doesn’t realize it… (or maybe he does!)

He then says:

This is a global asset price crisis. It doesn't make any sense… If you walk into the supermarket and the price of everything has tripled, and then you pick up the coffee and you say why is coffee tripled…

Are the ultra-rich hoarding… coffee?

Of course not.

Gary is conflating investment assets with common goods. And the fact that everything has gone up in price (not just investment assets) suggests that this is an issue with inflation… not just the rich hoarding assets.

Alright, a minor flub... But it gets worse.

Where Did the Money Come From, Gary?

Gary communicates at multiple points of the video that the rich would buy up more assets:

At the beginning of Covid (…) I realized very quickly that the rich would accumulate a lot of money.

I agree with Gary here. This is why I started studying Bitcoin in 2020 as well.

But then Gary goes on and says:

When you give rich people money, they buy assets.

As well as:

If we give a trillion pounds to the richest people in the country, obviously house prices and stock prices will go up.

Wait a second…

When who gives rich people money?

If who gives a trillion pounds to the richest people in the country?

This is where Gary completely misses the mark.

Covid crisis > Fed buy assets > Large institutions get cash > They buy more assets > Price of assets go up

The “trillion pounds” he is referring to here is the tidal wave of stimulus that was given to individuals and corporations in the wake of the 2020 Covid crisis.

It started with the USA, and then the rest of the world followed suit.

As a reminder, the Federal Reserve bought $3 trillion dollars of assets in 2020 to “save” financial markets.

What does this mean?

It means the money Gary is referring to was given to the rich by the government, via monetary printing (specifically, lowering interest rates, quantitative easing, and lowering lending restrictions).

But in Gary’s 28 minute video, he does not mention any of the following things once:

Money printing

Government stimulus

Quantitative easing

Interest rates

Central banking

Federal Reserve / the Fed

Fiat money

Sound money

That’s because if Gary were to answer the very straightforward question of “Where did that money come from?”, his whole thesis would fall apart.

And that takes me to the part of his video that upsets me the most…

Yes, You CAN Improve Your Financial Situation

Gary’s solution is “tax wealth, not work".

It’s an elegant and simple slogan.

I’m not even going to argue against the intricacies of a wealth tax, and the mountains of evidence of why it doesn’t work as well as many think. I already did that in my previous video.

But what I take issue with is that Gary proposes campaigning the government as the only solution.

He tells you that “the ultra rich buy assets", and he even says that he himself buys assets:

I suppose you could say I’m a moderately rich person… if you were to give me a hundred grand, I would go that day and buy a hundred grand of assets.

But not once in his video — or in any of his videos* — does he tell his audience that they can buy assets too.

I haven’t watched ALL of his videos, so if there is a video where he talks about how to buy assets, please send it my way. I would be very happy to be wrong. But from what I’ve seen, the message he repeats over and over again is that you can’t compete with the ultra-rich.

He doesn’t talk about how to buy stocks, how to invest in ETFs, how to save more money, how to build a budget…

(All topics that I cover on Wealth Potion, by the way.)

Because while I 100% agree with Gary that the rich people buy assets, my reaction to learning this fact was “OK, how can I buy assets?”

Instead, what does Gary say to do?

The reason house prices are so expensive is that the rich are really really really really rich now, and you can’t compete with them. And unless you do something about that, you won’t be able to.

And:

And if you don't fight that fight, you lose your wealth (...) resources (and) living standards.

His solution is to campaign the government — the same government that gave the rich people a trillion pounds to buy assets — to tax the rich people more.

I’m all for political action and exercising your voice in a democracy.

If you want to call up your government representative, or volunteer a political campaign, or show up to a (peaceful) protest… all the power to you!

But that’s not the only solution.

Ironically, I agree with Gary’s closing statement:

"You're gonna have to make it happen yourself, good luck.”

Yes, you’re going to have to make it happen yourself.

You can improve your financial situation.

You can buy assets, just like the rich do.

You can build wealth, without the help of the government.

And that’s exactly why I created Wealth Potion. To help you do just that.

To your prosperity,

Brandon @ Wealth Potion