The ‘Buy Now, Pay Later’ era is upon us.

On the surface, it seems like a wonderful thing!

Defer payments at 0% interest? What’s there not to love?

When we dig a little deeper, we see a massive problem rotting beneath the surface.

And if you’re not careful, ‘Buy Now, Pay Later’ can quickly become ‘Spend Now, Retire Later’.

Today, I’m not holding back. We’ll cover:

What ‘Buy Now, Pay Later’ is, and how it works

How ‘Buy Now, Pay Later’ companies make billions of dollars

Why ‘Buy Now, Pay Later’ destroys your finances (and your wellbeing)

What to do instead

And as always, you can tune in on YouTube where I really rip into these companies:

This week’s Wealth Potion newsletter is brought to you by Affirm, the world’s leading…

Just kidding. Sorry, I couldn’t resist 😂

Here’s a quick message from this week’s actual sponsor:

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

What is Buy Now, Pay Later?

‘Buy Now, Pay Later’ or BNPL for short, is a type of short-term loan that has become extremely popular in the past few years.

It works exactly like it sounds. You buy an item, and instead of paying the entire price up-front, you pay later. Usually, in the form of multiple installments over the course of months.

The BNPL market is projected to grow exponentially…

BNPL is a credit card on steroids.

Here are some quick stats to give you an idea of the scale:

The big BNPL companies were all founded in the 2010s

In 2025, 90 million Americans used BNPL (about 30% of the population)1

60% of BNPL users have multiple loans at once

Gen Z consumers are most likely to miss payments

66% of Gen Z regret using Buy Now, Pay Later

BNPL is a new phenomenon, but it is growing fast.

So what’s the issue?

BNPL Isn’t Free

The first issue is how it is advertised.

You will almost always see the BNPL company (or the retailer offering BNPL) tell you that it is “interest free”.

From the affirm.com website

This is technically true… but there’s always a catch.

First of all, “no fees” should always ring an alarm bell.

If there were truly “no fees”, why would Affirm, Klarna, and Afterpay offer this service at all?

Why would each of those companies be worth $25-$50 billion USD?

We’ll come back to these questions later in the article…

But let’s dive into Affirm, as an example.

Affirm states that there are never any fees. Even if you miss a payment, you won’t ever accrue late fees!

However…

If you have too many late payments, it will impact your credit score.

And if your credit score is too low, or if you have a history of missing payments…

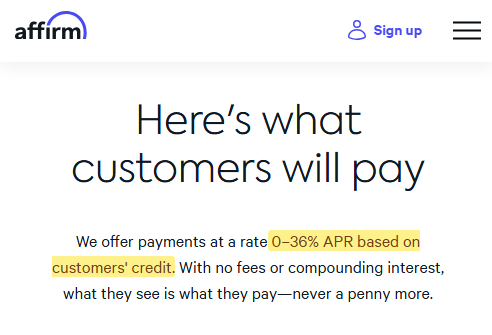

Then you might not qualify for 0% interest. In fact, interest rates can get as high as 36% APR, just like a credit card:

This is a perfect example of the sleight-of-hand at work:

They sell you on “no fees” without telling you the massive fees if you miss payments.

And a lot of people miss payments.

Various surveys show that 24%-41% of BNPL users miss payments.

At this point, you might be thinking…

“Well, I’m a responsible consumer! I always pay my credit card on time, so I should be fine with BNPL…”

This is where human psychology comes into play. And it’s not pretty.

The Illusion of Affordability

Fundamentally, BNPL makes you believe you can afford something that you can’t afford.

The challenge is with keeping track.

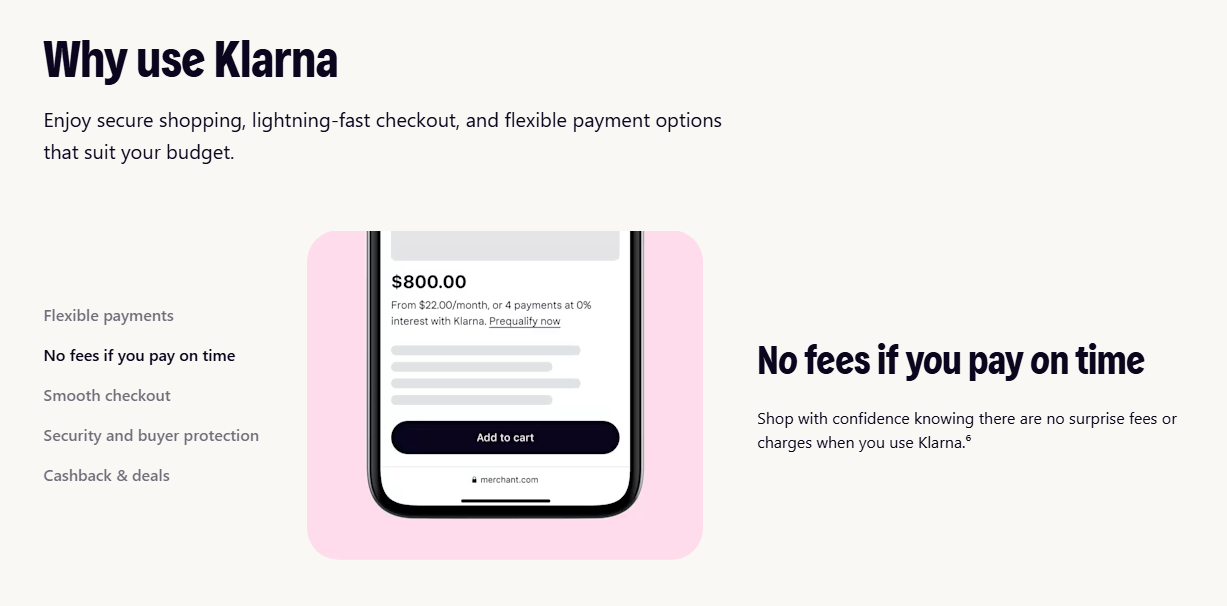

From klarna.com, another leading BNPL provider. Notice the footnote?

Most people are familiar with credit cards. You buy something with your credit card, and you see your credit card balance go up.

You know that if you don’t pay your credit card balance in time, you will incur huge interest fees.

So most responsible credit card users pay off their credit card as soon as they are able to.

BNPL, as we just discussed above, doesn’t always have that same clear incentive structure.

They all hide their fees a little differently.

The footnote from above clarifies that APR can be up to 36%, once again.

You could very easily be tempted by:

“No late fees”

“Zero percent interest”

“Flexible payments”

But there is always a catch.

And regardless of if they charge late fees (like Klarna) or hide their fees (like Affirm), there is always a psychological catch.

Like credit cards, BNPL is extremely addicting. And this is where things get ugly:

63% of BNPL users have more than one loan at the time.

69% of BNPL users are already in credit card debt.

20% of BNPL users take out more than one loan per month.

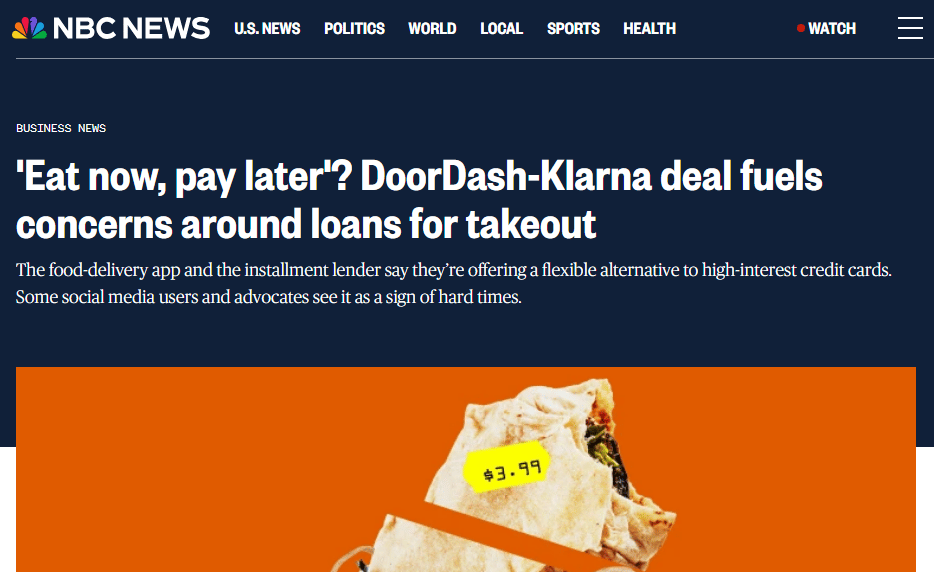

As a hilarious example of how fast the BNPL virus is spreading, Klarna recently announced a partnership with Chipotle.

Yes, that’s right. You can now finance your burrito.

Let’s now re-visit the questions we asked earlier. How do BNPL companies make money?

How do BNPL Companies Make Money?

Affirm, Afterpay, and Klarna are all decacorns AKA they are all worth over $10 billion dollars.

So how do they make money?

Simply put, they get you to spend more money.

BNPL companies charge retailers anywhere between 2% and 8% when a purchase is made using BNPL.

So why would retailers agree to this?

Retailers love BNPL services because on average, BNPL increases order value by 20-30%.

Retailers paying 2%-8% is a no-brainer when consumers are buying 20%-30% more.

And it’s exactly that “buying 20%-30% more” that consumers aren’t noticing.

BNPL is the Enemy of Wealth

‘Buy Now, Pay Later’ is the epitome of lifestyle creep.

By using BNPL, you improve your lifestyle at the expense of your wealth.

Building wealth requires patience, discipline, and saying no to purchases.

BNPL is the exact opposite.

BNPL tells you to be impatient, to not be disciplines, and it makes you say yes to purchases you can’t afford.

This has a lot to do with human psychology.

There is something called the Temporal Discounting effect.

We are finite beings. We’re all going to die, someday.

So naturally, we place higher value on things that we can receive now vs. things that we will receive in the future.

In economics, this is also referred to as the Time Value of Money.

Money is quite literally worth more to us now than in the future.

‘Buy Now, Pay Later’ takes advantage of this perfectly. It’s right in the name!

“Go buy that item now (because you value it more now), and pay for it with future (with future dollars that you value less)”

It’s precisely this psychological effect that makes BNPL dangerous.

What To Do Instead of BNPL

The solution couldn’t be simpler:

Don’t use Buy Now, Pay Later.

Avoid it like the plague that it is.

Recognize that it is like a forbidden fruit that once bitten, will sneak into your thoughts and your purchasing decisions.

First recorded instance of Buy Now, Pay Later at checkout (2010, colorized)

“We can totally afford that thing…”

“We don’t have the cash now, but we’re getting paid next week…”

“We deserve a little treat…”

NO!

Say no to BNPL.

Buy only things you can afford. Or, consider if you really need that purchase at all.

Instead of spending money you don’t have, invest the money you do have… and build your wealth.

To your prosperity,

Brandon @ Wealth Potion