“Optionality is the property of asymmetric upside (preferably unlimited) with a correspondingly limited downside (preferably tiny).”

Many top investors call asymmetric bets the Holy Grail of investing.

Why?

Because an asymmetric opportunity is one where the downside is small but the upside is big.

You could lose a little… but you could win a lot.

But there’s a catch.

Today, we’ll discuss:

What is an asymmetric bet?

Examples of asymmetric investments

What does it take to hold onto an asymmetric bet?

Entrepreneurs who made asymmetric bets (and how they paid off)

How to live an asymmetric life(don’t skip this)

What is an Asymmetric Bet?

With all investments, there is a downside and an upside.

The value of that investment could go up over time, or it could go down over time.

In fact, we have so much information nowadays that most mainstream investments have a fairly predictable return profile.

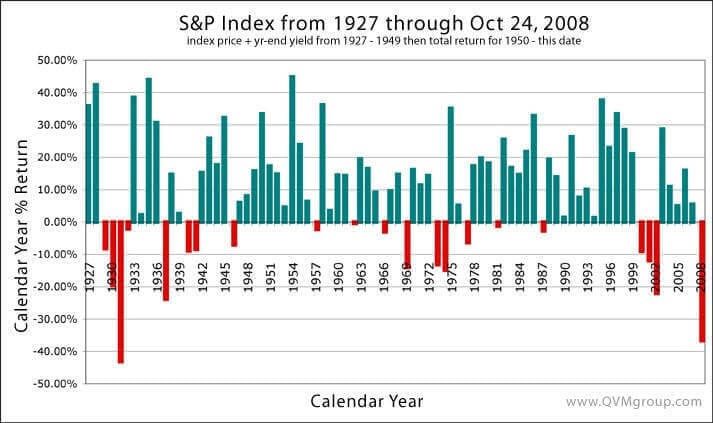

For example, let’s look at the performance of the S&P 500.

You’ll see that it has averaged a ~10% return per year over the past 100 years.

And while there are recessions and downturns from time to time, the upside gradually outweighs the downside – thus averaging 10% gains per year.

Moderate upside, moderate downside.

You probably won’t lose all your money by investing in the S&P 500 (-100%)…

But you probably won’t see a year where your investment doubles either (+100%).

To be clear – this does not make the S&P 500 a bad investment. In fact, it’s one of the best investments you can make, especially if you are new to investing.

But the S&P 500 is not an asymmetric bet.

An asymmetric bet is one where the downside is limited, but the upside is huge in comparison.

With most investments, the most you can lose is 100% of your money.

But what if you could gain 500%? Or 1,000%?

This is the very nature of asymmetric bets.

Examples of Asymmetric Investments

Some examples of asymmetric bets in investing include:

Financially distressed companies

Call options

Angel investing / venture capital

Penny stocks

Hated industries and sectors

Bitcoin and crypto

With each of these investments, you could lose your entire investment.

But you could also achieve 10x, 100x, or even 1000x returns.

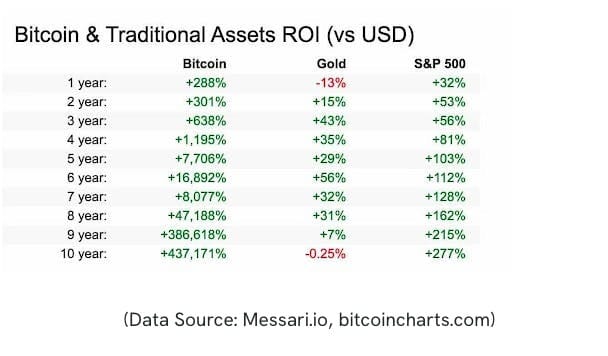

Let’s look at the example of Bitcoin.

Many opponents of Bitcoin argue that it could go to zero.

Let’s assume that this is true – that you could lose 100% of you investment.

Proponents of Bitcoin will point out that the historical performance of Bitcoin vastly outweighs the downside:

You can’t lose 100% of your money investing in the S&P 500… but you also can’t achieve 400,000% returns.

Another easy-to-understand example is a financially distressed asset.

When a company is at risk of going bankrupt, the stock price of the company usually plummets. Investors want to protect their cash.

But savvy investors may use that depressed stock price as an opportunity to buy into the company and help the business turn around.

For a real historical example, read about Warren Buffett’s investment in American Express in the 1960’s when they were victims of the ”Salad Oil Scandal”.

Buffett made a 500% return on his investment.

500% returns? That sounds amazing!

So what’s the catch?

By definition, the financial cost of an asymmetric bet is small (i.e. the downside). However, asymmetric bets come with a different kind of cost.

It is a mental and emotional cost.

Pulling the trigger on an asymmetric bet is incredibly difficult. You have to identify the asymmetric bet, then commit to it, then hold onto it while the rest of the world tells you you’re wrong.

In other words, you have to embrace being a contrarian.

And doing all of this while the crowd calls you insane, stupid, or foolish… that’s the difficult part.

How to Invest Asymmetrically – Being a Contrarian

One of the reasons asymmetric bets have such a massive upside potential is because the average person is either not aware of the opportunity, or disagrees with the thesis altogether.

By definition, an asymmetric investment will be unpopular.

If it were popular, it wouldn’t be asymmetric!

This sort unpopularity is often referred to as being contrarian investing.

Contrarian investing isn’t for the faint-hearted. You’ll face skepticism, doubt, and even ridicule.

But if you’re right? Then you reap the outsized rewards.

In other words, you’ll have to:

Pull the trigger on an investment that most people disagree with

Hold onto the investment while the rest of the world is unaware

Maintain your conviction for a long, uncomfortable period of time

Monitor the data to look for anything that might change your investment thesis

If this still seems too theoretical, here are some real life examples of asymmetric bets that go beyond investing.

Elon Musk and SpaceX Being “Unrealistic”

Elon founded SpaceX with the mission of making humanity a multi-planetary species.

Not only did the general public believe this to be impossible… but well-respected astronauts like Neil Armstrong and Eugene Cernan (Elon’s heroes) doubted Elon as well.

Check out this interview from 2012:

A 154x return. A 52% compound annual growth rate.

Jeff Bezos and Amazon Being Unprofitable

Jeff Bezos was ridiculed publicly for Amazon being an unprofitable company for many years.

This was before it became popular for high-growth technology companies to invest everything back into the business.

Check out this interview from 1999:

Amazon valuation at time of interview: $46.8 billion

Amazon valuation today, 25 years later: $1.88 trillion

A 40.2x return. A 16% compound annual growth rate.

Chris Pan’s OSU Commencement Speech

In recent Bitcoin news, Chris Pan gave a commencement speech at his Alma Mater and was met with booing when he mentioned Bitcoin.

This speech was given in early May 2024:

Bitcoin valuation at time of speech: $1.255 trillion

Bitcoin valuation in 10 years: ???

Bitcoin valuation in 25 years: ???

This speech was only a couple weeks ago… so time will tell how this asymmetric bet will play out.

Beyond Investing – Living an Asymmetric Life

This one is a longer video.

But if you have the time, I highly recommend you check it out.

Graham Weaver is an investor, entrepreneur, and professor at Stanford Business School, where he gave this lecture on the final day of classes.

Either way, I hope you’re left pondering the following questions:

Do you want to live an asymmetriclife?

Are you doing hard things?

Are you doing your thing?

Are you doing it for decades?

Are you writing your own story?

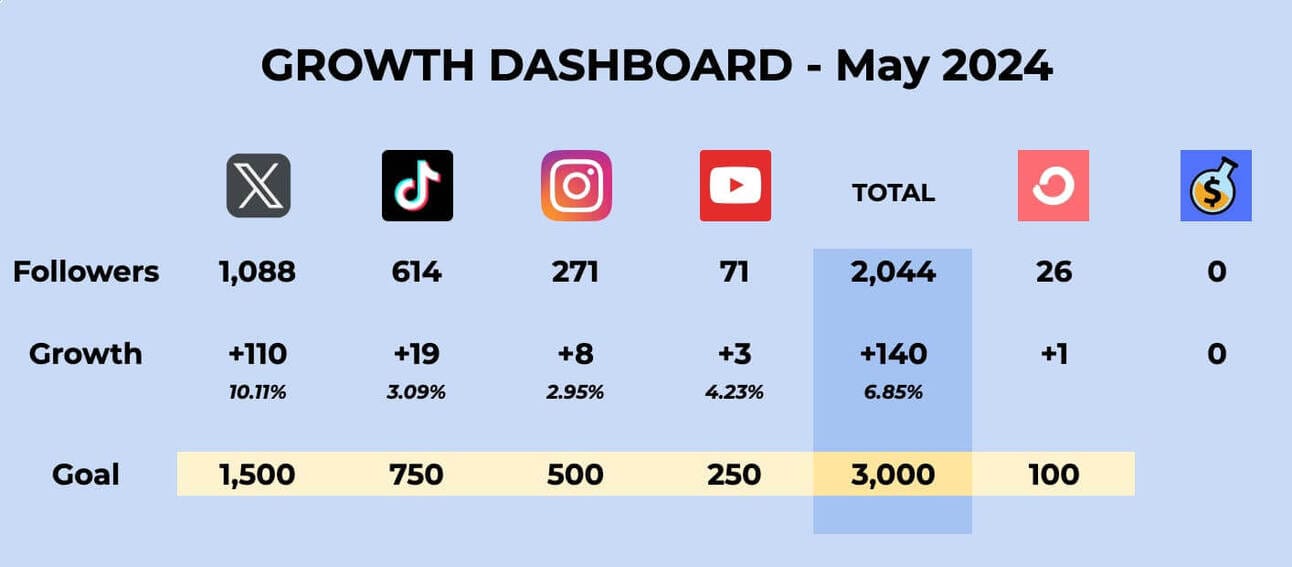

Wealth Potion ‘Build in Public’ Update

May has been a slower month than expected. I was travelling for a friend’s wedding in Manila which threw off my routine. This was a good reminder that consistency is much easier said than done.

With that said, I am taking the advice my mentor gave me to heart.

It is okay to slow down in order to speed up.

I don’t need to constantly hustle and grind.

I am unlearning the bad habits that I picked up from 10 years working in corporate.

And that’s ok.

—

To your prosperity, Wealth Potion

Follow Wealth Potion on social media for more exclusive content:

+

If you enjoyed reading, consider forwarding to someone who would find this valuable.

You can read all our previous newsletters here.

The post The Holy Grail of Investing: Asymmetric Bets appeared first on Wealth Potion.