You’ve heard the pushback.

Tariffs are inflationary. Tariffs destroy global trade. Tariffs led to the Great Depression.

Whether it was from my Wealth Potion article from earlier this week, or from practically any other news source… the overwhelming mainstream consensus is that tariffs are a terrible move.

So what is the Trump administration thinking? What is their worldview? How could they possibly see tariffs as a good thing? What are they hoping will happen?

Today, I’m going to steelman their case for tariffs.

We’ll also cover the breaking news of Trump’s 90 day pause on tariffs and what this means.

And as always, you can watch on YouTube here:

To be clear, this is not an endorsement of Trump’s tariffs. I’m not arguing that his strategy is going to work, I’m simply describing it to the best of my ability. Please try to read this article objectively before you react to it. I listened to hours of Trump administration interviews so that you don’t have to, alright? And as I mentioned on Monday, this situation is changing rapidly, so these things are all subject to change.

A Quick Note on Steel-manning

Learning how to steelman an opposing argument is a super underrated skill.

And in today’s hyper-polarized world, steel-manning is unfortunately becoming less and less common.

So what is steel-manning?

Steelmanning is essentially the opposite of strawmanning.

Steel-manning is the opposite of straw-manning.

Straw-manning is a logical fallacy where someone misrepresents the opposing view to refute it more easily (Imagine putting up a “straw-man” and attacking it instead).

Therefore, steel-manning is an effort to understand the best possible argument possible for the opposing viewpoint… and then refute that.

Echo chambers are a real problem in 2025, and it’s exacerbated by social media algorithms.

One of my goals with Wealth Potion is to provide a simple, objective, and nuanced view on complex topics. If the far right and the far left are mad at me, then I’m doing a good job.

The True Meaning of “America First”

Trump is well-known to be an isolationist (as opposed to a globalist).

Put simply, “America First” means “everyone else next”.

This worldview rejects the post WWII world order of global free trade, supernational institutions (UN, WEF, World Bank, NATO) and the overall view that the USA is the caretaker and financier of the world.

The Trump worldview also rejects the idea that maximum efficiency and cheapest price should always be the goal of economic policy, which largely goes against the economics of the past couple decades.

Instead, it prioritizes:

Resilience over efficiency - Manufacturing critical goods in America, even if it’s more expensive

Self-sufficiency over dependence - Especially dependence on China, which we’ll cover in a moment

National power over GDP growth - The stock market is not always the best indicator of the underlying economy

For decades, the U.S. has outsourced entire industries (semiconductors, steel, pharma, textiles), in order to provide cheaper goods to American consumers. American consumers have largely enjoyed this tradeoff.

Trump and his administration are shining a light on the other side of that tradeoff.

Because in his worldview, the real cost of those cheap goods has been the hollowing out of the manufacturing sector, the desertification of the rust belt, and the eroded living standards of the average American worker.

Meanwhile, rivals like China built manufacturing moats, cornered critical supply chains, and gained geopolitical leverage. And we’ll talk about how in just a moment.

This is not a partisan issue, by the way. Trump happens to be the champion of this issue in 2025, but it has historically been championed by the Democrats all the same. Even Bernie Sanders.

In short, the first lens through which to view these tariffs is to see them as a rejection of the post WWII world order, and a (hopeful) return to America as a more sovereign, independent nation.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

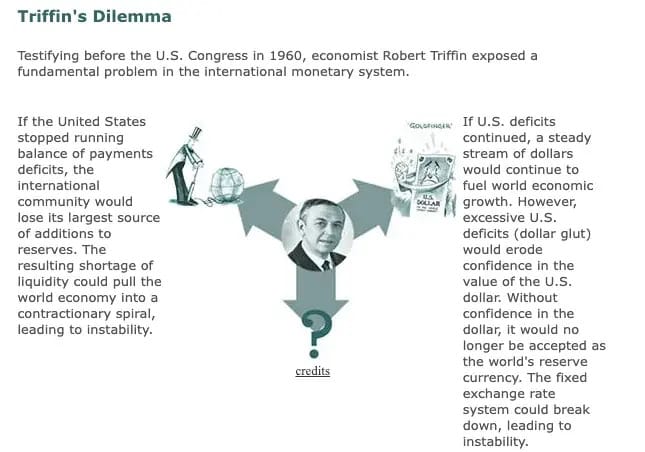

Breaking the Triffin Dilemma

The Trump administration understands that America’s trade policy is shackled by a deeper, structural problem: Triffin’s Dilemma.

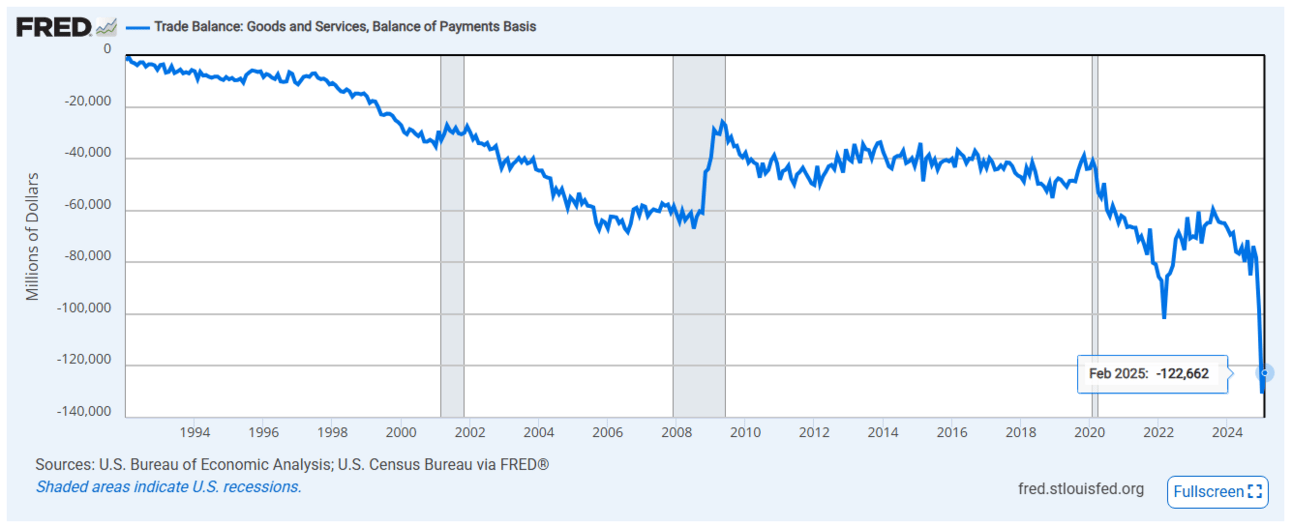

The U.S. trade deficit sits at about $130 trillion

A fundamental pillar of Trump’s worldview is that being in a perpetual trade deficit is bad for America.

A trade deficit, simply put, means that the U.S. buys more things from other countries than other countries buys from the U.S.

This makes America more reliant on foreign production and thereby loses its domestic production (i.e. manufacturing).

So just close the trade deficit, right?

If only it were so simple.

The U.S. dollar is the world’s reserve currency, meaning that countries around the world need an ample supply of U.S. dollars to conduct trade.

This brings us to Triffin’s Dilemma.

Triffin’s Dilemma summarized

In order to keep global markets supplied with dollars, America must run persistent trade deficits. America buys goods, providing dollars to the nations that need them.

But it is those same trade deficits that erode domestic industry and make the U.S. reliant on foreign production.

It’s a catch-22.

Trump’s tariffs can be seen as an attempt to break that cycle.

So let’s play that out. What might happen?

Well if Trump’s administration is successful at reducing the global outflow of U.S. dollars, that will have a few effects.. In theory:

Supply of dollars to the rest of the world will drop 📉

The U.S. dollar will rise 📈

Bond prices rise 📈

Interest rates fall 📉

And that’s brings us to another theory around Trump’s “master plan”:

Refinancing the debt.

Lower Interest Rates to Refinance the Debt

As we’ve talked about in the past, the U.S. has over $36 trillion in debt. And Trump very much campaigned on a promise of reducing the deficit and cutting government spending (see DOGE).

The $9 trillion in debt due to mature this year, which will need to be re-financed

$9 trillion of that debt is due to mature this year. This presents Scott Bessent (Treasury Secretary) with a window of opportunity.

Refinancing that at 4–5% yields would be brutal. But if inflation drops and yields fall, the Treasury can roll over that debt at a lower cost.

So why did the 10Y yield fall but then immediately recover back to 4.4%? No one knows for sure but it’s likely that with the chaotic messaging around tariffs, some foreign nations were selling off US Treasuries which put upward pressure on interest rates.

In other words, the tariff announcement didn’t just scare investors away from the stock market, it scared investors away from the USA in general… Yikes.

Here’s the theory in a nutshell:

Tariffs gradually shrinks the trade deficit, which reduces dollar outflows.

Fewer dollars abroad = lower Treasury issuance demand = potentially lower interest rates

Lower interest rates means the U.S. Treasury can refinance debt and save money on interest payments

In addition, lower interest rates on the long-end of the curve along with a falling stock market could help Trump pressure Jerome Powell into cutting rates (on the short-end of the curve) — something that Trump has not been shy about.

The Real Target is China

As I was writing this article, Trump announced a 90-day pause on all tariffs, with the exception of China, EU, Mexico and Canada.

Canada and Mexico have an existing USMCA agreement that is currently being negotiated, and EU threatened to retaliate recently.

That leaves us with China.

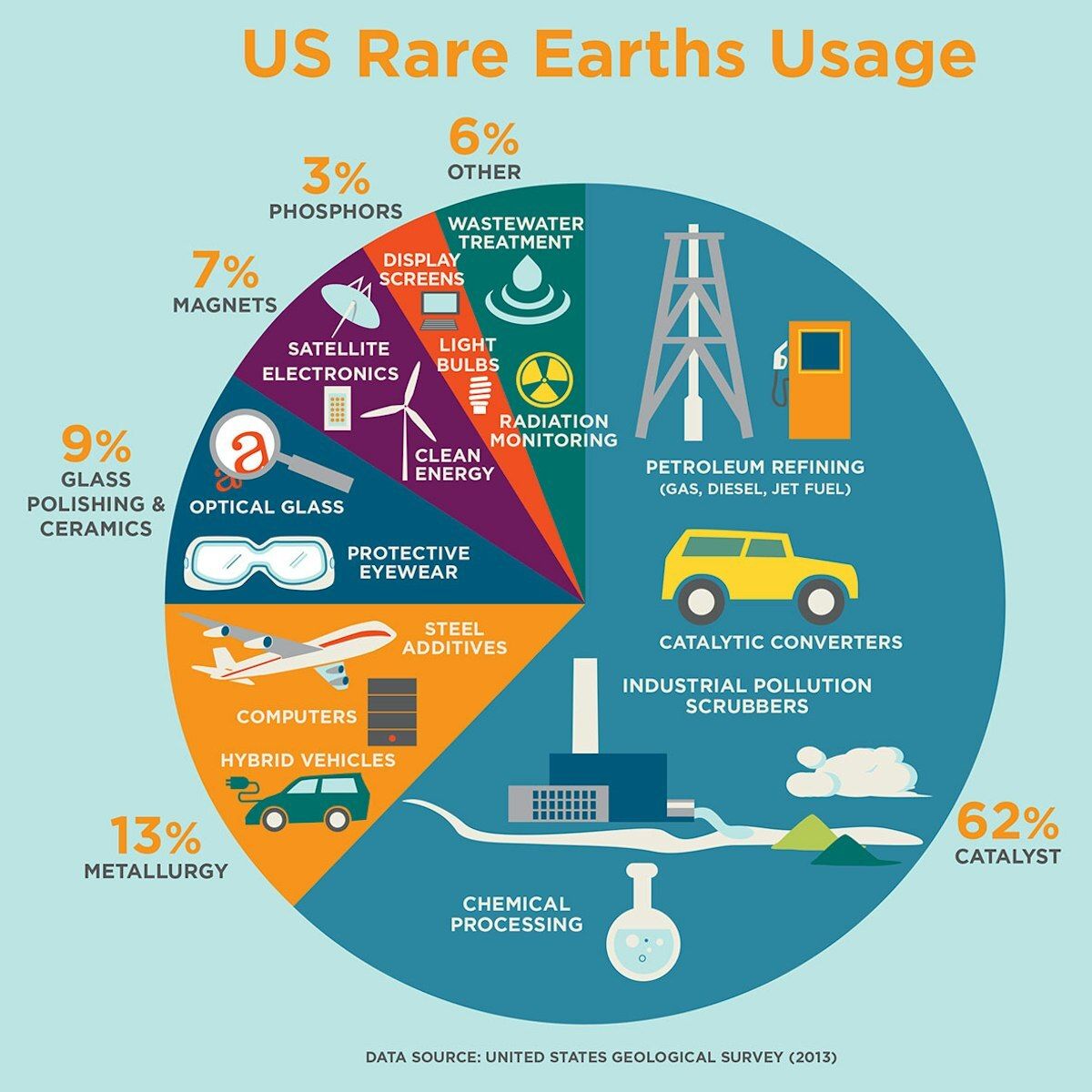

China not only retaliated instantly with 34% tariffs of their own, but have restricted the export of rare earth minerals.

In my opinion, this is saying the quiet part out loud:

The tariffs are ultimately about China.

Not only is China the source of a huge chunk of the U.S.’ imports, but the U.S. is reliant on China for many critical goods.

That includes rare earths.

Rare earths are used in everything from computers, to robotics, to renewable energy technology, and more.

It’s estimated that China controls over 80% of the world’s supply of rare earths. China knows this. The U.S. knows this.

And rare earths are just one example.

In the event of a real, kinetic war, those critical supply chains would be blocked off. We saw something similar play out when Russia invaded Ukraine, and Europe was cut off from Russian energy.

In short, Trump is optimizing for future resilience, as opposed to growth.

What Happens Next?

In summary, I believe Trump is trying to accomplish the following things — and what I’ll be watching for to see if I’m correct:

Shift away from the post-WWII world order — I’ll be watching for more hints from the administration, the dollar, bond yields

Question the U.S. dollar’s role as reserve currency — related to the above, I’ll be watching for discussions among BRICS members, CBDCs from the EU, and the yuan’s reaction to all of this

Corner China by effectively instigating a trade war — I’ll be watching China’s retaliation, and if the U.S. tries to strike deals with Korea, Canada, EU, etc. that explicitly suffocate China

Re-shore critical manufacturing in the U.S. — I don’t think we’ll be seeing shoe factories… but I will be watching for rare earth mining / processing, chip manufacturing, and pharmaceuticals

As I mentioned earlier this week, this is an extremely high-risk strategy. It might not work. Heck, it probably won’t work.

But I’m also not going to call ‘Game Over’ prematurely. I’ll be watching, and I’ll keep y’all posted.

Last but not least, I want to reiterate the action item from last week.

Do. Not. Panic.

If you panic sold over the past few days, you are kicking yourself right now.

The stock market could continue rallying here, or it could drop again. No one knows. Never invest emotionally.

To your prosperity,

Brandon @ Wealth Potion