On August 1st 2023, ratings agency Fitch Ratings downgraded US debt from AAA (the highest rating) to AA+ (the second highest rating).

Fitch cites the “expected fiscal deterioration over the next three years” and “a high and growing general government debt burden”.

The very next day, the US treasury of the US govt increased it’s bond issuance (i.e. they plan to issue even more debt) to $103 billion USD this quarter, which represents $19 billion of new cash.

You can read their full announcement here.

Ironic, isn’t it?

Why It Matters:

Well, according to Warren Buffett, this is something you shouldn’t care about.

“There are some things people shouldn’t worry about. This is one.”

The mainstream market seems to agree, with Financial Times pompously stating “the Fitch downgrade won’t matter either. C’mon.”

Well, the rest of the market disagrees.

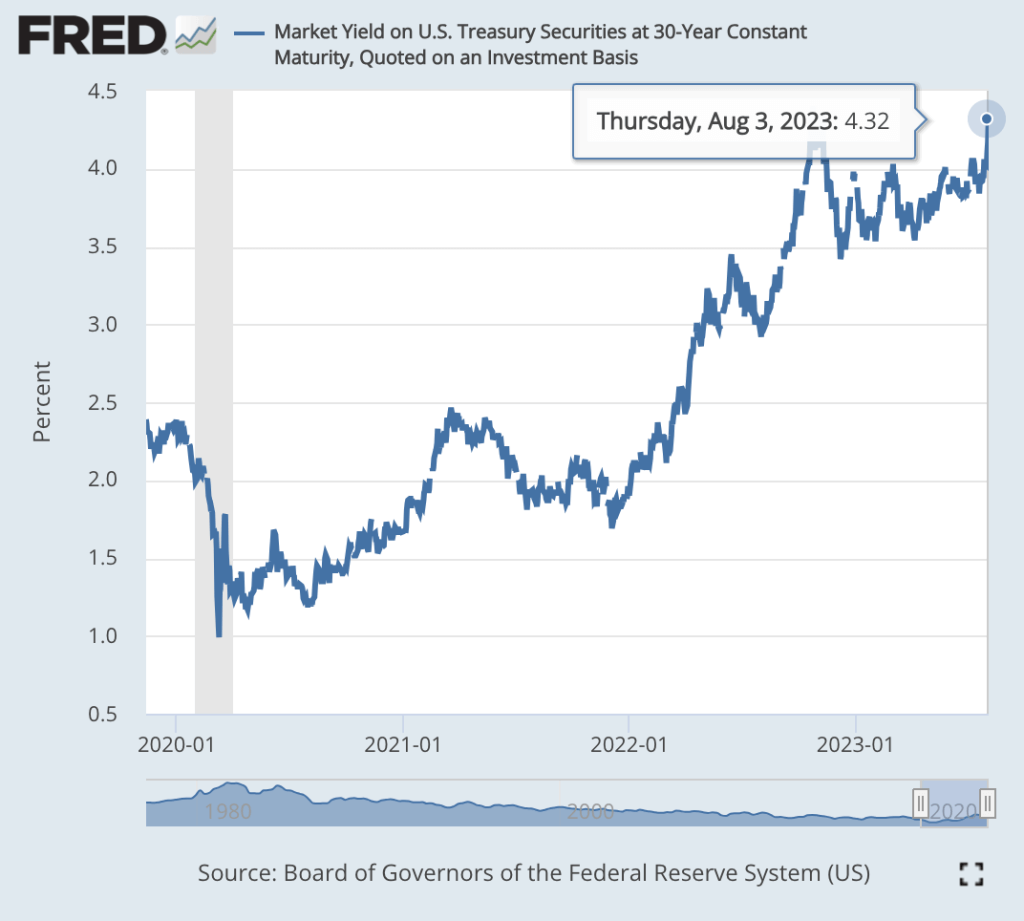

Since the pair of announcements, the 30-year yield increased from 4% to 4.3%

The last time the 30-year yield was this high was in 2011.

If you’re unfamiliar with how bonds work, here is a quick crash course:

When bond yields increase, the price of the bond decreases.

In other words, the investors who are buying this debt from the government expect a higher % return in the future as a reward for holding that debt.

Where previously investors were willing to buy 30-year bonds from the government for a 4% annual return, they now require a 4.3% return.

In other words, investors agree with Fitch. US government debt has become riskier to hold. And investors expect to be paid for taking that risk.

How to Profit From It:

Here are some questions to ask yourself:

How much debt burden do you have personally, and what can you do to reduce it?

Are you exposed to government debt directly via bonds, or indirectly via the equities you own?

What do you think will happen to the stock market and global financial markets if this trend continues?

Here at WP, we are cautiously increasing our cash on hand. This is not financial advice.

To your prosperity,Wealth Potion

The post #014: US Debt Downgraded from AAA to AA+ appeared first on Wealth Potion.