You’ve lost your job.Your mortgage payments have doubled.You or one of your loved ones needs emergency medical care.

Maybe none of these things have actually happened to you. But with enough time, one of them will. And the way you protect yourself from these negative events, is by calculating and maintaining an emergency fund.

What is an Emergency Fund?

An emergency fund is a source of available cash in case of an unplanned expense. This can literally be in the form of cash, or it can be in the form a highly liquid savings vehicle, such as a high-interest savings account (HISA).

The goal of the emergency fund is not to maximize returns, but to maximize liquidity. This means that if there is a real emergency, you can access these funds quickly.

How to Calculate Your Emergency Fund

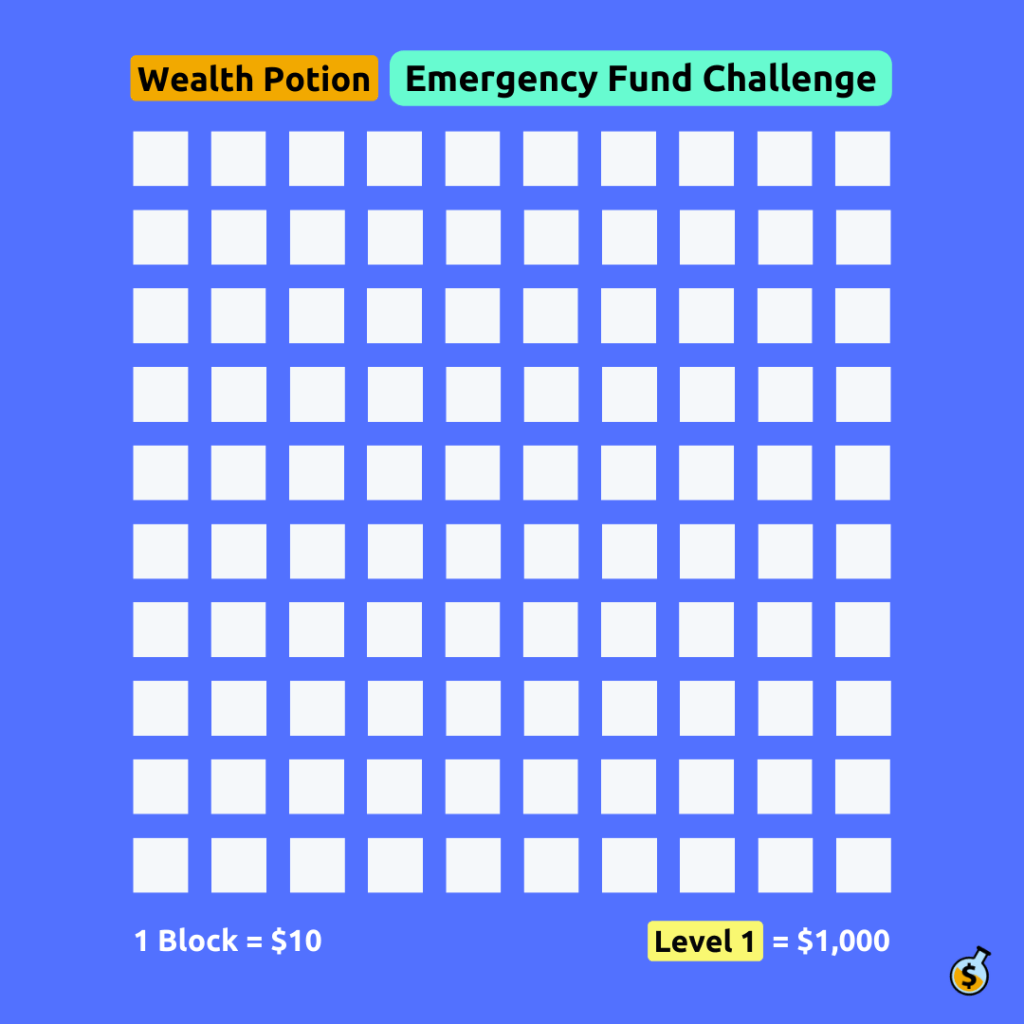

If you don’t have an emergency fund yet, Wealth Potion recommends calculating your emergency fund using the following levels:

Level 1: Save $1,000$1,000 is a worthy goal for many people who have not begun their journey of investing for the future, yet. This is a huge accomplishment if you’ve already achieved this. Bravo.

Level 2: Save 3 months of expensesUsing a budget, calculate how much you spend per month, on average. Then, set a goal to save 3 months of expenses. This should cover most moderate emergencies such as your landlord kicking you out, you losing your job, etc.

Level 3: Save 6 months of expensesThe final level is to save 6 months of expenses. This may seem like a lot, but this will protect you from major emergencies such as health issues. Additionally, this will give you a safety net of savings so that you can quit your job and start your own business, if you wish.

Pro Tip:Write yourself a personal statement. What are your long-term investment goals? What are you saving for? To buy your first home? For a vacation with your family? Having a clear vision and goal will make achieving your savings goals much easier, especially when your vision is charged with real emotion.

Why set aside an emergency fund?

Peace of Mind:Even without a crisis at hand, you will experience greater calm and lower stress if you have a financial safety safety net.

Protecting Long-Term Goals:Without an emergency fund, you may need to sell other investments (house, stock portfolio, Bitcoin) to deal with the emergency event.

Avoiding Debt:By calculating an emergency fund, you can avoid accumulating high-interest debt when faced with financial emergencies.

How to set aside an emergency fund?

Step 1: Choose a place. It could be a high-interest savings account with your bank. It could be a hardware wallet. It could be cash in a shoebox.

Step 2:Deposit money. Start with a single paycheque. Try to work your way up to 3-6 months of your living expenses.

Step 3:Monitor over time. Make sure that your emergency fund covers your living expenses for 3-6 months, as your lifestyle changes and your expenses increase or decrease. Re-calculate as needed.

An emergency fund is like a seatbelt. 99% of the time, you don’t need it. You might even question yourself every time you put it on when you get in your car.

But when you need your seatbelt, you really need your seatbelt.

To your prosperity,Wealth Potion

The post #009: The 3 Levels of Emergency Funds – and How to Calculate Them appeared first on Wealth Potion.